In the fight against inflation, the US Federal Reserve could raise interest rates even further. Fed Chairman Powell then got the financial markets in the mood. However, he avoided a clear statement on the further development of interest rates.

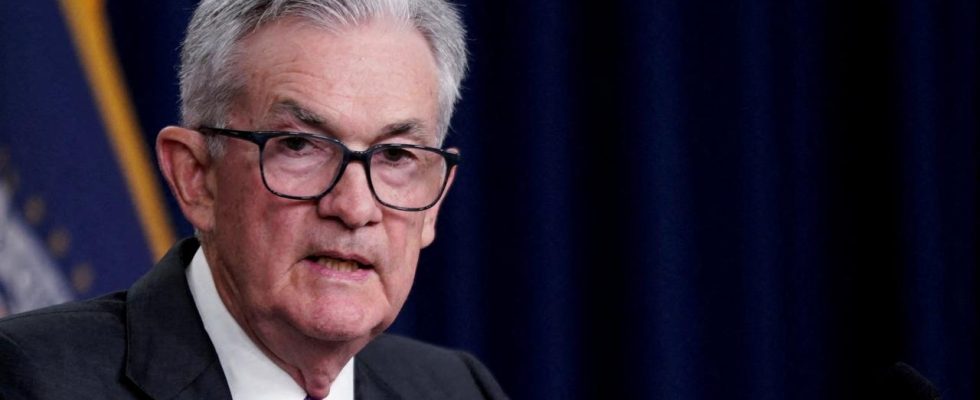

The US Federal Reserve still considers inflation to be too high to announce an end to the series of rate hikes already. “We stand ready to raise interest rates further if necessary and intend to keep monetary policy at a restrictive level,” said Fed Chair Jerome Powell in his much-anticipated speech at the Fed Forum in Jackson Hole. At the same time, however, he signaled that the monetary authorities would proceed cautiously.

Borrowing costs will be kept high until inflation is on a sustainable path towards the inflation target. The Fed is targeting an inflation rate of 2 percent. It has raised interest rates from near zero to a range of 5.25 to 5.50 percent in a series of hikes since early 2022 to rein in inflation and cool the hot labor market.

Low unemployment rate, falling inflation

However, the unemployment rate is currently at a historically low 3.5 percent. The US economy has so far weathered the series of rate hikes unexpectedly well. The inflation rate has already fallen significantly in recent months – in July it was 3.2 percent, but again slightly above the June figure of 3.0 percent.

The US Federal Reserve wants to make its further action dependent on the incoming data. In his speech, Powell left the question unanswered as to whether or not the Federal Reserve will raise interest rates further in September. The majority of experts on the financial markets are assuming that the Fed will refrain from raising rates in September and could follow suit in November or December if necessary. From the point of view of the market participants, Powell’s speech in Jackson Hole did not provide the hoped-for clarity, as the few reactions showed.