Status: 02/28/2023 5:32 p.m

“Football stocks are for fans who want to suffer twice,” say mockers. It is often not possible to achieve a particularly good return. And yet huge sums of money continue to flow into the industry.

Going from being a spectator to being an active player in the football business: Apparently that appeals to many football fans. When they buy bonds from “their” club, they do so less in order to make as much profit as possible. “For many fans, the reason for investing in these bonds is more the thought of helping the club than a safe investment,” says Arthur Brunner from the ICF Bank. Many fans therefore only bought the club shares in relatively small numbers.

The principle: by buying bonds from football clubs such as Hamburger SV, FC Schalke 04, Werder Bremen or Hertha BSC, the buyer lends the club the money. The football club pays annual interest on the loan. And at the end of the term, the investor gets his original investment back. That’s the plan – but it doesn’t have to work.

Partly deep red balance sheets

“Football bonds are of course very risky,” admits stock market expert Brunner, citing Schalke as an example: “If you look at the balance sheets, some of them are deep in the red. It depends a lot on developments. Should there be a descent, the financial situation will of course be clear more difficult.” This also applies to other clubs that got into trouble due to the slack during the Corona period, among other things. Nevertheless, Brunner considers the bonds to be interesting because you get a very good interest rate of up to six percent for the money you borrow.

Marc Tüngler from the German Association for the Protection of Securities, on the other hand, says that the interest rates should be much higher given the risk. “We’ve probably gotten to the point where football clubs issue such a bond, for example, that the banks would no longer give loans at all,” Tüngler points out – because the risk is too high for the banks.

Because football clubs usually issue bonds when other sources of money have dried up. The fans are seen as the last anchor. Oliver Roth from Oddo BHF therefore says that when it comes to an investment that is supposed to bring in money, the purchase of football bonds should be treated with caution.

It’s different when fans want to support, says Roth: “Of course, every fan can donate money to their favorite club at any time. If they do it in the form of a bond, where they have a good, maybe a fair chance of getting their money back and that also earn interest, then that’s a really, really great thing.” It is only important that the fan is aware that it is a kind of donation.

Difference between bonds and stocks

While football bonds expire after a few years, football shares give you a stake in the club. Internationally active football clubs such as Manchester United are listed on the stock exchange. The stock had risen sharply after rumors that Tesla boss Elon Musk wanted to get on board. Today she loses a double-digit percentage.

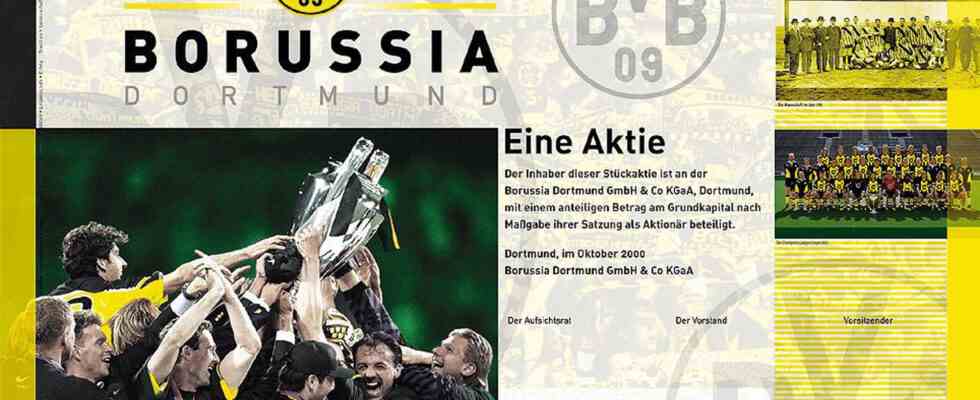

In Germany, in addition to the Unterhaching game association, Borussia Dortmund is also listed on the stock exchange – in the long term with deep red stock market results. “If you look at the course, investors have to be modest, the course was more of a headache,” says DSW expert Tüngler. “If you don’t play at the top internationally, you can’t get hold of the big money pots, then it becomes more difficult.”

Football stocks reacted strongly to clubs’ participation in international competitions such as the Champions League. Even those who rank at the top of the table, their shares rose. It is crucial to bet on the right club. Otherwise, the following applies: football shareholders often suffer twice – on the stock exchange and on the pitch.

Football and the stock market – how does that go together?

Heidi Radvilas, ARD Stock Exchange Studio, February 28, 2023 at 4:21 p.m