1) General information about Depositing (Lending) Earning Interest in FTX

Today, various trading platforms As well as many DApps platforms provide features. Lending/Borrowing happened a lot Either deposit stablecoins or other cryptocurrencies to earn interest on deposits. Each platform has its own deposit objective, interest payment method, percentage interest payout. Including the time to pay the interest that is not the same

By referring to the platform Decentralized Lending such as Compound or Aave that has been open for service on the Ethereum blockchain for a long time. Deposit characteristics of depositors/lenders is in order to give the borrower which can be anyone from all over the world Come to borrow money from the pool of coins that have liquid coins that the borrower wants. or will be the depositor himself to deposit any assets into one to be used as collateral for collateral for borrowing money, etc.

If it is the purpose of depositing money (Lending) on a common crypto trading platform like Binance or FTX, it will be a deposit. In order for the system to be able to continue to use this money in margin trading or leverage trading.

for example If we want to open Long or Short on a particular asset We only need to place some collateral and we can close these contracts. But if you really look at the system behind the house, opening a long or short contract of a trader is to stand the asset (short) to sell first. and borrowing money (Long) to buy first Where does this asset or money come from? It comes from having people deposit money (Lending) to lend so that the back-end exchange systems can run smoothly.

For FTX, the deposit for the loan is Our funds are used for margin trading and leverage trading as well as other trading platforms. But what is different is The interest on FTX deposits/lenses fluctuates all the time. According to the usage and borrowing of Traders from Margin Trading, because their function is Come to borrow liquidity of various coins from people who deposit / lend. And give interest on the loan to those who come to deposit, which if the trader wants to borrow the coins that have been borrowed a lot They will have to pay higher interest rates based on the utilization of the coins. Therefore, people depositing money like us There is a chance to earn higher deposit interest as well.

The loan interest that FTX charges traders in Margin Trading is approximately 20% of the interest payable. For example, if the trader is to pay $100 interest to the depositor/lender, then FTX will charge $20 and another $80 will be sent to the deposit/lender, for example.

2) Overview of FTX Deposit/Lending

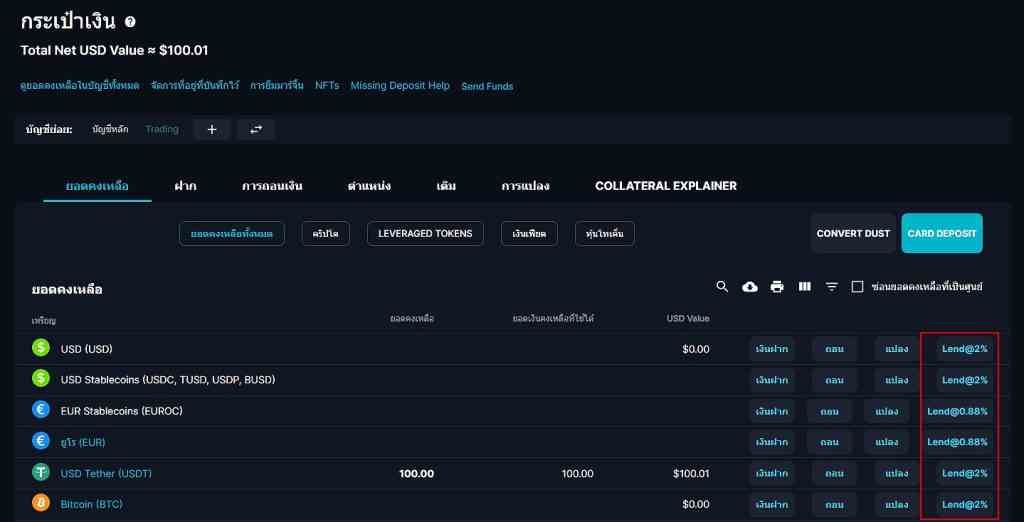

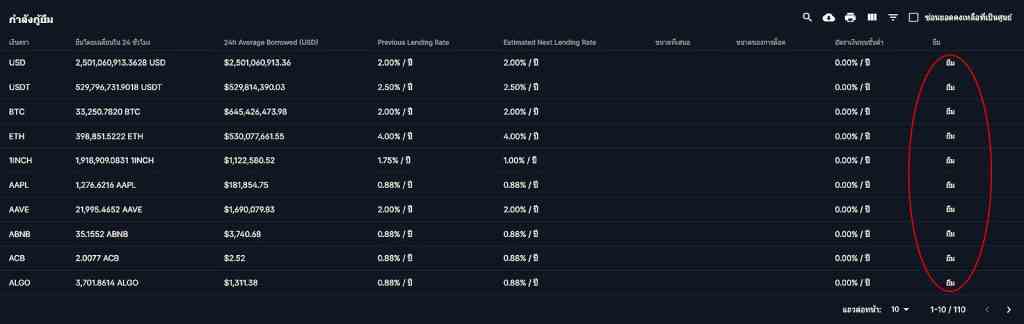

in the beginning There are two ways to get to the Deposit Dashboard. in the first picture After we log in to the FTX platform, this page will appear. Users can press the word “Lend” on the back of the coins. Because the FTX platform can allow users to deposit/lend money. Almost any coin liquidity can be deposited at FTX listed on the trading board.

