12:50 p.m. Bonduelle’s position in Russia “less and less tenable”

Bonduelle, slightly up at the opening, now loses nearly 2%. TP Icap Midcap believes that Bonduelle’s position in Russia is “less and less tenable”. The financial analysis firm now recommends selling the shares of the world leader in processed vegetables, known for its canned and frozen foods. The war in Ukraine has spread to Russian border areas, a factory near Belgorod is shut down and the threat of expropriation is “increasingly strong”.

———————

12:15 p.m. Mid-session in Paris

With a decline of 0.28% to 7,182.81 points, the flagship index of the Paris Stock Exchange is currently up 2.7% over the week, its worst weekly performance since mid-March. The last few days have been marked by interest rate hikes decided by the Bank of England, the Bank of Norway and the Swiss National Bank. The three central banks left the door open to further monetary tightening, while Jerome Powell gave the same speech to Congress.

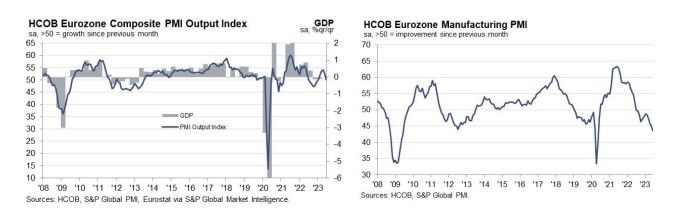

” Investors find themselves digesting a lot of bad news, with no sign of any near-term catalyst. commented Deutsche Bank’s Jim Reid. The PMI indices of activity in the private sector also show that the economy of the euro zone stagnated in June, where that of France experienced its first contraction since January.

On the values front, SES-Imagotag plunged 49.7% after being suspended from trading the day before following Gotham City’s analysis. This morning’s AGM gave the leaders of the manufacturer of electronic labels for mass distribution an opportunity to express themselves. A call is expected with analysts on Monday morning.

———————

11:52 a.m. SES-imagotag: a call with analysts scheduled for Monday morning

End of the general meeting of SES-imagotag. In the aftermath of Gotham City’s analysis, this morning’s AGM allowed the leaders of the manufacturer of electronic tags for mass distribution to express themselves: no double counting, no circular turnover while the mega-deal with Walmart is profitable. A call is expected with analysts on Monday morning.

On the stock market, the action still falls by half for its resumption of trading, to 86.30 euros.

Bloomberg

———————

11:32 a.m. The yacht builder Ferretti is preparing an IPO in Milan

Ferretti, an Italian yacht builder, has priced its share at 3 euros for its listing on the Milan Stock Exchange. The valuation would thus be of the order of one billion euros.

By way of comparison, Beneteau weighs 1.25 billion euros on the Paris Stock Exchange, Catana Group just under 210 million and Fountaine Pajot 225 million euros. Ferretti is already listed in Hong Kong.

———————

11:05 a.m. Siemens Energy plunges in Frankfurt after withdrawing its forecast

Siemens Energy shares fell more than 31% in Frankfurt on Friday, after having abandoned their forecasts for 2023. In question, the multiplication of disappointments in the turbine division for wind turbines. The review initiated by the board of directors of Siemens Gamesa suggests that the objectives set to achieve the quality objective of certain offshore platforms entails significantly higher costs than expected. Oddo BHF, which remains “neutral” on the stock with a target of 23.10 euros, also indicates that ” many questions remain unanswered “.

10:49. An acquisition at Capgemini which reinforces its growth objectives

Capgemini (+0.53%) is one of the few risers in the Cac 40. The digital services group announced this morning the acquisition of BTC, one of the main digital and cloud service providers in Japan, for a amount not disclosed.

If the results of BTC are also not known, the financial analysis firm Invest Securities calculates that “BTC should represent more than 80 million euros in revenue, i.e. a scope effect of +0.4 points over a full year. Not enough to upset the group’s financial outlook, but to reinforce the 2023 guidance which currently includes growth at constant exchange rates of +4 to +7%, including a scope effect of +0.5 to +1 point. »

————–

10:32 a.m. The economic recovery is fading in the eurozone

Private sector activity virtually stagnated in June in the euro zone, the composite PMI index, a synthesis between industry and services, standing at 50.3 points in flash data for June, according to the HCOB bank, a plus 5-month low, after 52.8 in May. While the service sector continues to grow at 52.4 points, it marks a slowdown compared to 55.1 in May. The manufacturing sector, on the other hand, remains in the contraction zone at 43.6 points, a 37-month low.

This slowdown is partly due to the contraction observed in both industry and services in France, while the latter sector continues to expand slightly in Germany.

The positive point in this slowdown compared to the recovery observed in the spring is the significant lull in inflationary pressures thanks to the drop in manufacturing costs and selling prices in the manufacturing sector. Good news for the ECB.

————–

10:26. “Naughty cocktail” for the pound sterling

The pound sterling continues this morning to depreciate against the greenback, at less than 1.27 dollars. High inflation and “mediocre” growth in the UK, “it’s a bad cocktail” for the pound, says Mark Dowding, chief investment officer at BlueBay.

FactSet

————–

10:07 a.m. SES-imagotag falls on resumption of trading

The listing of SES-imagotag has just resumed. The action fell 57% to 73.6 euros.

————–

9:51 a.m. Surprise rise in UK retail sales

Retail sales rose 0.3% across the Channel last month, while marking a slowdown from the 0.5% rise in April. The consensus formed by Bloomberg, however, expected a decline of 0.2%. Year-on-year, sales fell 2.1%, compared to an estimated -2.5% and a decline of 3.4% in April.

————–

9:43 a.m. Surprise contraction in services in France

Activity in the private sector has returned to the contraction zone in France, according to the composite PMI flash index established by HCOB. In provisional data for June, the composite index, a synthesis between industry and services, fell by 3.9 points to 47.3, thus falling back below the critical threshold of 50 points. A deterioration due in particular to the contraction of 4.5 points to 48 observed in the services sector, the first since January. The manufacturing sector remains in a contraction zone at 45.5 points, after 45.7 in May.

————

9:21 a.m. SES-imagotag unbeatable on the decline

Trading on SES-imagotag resumed on Friday after being suspended on Thursday. But no balance has been found for the moment in an unbalanced downward order book, which suggests a fall of more than 60% in the title of the manufacturer of electronic labels for mass distribution. Hedge fund Gotham City Research launched an attack yesterday morning accusing SES-imagotag of presenting “misleading, incorrect and deficient” financial statements. After trading, company management responded that Gotham City’s report contains numerous gross inaccuracies and/or misunderstandings.

9:03 a.m. The Cac 40 continues its decline in opening

In the very first exchanges, the Cac 40 lost 0.41% to 7,173.61 points. SES-imagotag is once again reserved for the downside. The quotation of the action of the specialist of the electronic labels had been suspended Thursday after the attacks of the hedge fund Gotham City Research.

hello to all, let’s go for this last session of the week that we will analyze live until the closing in order to give you the best possible light.