A supermarket in Glendale, California on January 12, 2022 (AFP / Robyn Beck)

Consumer prices soared in 2021 in the United States, where inflation has been at its highest for nearly 40 years, a major concern for Joe Biden, but also for the central bank, to which all eyes are now turning.

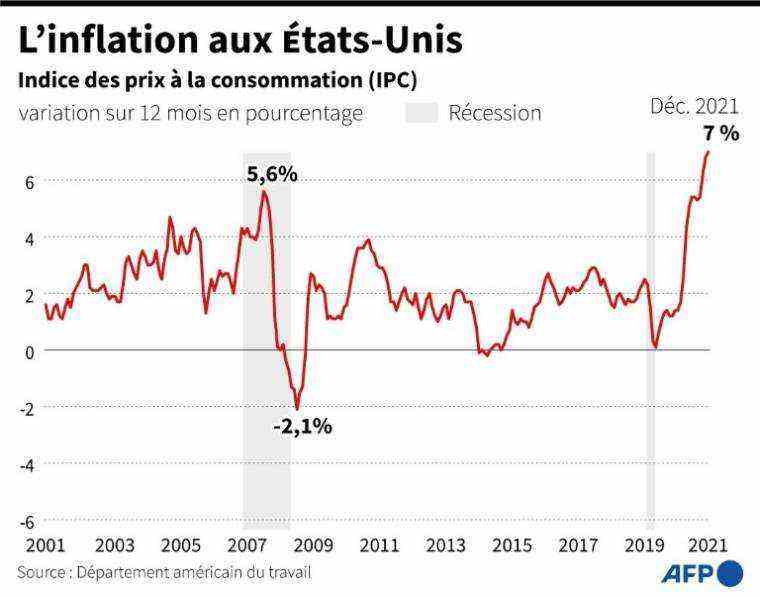

Inflation hit 7% in 2021, a record for the twelve months ending in June 1982, according to the Consumer Price Index (CPI) released Wednesday by the Labor Department.

Joe Biden, for whom this soaring cost of living is a major political problem, stressed the “progress” made by his administration, but admitted that “there was still work, with prices still too high, which squeeze the market. household budget “.

The Republican opposition criticizes the Democratic President for an inflationary policy with too much spending, and denounces what it calls “Bidenflation”.

In December alone, however, the increase was smaller than in November (0.5% against 0.8%), in particular because the increase in energy prices slowed for the first time since April.

This is a “welcome deceleration”, greeted Wednesday the principal economic adviser of the White House, Brian Deese, during a press briefing. “It’s still too high but it’s going in the right direction.”

Inflation in the United States since 2001 (AFP /)

He also announced new measures by the end of the month, to further reduce congestion problems in US ports, and ease the pressure on prices.

All eyes are now on the American central bank (Fed), which could raise its key rates earlier and higher than expected, in an attempt to curb this inflation, which it considered until recently to be only temporary.

– Fed balancing act number –

“Inflation is too high,” Lael Brainard, future vice-president of the institution, will alert Thursday during her hearing before the Senate banking committee, according to her text published on Wednesday.

“Our monetary policy is focused on reducing inflation to 2% while maintaining a recovery that includes everyone. This is our most important task,” she said.

The Fed is in fact preparing to perform a subtle balancing act, by raising its key rates to stem inflation, without however slowing down the economy, which could jeopardize the recovery of the labor market.

But in December, if unemployment fell to 3.9%, job creations lagged behind, and very high inequalities.

Jerome Powell with Joe Biden at the White House on November 22, 2021 (AFP / JIM WATSON)

Fed Chairman Jerome Powell, who was heard in the Senate on Tuesday, pledged to act “accordingly” if inflation persists in the second half of the year, preparing people’s minds for a potentially sharp rate hike.

The Fed “went from patience to panic in the face of inflation in record time,” notes Diane Swonk, economist for Grant Thornton.

The Omicron variant of Covid-19 could push prices further, with many employees placed in quarantine, de facto slowing production and delivery.

“Persistent bottlenecks in the supply chain, in a context of strong demand, will keep the inflation rate at a high level at least in the first quarter”, anticipates Kathy Bostjancic, chief economist for Oxford Economics.

Despite rising prices, demand remains very strong.

– “Slightly slowed down” –

However, signs of moderation seem to appear. Thus, “certain” companies questioned in December by the American central bank for its Beige Book published on Wednesday, “noted that price increases have slowed a little compared to the sustained pace of recent months”.

These figures should anyway put a little more lead in the wing to the social and environmental investment plan of Joe Biden, “Build Back Better”, already paralyzed because accused of being inflationary.

These 7% of inflation are still far from the 14.8% that the country experienced in 1980.

A New York gas station on January 12, 2022 (AFP / TIMOTHY A. CLARY)

Recently, it was rather low inflation that worried economists. In 2020, it was, for the whole year, at the lowest in five years, at 1.4%.

But 2021 has been marked by tremendous pressure on the global supply chain.

To attract candidates, employers also offered more money and better conditions. In 2021, the average hourly wage thus increased by 4.7%, only partially offsetting this price increase, but fueling inflation since these costs were passed on to prices.

Another consequence of inflation: the rise in the cost of the debt of the United States, which increased by 15% from October to December compared to the same three months of the previous year, due in particular to securities adjusted on the ‘inflation.

bur-jul / dax