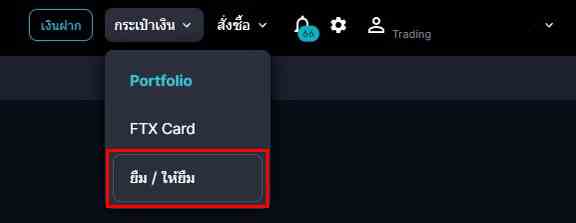

Another way to access the Dashboard as shown in the second picture is that in the upper right corner, we can click on “Wallet” and click on the word “Borrow/Lending) which does not whether to access the Dashboard by any means The process for depositing/lending loans is no different.

by having to precede that Interest on FTX deposits/lenses, FTX pays us hourly interest. And interest is recalculated every hour based on the demand to borrow that coin from Margin Trader as mentioned above.

for example If last hour USDT coin paying interest rate 3% per annum, but during that time, Margin Trader borrows huge amount of USDT coin and also low liquidity of USDT coin in FTX, then Margin Trader pay interest on loan. more than ever As a result, people who deposit money/lender will receive more interest in the next hour.

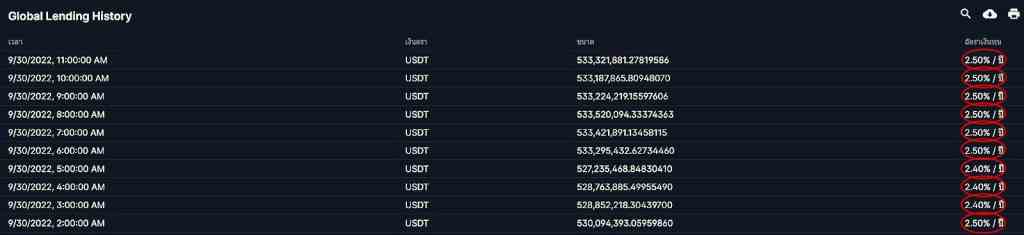

In this Dashboard page, it will show the details of the coins that FTX is open for us to deposit/loan. Which can be observed from the red squares that are numbers, Previous Lending Rate and Estimated Lending Rate. For Previous Lending Rate is the interest rate that the platform pays to people who deposited/lent that coin in the last hour and Estimated Lending Rate is Estimated interest rate based on people who borrowed during the last 1 hour, etc.

which if scrolled down We will find the interest payment history of various coins that people have deposited / lending hourly. If we are interested in depositing only stablecoins, we can filter them as deposit/lending information. And the interest rate of that stablecoin is the same as in the picture below, it can be seen that in the past 9 hours (from 2.00-11.00) FTX has paid interest to depositors/lenders at a rate of 2.5%. This year and hourly interest will be transferred directly to our Wallet.

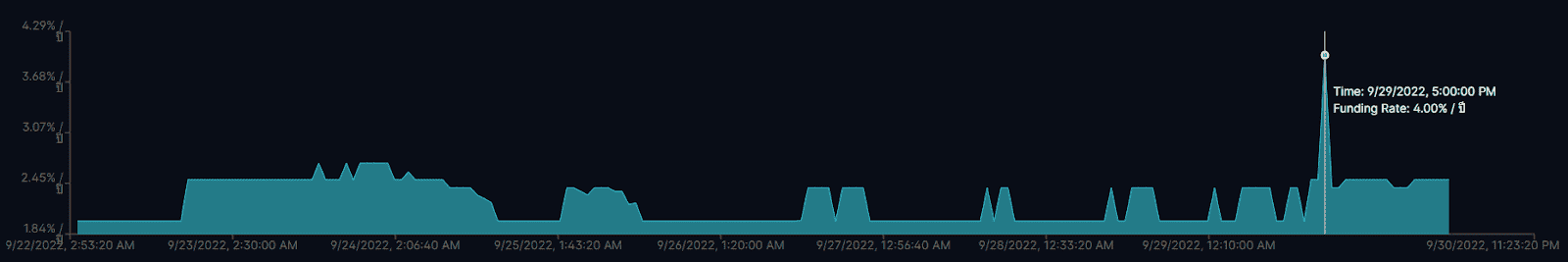

If scrolling down again You will find a history of 7 days in the past that the interest on the deposit of USDT coins is how much. It can be seen that at certain times, only 2% per year, but in peak periods it can be as much as 4% per year, etc.

