Interest rate worries don’t work

US stock markets close slightly higher

February 6, 2024, 10:56 p.m

Listen to article

This audio version was artificially generated. More info | Send feedback

Strong balance sheets of major corporations keep US investors happy. Instead of recession, the US economy is showing growth. This means that a turnaround in interest rates by the Fed remains a long way off.

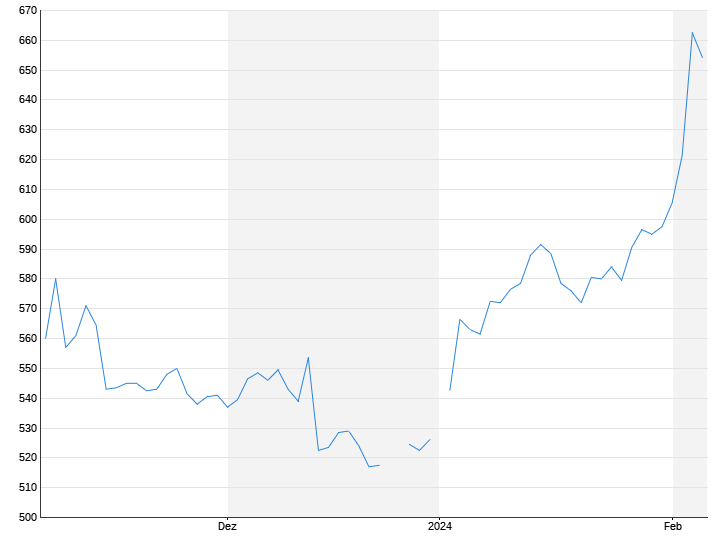

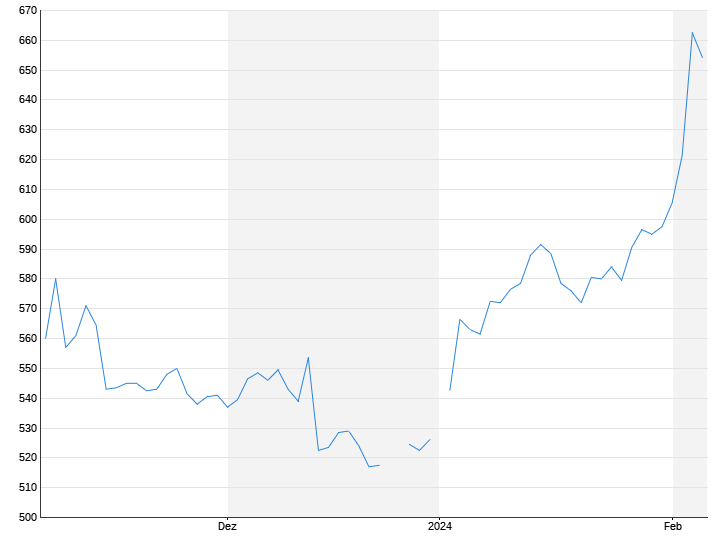

Despite ongoing interest rate concerns and inconsistent corporate balance sheets, the US stock exchanges closed with slight price increases. The Dow Jones Index the standard values rose 0.4 percent to 38,521 points from trading. The technology-heavy one Nasdaq advanced 0.1 percent to 15,609 points. The broad one S&P 500 gained 0.2 percent to 4954 points. “Investors expected 2024 to be a positive year for the stock market in general,” said Russell Hackmann, founder of asset manager Hackmann Wealth Partners. “And if you expect interest rates to fall at some point, then it should. But at the same time, there are a lot of risks in terms of geopolitics and what the Fed will do next.”

Fed Chairman Jerome Powell recently signaled that the next meeting in March would probably be too early to start cutting interest rates. After a phase of sometimes aggressive increases, the Fed recently paused four times in a row and kept the key interest rate in the range of 5.25 to 5.50 percent. In the past few weeks, many investors had bet on a quick turnaround in interest rates in the USA.

GE Healthcare and Dupont asked

The balance sheet season continued with varying consolidated balance sheets. The forecast from, among other things, ensured a better mood GE HealthCare. The shares of the medical device provider rose by almost twelve percent. The company expects 2024 adjusted annual earnings of $4.20 to $4.35 per share. Analysts are forecasting an average of $4.22. The papers from were also in demand DuPont with an increase of 7.4 percent. After a setback in the fourth quarter, the chemical company is looking a little more confidently at the current financial year and wants to pay out more to its shareholders.

“Some companies are expecting profit growth in the next six to 12 months, some are expecting revenue growth. But it is definitely growth and not the recession that investors feared last year,” said Kim Forrest, chief investor at the asset manager Bokeh Capital Partners. About half of the S&P 500 companies have already reported fourth-quarter figures. According to LSEG data, more than 80 percent exceeded market expectations.

It was also on the stockbrokers’ shopping lists Palantir. A strong outlook sent the stock up more than 30 percent. Palantir forecast full-year profit above Wall Street estimates due to strong demand for its artificial intelligence offerings.

Oil prices rise

However, profit-taking was depressing Eli Lilly. The US pharmaceutical company’s shares initially gained up to 4.5 percent after strong figures. However, it then turned negative and lost 0.2 percent. Eli Lilly is expecting a tailwind this year from its new weight loss injection Zepbound. For 2024, the group expects a significant increase in sales to between $40.4 and $41.6 billion. Adjusted earnings per share are expected to increase to $12.20 to $12.70 (previous year: $6.32). With a market capitalization of over $600 billion, Lilly is now the world’s highest valued healthcare company.

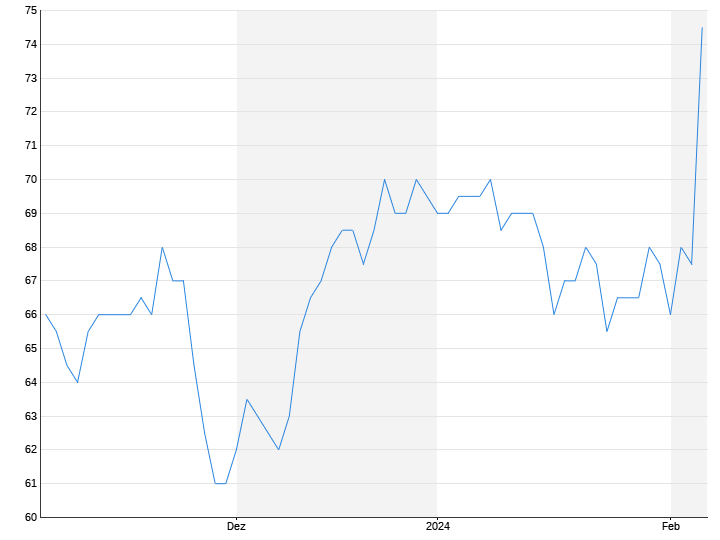

At the Oil market Expectations of tighter supplies pushed prices higher later in February. The North Sea crude oil type Brent and the light US type WTI rose in price each by almost one percent to 78.50 and 73.27 dollars per barrel (159 liters). U.S. inventory data due later on Tuesday and Wednesday is likely to remain relatively high, said Phil Flynn, analyst at broker Price Futures Group. However, it is expected that these stocks will decline in the future.