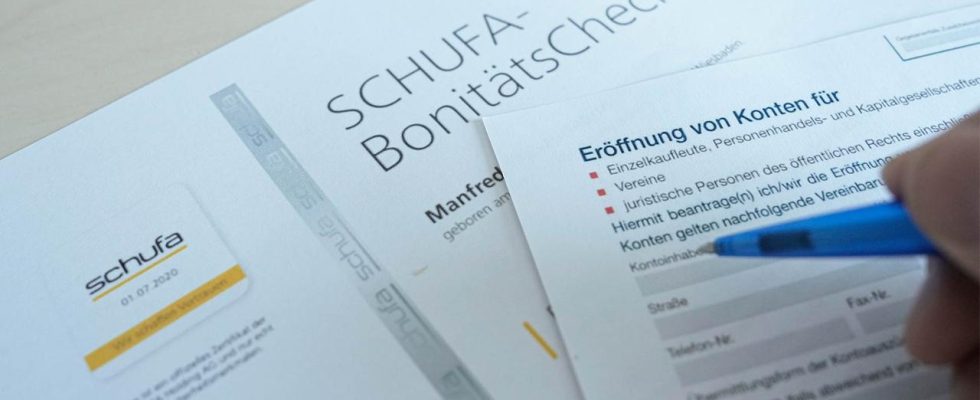

The SCHUFA score should not be the only factor when it comes to whether companies conclude contracts with their customers. The European Court of Justice decided this today. The background is a case from Germany.

SCHUFA receives a clear reprimand from Luxembourg. The European Court of Justice ruled today that the current data collection and nationwide evaluation of customers, as SCHUFA has been practicing for years, violates European data protection law. At least when the evaluation, the so-called scoring, is the decisive criterion for whether a customer gets a loan or a cheap electricity contract, for example.

The Wiesbaden Administrative Court had presented the EU’s highest court with the case of a customer who was unable to get a loan because her SCHUFA rating was too poor. Goal: The ECJ should fundamentally clarify SCHUFA’s relationship to the General Data Protection Regulation (GDPR). The woman had asked SCHUFA to delete an entry and give her access to the data. SCHUFA told her her score and general information about the calculation, but not the exact calculation method.

The EU judges say: In this specific case, one must assume that everything depends on the customer’s score. Then automated data collection would be prohibited. Because such “profiling” could discriminate against people.

German court now back on the move

European law also allows special national rules that allow more data storage. But the EU judges believe it is very possible that the German law violates the principles of European law because it does not protect people enough. This must now be finally clarified by the administrative court in Wiesbaden. Until the final clarification by the German courts, it remains the case that in Germany SCHUFA assesses the solvency of customers.

In an initial reaction to the ruling, SCHUFA stated that it does not restrict the way it works. For banks and other companies that query customer ratings, this scoring is not the sole reason why customers receive or do not receive certain contracts. In this respect, the dispute continues. However, the signals from Luxembourg are clear: data collection and evaluation is only permitted under very strict conditions.

Assessment of payment practices

The “Protection Association for General Credit Protection,” as SCHUFA is officially called, collects huge amounts of data, for example from banking transactions. From this, the credit agency calculates how creditworthy it considers individual consumers to be. The basic score describes, on a scale of 0 to 100 percent, the probability with which someone will meet financial obligations.

The higher the score, the higher the creditworthiness. Anyone who regularly pays bills late and often receives reminders will be rated worse. If there is a legitimate interest, SCHUFA provides its approximately 10,000 contractual partners – including banks and savings banks, mail order companies, mobile phone providers and energy suppliers – with an assessment of the creditworthiness of their customers before contracts are concluded and goods are handed over.

With information from Gigi Deppe, ARD legal editor

Gigi Deppe, SWR, tagesschau, December 7th, 2023 10:52 a.m