3) FTX deposit/lending process

Users can click on the word Lend as in the picture above or press the word Borrow (Lend) as in the picture below. Which is enough for the Thai version, there may be a little bug. but if used in English The image below will show “Lend” as well.

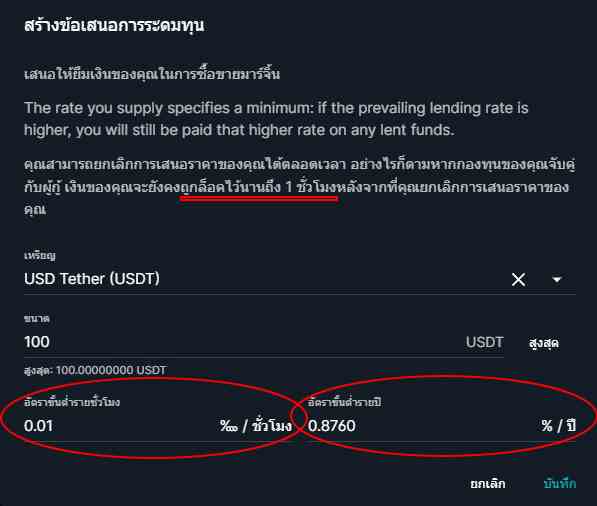

After pressing enter, this page will appear. One warning that depositors/lenders need to know is The funds we have deposited can be withdrawn at any time. But if the liquidity of the coins that we will deposit in FTX is low, together with the borrowers will come to borrow as well. Our funds may not be withdrawn for 1 hour, this 1 hour cooldown is for Margin Traders to return the borrowed liquidity. or wait for other users to deposit more money

as said Interest rates are subject to market mechanisms. If at that time a coin had low liquidity. The interest on the loan will be higher to avoid margin traders from borrowing more. Including deposit interest will be higher. to incentivize people to deposit money as well

If during this 1 hour cooldown, of course other Margin Traders will rush to recover the borrowed funds. In order to avoid high interest on the loan. This is because the interest on the loan also changes hourly as well as the deposit interest. Including it will incentivize users to deposit more money as well. which the author himself met a time The interest on stablecoin deposits like USDT used to reach 60% per annum. But the numbers were only this high for a few hours. Because the depositors brought more deposits. In addition, the borrower quickly took the loan back. Finally, interest will return to equilibrium, etc.

Then we choose the coin and the number of coins we want to deposit. And one more thing to note is Minimum hourly rate (Minimum Hourly Rate) and Minimum Yearly Rate (Minimum Yearly Rate), these numbers we can custom ourselves, how much interest we need on the minimum deposit.

which the author recommends that you put it at 0% as a minimum Because we will receive interest on every hour deposit, no matter how small or how much. But if we set it very high, such as 60% per year, our deposit will be borrowed only when At that hour, interest on FTX deposits only went as high as 60% per annum.

After selecting the values Then press save. This is the end of depositing/lending money in FTX.

4) Risk of Depositing/Lending in FTX

If we are depositing in Fiat or Stablecoin, our funds are almost at risk of not getting the principal back or getting no interest at all. Because according to the FTX back-end mechanism, if the Margin Trader incurs a loss to a certain level, The money he borrowed will be liquidated immediately and those money + fines. It will be brought back to the person who deposited/lend the same money.

But if depositing in other crypto coins such as BTC ETH, there may be a risk of price fluctuations. For example, if we deposit ETH coins and want to withdraw and sell at the market price, but during that Margin traders are borrowing a lot of ETH, so our principal will have to wait 1 hour cooldown time, so we may not be able to sell ETH at the price we want.

In summary, depositing/lending in FTX is that if you look at the interest rate received. It may be less than depositing / lending at other exchanges, but the advantage here is that The interest rate is really based on the market mechanism. If a lot of people come to borrow We also get more interest on deposits as well, but in some exchanges, the deposit interest rate is fixed. It may be an incentive for people to deposit in the short term.

But if in the future the utilization of that coin is less With fewer borrowers, Exchange can change interest rates on deposits at any time. This could lead to investors giving more or less less credibility to those exchanges, for example.

The post How to Deposit (Lending) to earn interest in FTX appeared first on Bitcoin Addict.