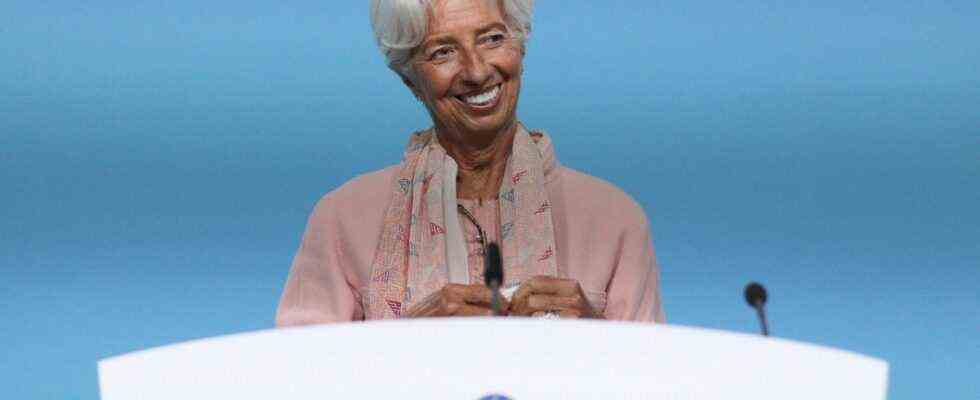

The European Central Bank will continue its loose monetary policy until further notice. You can be “patient”, said ECB President Christine Lagarde at the opening of the ECB Central Bank Forum on Tuesday. “We do not see any signals that the current surge in inflation is establishing itself on a broad basis,” said Lagarde. The currently rising prices – in August it was three percent in the euro zone – are of a temporary nature. For Germany, the Bundesbank expects that four to five percent will be possible in the next few months. Due to rising gasoline and food prices, the inflation rate was 3.9 percent in August, the highest it has been in 28 years.

Lagarde said the measures to combat the coronavirus pandemic had “led to supply shortages in certain sectors”. As soon as these effects subside, inflation would also fall again. Lagarde expects the gross domestic product to recover to the pre-Corona level by the end of the year. It is the strongest economic recovery since 1975. Nevertheless, the loose monetary policy will be adhered to in order to safely lead the euro zone out of the corona crisis. The ECB has launched a rescue program worth 1.85 trillion euros. This emergency bond purchase program is likely to expire in March 2022 as announced. But the ECB will still buy government bonds afterwards. The monetary authorities are also likely to maintain the zero interest rate policy for the time being.

The global financial markets must, however, adapt to the fact that other central banks in the western world will end the era of ultra-cheap money more quickly in view of the rising inflation rates. In Great Britain and the USA, too, the price increases are in some cases well above the target values of a maximum of two percent.

Other central banks have already announced tighter monetary policies

While the ECB is hesitant, the Bank of England and the American Federal Reserve have already announced that they will tighten their monetary policy. In the UK, inflation rose to 3.2 percent in August. That was the highest rate since March 2012. The British central bank expects an inflation rate of up to four percent. The first rate hike could come as early as spring 2022. In the US, the rate of inflation is five percent, and it is likely to remain high in the coming months before it declines, said Fed chairman Jerome Powell. The Federal Reserve would like to reduce its security purchases of $ 120 billion per month in the near future. A rapid increase in the key interest rate is also possible.

“In the euro zone there is a lack of supplies in some sectors, some goods are becoming scarce. That drives up prices. So we are experiencing supply inflation. The ECB cannot do anything about that,” says Dirk Schumacher, chief economist at the French investment bank Natixis. According to the experts, these bottlenecks should soon disappear, which would lower inflation again. “In the US, the situation is different. There you can see signs of demand inflation. Consumers are buying as much again as they were before the pandemic. The labor market is also becoming so scarce that wages are rising faster. That is why the Fed is reacting earlier than they were ECB, “said Schumacher.

Meanwhile, Norway became the first industrialized country to raise its key interest rate since the outbreak of the corona pandemic, from zero to 0.25 percent. Other countries are more cautious. The Swedish Reichsbank wants to keep the zero interest rate until 2024. Switzerland is also sticking to its negative interest rate of 0.75 percent.

The loose monetary policy made the rich even richer

The central banks are unsettled. The financial sector has got used to cheap money. An overly abrupt or poorly communicated increase could cause turbulence on the stock markets. With their loose monetary policy, the central banks helped to contain the economic consequences of the global financial crisis in 2008, the euro debt crisis in 2012 and the corona pandemic in 2020. The cheap money accelerated the economic recovery. New, well-paid jobs were created. At the same time, however, the distribution of wealth in society changed. The rich got richer. The zero interest rate policy enabled cheap borrowing to purchase real estate and ensured that share prices rose sharply. However, households with low incomes can hardly afford to buy stocks and real estate.

Due to its structure, the eurozone is particularly dependent on the central bank. This was shown by the euro debt crisis, which was only defused by Mario Draghi’s “Whatever it takes” promise. “In the event of a crisis, the ECB also has an important stabilizing role for the refinancing conditions of the individual states,” says chief economist Schumacher. “As the financial markets tend to exaggerate, it may be necessary for the ECB to make purchases to prevent a self-reinforcing spiral.” But their announcement may be enough to buy to achieve stabilization.