analysis

Status: 06.04.2023 08:51

Strict budgetary rules apply to all federal states. Bremen, Saarland and Berlin in particular are now looking for new ways to finance investments in climate protection – bypassing the debt brake.

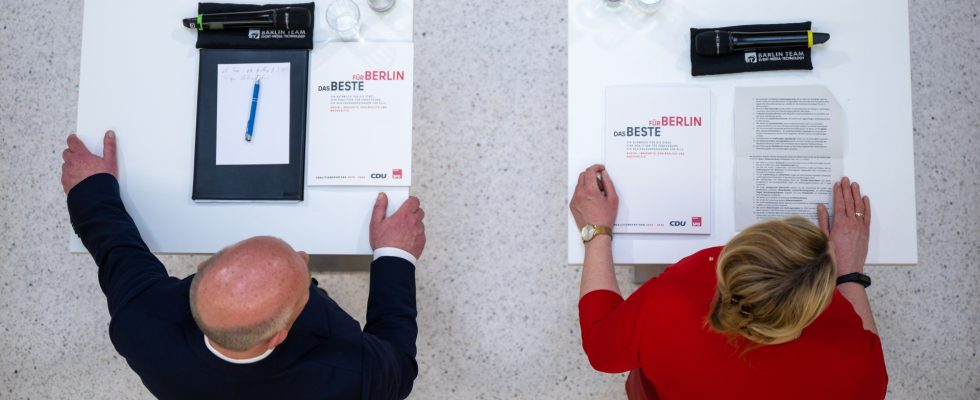

“The best for Berlin” – this is the motto under which Kai Wegner, who is expected to be the new Governing Mayor of Berlin from the CDU, wants to get off to a good financial start with his targeted black-red coalition. Berlin is notoriously indebted and also the largest recipient in the financial equalization of the federal states. According to the coalition agreement, Berlin should soon be able to take out five to ten billion euros in new loans – via a special climate protection fund.

“The decisive thing is that we want and have to achieve climate targets,” emphasizes Wegner. “We as the CDU and SPD coalition want to achieve these goals faster. And if we want to make Berlin climate-neutral faster, we have to spend money.”

More money, for example, for investments in energy-efficient building refurbishment or the switch to electromobility. Ten billion euros in new debt – that corresponds to around a quarter of a Berlin state budget.

Berlin follows Saarland

The capital would follow the example of Saarland with the special fund. At the end of last year, the federal state, which is also highly indebted, set up a largely debt-financed special fund of up to three billion euros for transformation measures to protect the climate.

SPD Finance Minister Jakob von Weizsäcker believes that an accelerated transformation is necessary due to climate change and the energy crisis: “The acceleration will ensure that a large part of this transformation burden will have to be shouldered over the next ten years.”

The problem with this: Normally, the federal states are not allowed to take on any debt at all. The debt brake anchored in the Basic Law is even stricter for them than for the federal government.

Debt brake suspended due to corona pandemic

But the federal government has shown in recent years how you can take out extensive additional loans despite the debt brake: via the emergency situation. The federal government was able to suspend the debt brake for three years because of the corona pandemic. Most countries did too.

In addition, the federal government set up large special funds – shadow budgets for certain long-term investments. For example, for the better equipment of the Bundeswehr or for climate protection and transformation.

From the point of view of financial scientist Thiess Büttner from the Friedrich-Alexander-University Erlangen-Nuremberg, the sense of the debt brake is undermined. Büttner is head of the Advisory Board of the Stability Council, an official body tasked with overseeing federal and state budget management.

“The Corona crisis was a dam bursting. It opened all the floodgates in financial policy,” said Büttner. “During this time, the federal and state governments have learned to open up credit leeway outside of the debt brake and then park these funds for further use in shadow budgets and reserves.”

Special way in Bremen

Bremen, the state with the highest per capita debt in Germany, is taking a special approach. There was a budget emergency in Bremen for three years due to the Corona crisis, which made additional debt possible. An emergency has now been declared again, which is primarily justified in an expert report with the climate crisis – combined with the ongoing energy crisis caused by the Russian war in Ukraine.

With this justification, the red-green-red-governed Bremen has just passed a supplementary budget, through which three billion euros are to be made available by 2027, financed by credit, in order to, for example, modernize public buildings energetically or to provide subsidies for the climate-friendly conversion of the Arcelor-Mittal steelworks in allow the city.

The taxpayers’ association criticizes the fact that Bremen could mutate into a permanent state of emergency. Public finance scientist Büttner considers Bremen’s justification to be legally untenable: “There is a difference between necessary and an emergency or emergency situation.” There is no doubt that there is a need for adjustments in households. But from Büttner’s point of view, necessary investments should be made through regular budgets.

Büttner: debt brake in danger

The CDU in Bremen reserves the right to take legal action against the supplementary budget before the state court, the constitutional court of the smallest federal state. However, the election campaign is currently underway in Bremen, and a new citizenship will be elected on May 14th. The financial policy spokesman for the CDU parliamentary group in Bremen, Jens Eckhoff, speaks of a difficult weighing process, a legal opinion is currently being prepared.

In addition to legal questions, it is about political considerations – to what extent can you score points if you sue against borrowing and thus more money in the short term. Especially since Bremen’s SPD mayor Andreas Bovenschulte advertises that he wants to use the loans to support the Bremen steelworks in the climate-friendly conversion and thus save them in the long term: “If we didn’t bring in the supplementary support, if we didn’t have the money available, then we would Putting tens of thousands of jobs at risk. And that can’t be done with this Senate or with me.”

Making new debts for climate protection: The three countries with the biggest financial problems in Germany apparently consider this necessary. Finance scientist Büttner, on the other hand, sees the debt brake in danger: “If society and politics consider this debt brake to be obsolete, ways will be found to circumvent the debt brake.”

Countries incur debt for climate protection

Martin Polansky, ARD Berlin, April 6, 2023 9:07 a.m