Everyone is hoping for the Fed

Wall Street is climbing new heights in leaps and bounds

December 27, 2023, 11:04 p.m

Listen to article

This audio version was artificially generated. More info | Send feedback

After the small Christmas rally from the previous day, the good mood on Wall Street continues. The firm belief in interest rate cuts soon has even pushed the Dow Jones Index and Nasdaq-100 to all-time highs. Meanwhile, the price of gold continues to climb.

US investors’ cautious interest rate optimism continues even in the uneventful period between Christmas and New Year. The Dow Jones Index the standard values closed 0.3 percent higher on Wednesday at 37,656 points. The technology-heavy one Nasdaq moved up 0.2 percent to 15,099 points, and both indices had even reached all-time highs. The broad one S&P 500 gained 0.1 percent to 4781 points. The indices thus defended their recent gains against the backdrop of the US Federal Reserve’s hoped-for interest rate cuts.

All three major Wall Street barometers had gained during the day, with the S&P 500 reaching its highest level since January 2022. “While I’m not entirely sure about the timing of the rate cuts, the Fed is clearly in the process of easing monetary policy and that is having a positive impact on the entire market,” said David Waddell, CEO and chief investment strategist at the asset manager Waddell and Associates.

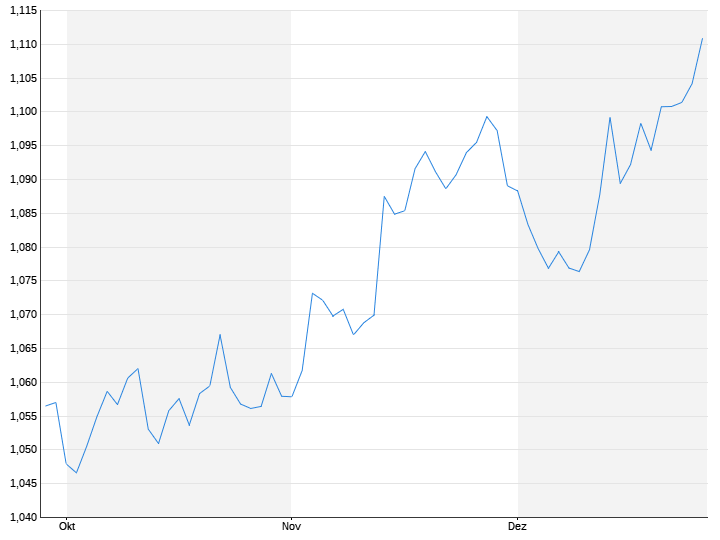

Meanwhile, hopes of falling interest rates depressed the US currency. The Dollar index fell by half a percent to a five-month low of 100,994 points. The Euro In return, it climbed 0.6 percent to $1,111. The weaker US currency and robust China data helped metal prices up.

At the Oil market prices fell again. The North Sea crude oil type Brent and the US light oil WTI each cost around two percent less at $79.44 and $73.88 per barrel (159 liters). The background was considerations by important shipping companies about resuming transit through the Red Sea. After attacks on freighters by the Houthi militia from Yemen, companies such as Hapag Lloyd, Maersk and CMA CGM announced that they would avoid the Suez Canal for the time being. Fears of supply after the change in the shipping route, which is important for oil transport, had recently driven up prices. The experts urged caution. “I think we have to wait and see whether the recent increased naval patrols lead to a reduction in attacks,” said Callum Macpherson, manager at asset manager Investec.

Biopharma companies are very popular

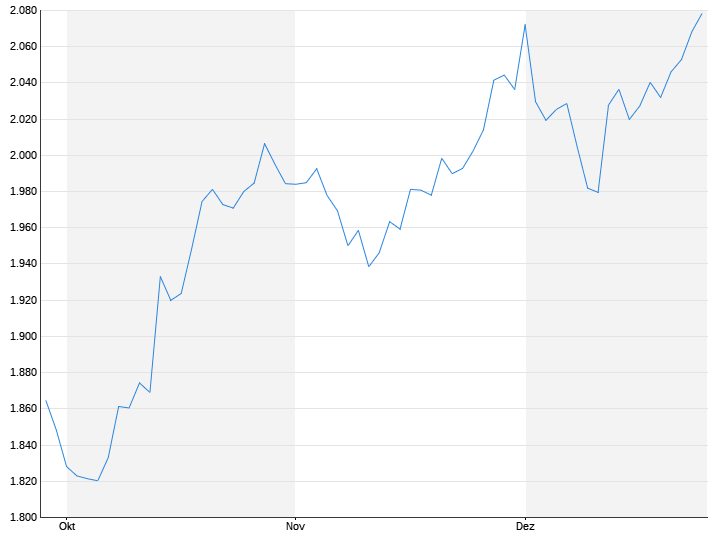

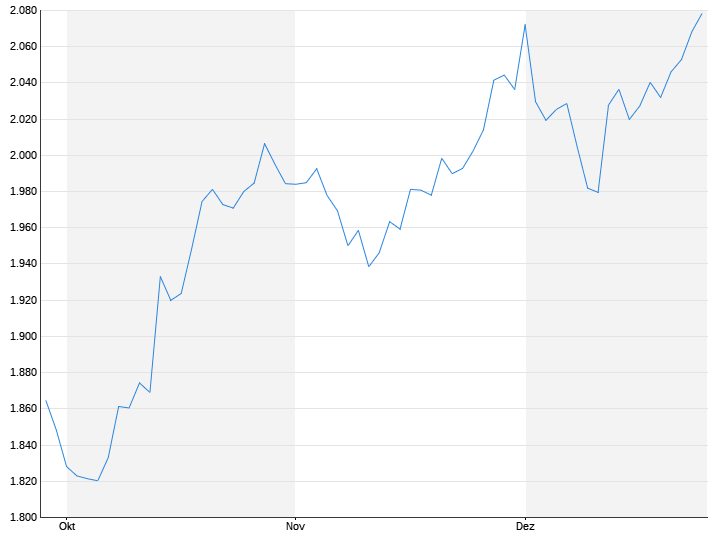

The Londoner Gold price benchmark meanwhile reached a new all-time high. At $2,069.40 per troy ounce, the price for the yellow metal was temporarily higher than ever, said the London Bullion Market Association (LBMA). The previous record from August 2020 was $2,067.15. “I can think of no clearer evidence of gold’s role as a store of value than the enthusiasm with which investors around the world have turned to the metal during the recent economic and geopolitical turmoil,” said LBMA CEO Ruth Crowell. The Refinitiv spot price for gold was 0.7 percent higher at around $2,081 per troy ounce. It reached its most recent all-time high of $2,135.40 on December 4th.

Among the individual stocks in demand were a number of stocks from biopharmaceutical companies. The announcement of the sale of a drug for intestinal diseases left the titles of First Wave Biopharma shoot up by up to 300 percent. They then leveled off at an increase of around 50 percent. The success of a heart drug from Cytokinetics A clinical study helped the share price increase by around 82 percent. Also the approval of a new drug delivery system Coherus trubbed the papers by almost 24 percent.

Investors also jumped in Bit Digital to. The cryptocurrency miner’s shares climbed by a good 18 percent. The company wants to double its capacity and mine around six units of the important cyber currency Ethereum per second in 2024.