Investing even just a few pounds a month can help grow your wealth, but a £10,000 lump sum should be enough to make some meaningful returns.

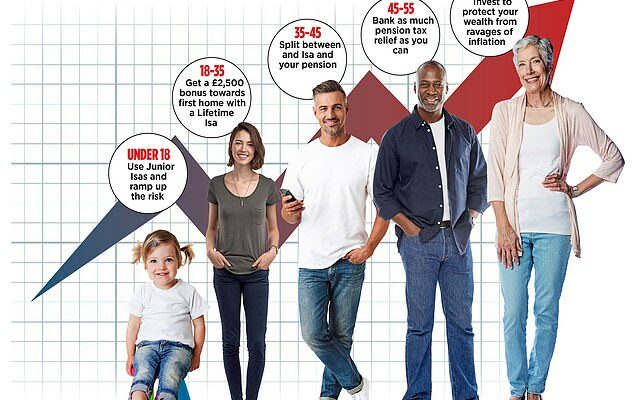

And while birthday cards might tell you that ‘age is just a number’, it really does matter when it comes to making the most of your money. The way we invest needs to alter as we approach major life changes, taking bigger or smaller risks with our cash.

Charles Amber, chief investment officer at wealth management group Saltus, says the key to using your money successfully is to look at your ‘genuine time horizon’ – understanding when and why money will be used before picking the right type of investment.

Experts explained what they would do with £10,000 at every stage of life to ensure that it grows as much as possible

He says: ‘Are you saving to buy a house in the next few years? When are you planning to retire? Will you want to send any children to private school, etc?’

You will also need to consider if you can afford to keep your money untouched for at least five to ten years or if you would be better off using it to pay unsecured debts.

With all these factors in mind, we asked experts what they would do with £10,000 at every age to ensure that it grows as much as possible – without taking on unnecessary risk. These are strategies that can be used by new investors as well as those with years of experience.

Under 18

With university fees and housing deposits becoming an increasing burden on young people, many parents and relatives want to help the next generation.

Accounts to consider

Most children do not pay tax on savings accounts, but if a parent is giving them the money they should consider the tax implications.

If children earn more than £100 in interest on money given to them by their parents, the parents will have to pay tax at their income tax rate on all the interest if it breaches their own personal savings allowance of either £500 (higher-rate taxpayer) or £1,000 (basic-rate taxpayer).

Solutions to this include the Junior Isa, which allows you to save £9,000 a year into an account for a child without paying tax on any interest, dividends or capital gains made within it. The money is controlled by the parent or guardian until the child turns 18.

Another tax efficient option is to put the money into a pension. Of course the child would not be able to access this until they reached pension age. However, the money would have decades to grow and they would benefit from extra money from the Government. Non-taxpayers such as children can put a maximum £2,880 into a pension and have the Government top it up by £720 in any one tax year.

The benefits are astonishing: it could turn your £10,000 into £332,486 by the time a child reaches retirement age, according to calculations by DIY investment group Bestinvest. All you would need to do is put the maximum £2,880 a year into an Isa until the full £10,000 is invested. The calculations assume investment growth of five per cent, net of fees.

How to invest or save

Junior Isas can be held in cash or shares. At present, cash rates are relatively high, and there are some Junior Isas, such as that offered by Beverley Building Society, paying more than five per cent.

However, once the Bank of England cuts interest rates, as is widely expected this summer, they will become less competitive. Most financial experts suggest that if you are investing for children long-term, choosing a diversified portfolio of stocks and shares should give better returns.

‘Young investors generally possess a higher risk tolerance, making them well-suited for the volatility that often accompanies growth funds,’ says Sheridan Admans, head of fund selection at investment platform Tillit. ‘They have ample time to recover from any short-term losses.’

You could choose to open a Junior Isa on an investment platform such as Hargreaves Lansdown, Interactive Investor, AJ Bell or Bestinvest, and then you can select which funds are suitable.

Alternatively you could use a so-called robo adviser such as Nutmeg or Wealthify, which select a portfolio for you based on your risk tolerance and timeframe. A low-cost fund that invests in shares of companies all around the world can be a good starting point. This can be added to with more focused or specialist funds.

John Moore, senior investment manager at wealth manager RBC Brewin Dolphin, suggests a cheap global tracker such as iShares MSCI World ETF, which follows a selection of developed markets. More focused funds include BlackRock Frontiers Investment Trust, which specialises in small emerging markets, suggests Admans.

Another of his picks, for a portion of a diversified portfolio, is Sanlam Global Artificial Intelligence, which invests in companies whose main activities are in developing, researching or using artificial intelligence. It also uses AI to make investment decisions.

18-35

Accounts to consider

A Lifetime Isa allows you to put £4,000 a year tax free into savings or investments, and adds a 25 per cent Government bonus. So over three years, your £10,000 could become £12,500 before any investment growth

Those aged 18-35 typically have little disposable income, as they are often either studying or paying off student loans.

However, you have time on your side if you’re investing for retirement, while those looking to save for a house deposit have a special account available that could give them a Government bonus.

The Lifetime Isa allows you to put £4,000 a year tax free into savings or investments, and adds a 25 per cent Government bonus. So over three years, your £10,000 could become £12,500 before any investment growth.

However, this money can be withdrawn only to spend on a first home worth under £450,000 or after the age of 60.

Those in this age bracket should also be contributing to pensions, whether through their workplace or into a private pension, as this money will have time to grow and benefit from tax breaks and employer contributions.

If you are already saving into a pension, your £10,000 could be split between a Lifetime Isa and an ordinary Isa.

How to invest or save

Between 18-35 is the time to take some risk with your long-term investments, says John Moore at RBC Brewin Dolphin.

One option is a cheap tracker fund or Exchange Traded Fund that follows the market.

Emma Wall, head of investment analysis and research at DIY investment platform Hargreaves Lansdown, says that 100 per cent equity funds are the most suitable for this age.

She suggests Legal and General Future World ESG Developed Index. This fund aims to track the performance of the Solactive L&G ESG Developed Markets Index and it won’t invest in tobacco companies, pure coal producers, makers of controversial weapons or persistent violators of the UN Global Compact Principles.

Alternatively, a fund such as Vanguard Lifestrategy 100 per cent equity fund will give exposure to equities at a low price.

Moore also recommends considering more volatile funds such as Scottish Mortgage – which is invested in technology – ‘provided you do not need the income and have a long-term mindset’.

He also likes Impax Environmental Markets, which, he says, is ‘a great way to gain exposure to businesses that might sit under the radar but can be influential in delivering environmental change’.

If you are looking at a shorter timeframe, as with a Lifetime Isa for a house purchase, Jason Hollands, managing director at Bestinvest, suggests cash combined with Personal Assets Trust which ‘is a multi-asset investment trust that includes equities, bonds, inflation-linked bonds and gold,’ he says.

35-45

Accounts to consider

Myron Jobson, personal finance analyst at Interactive Investor, the DIY investment platform, says this age is one where people have ‘significant financial responsibilities such as mortgage payments, children’s education expenses and saving for retirement’.

Some of these are very long-term objectives, while others are likely to be very much shorter, which means different investment strategies are required. This may mean splitting your £10,000 between an Isa, which allows you to take out the money for expenses when you need them, and a pension that will give you income later.

How to invest or save

Jobson explains that analysis of Interactive Investor clients of this age suggests that many are focused on stocks paying an attractive dividend.

Adding bonds to your portfolio could also help with paying income. Admans, at Tillit, suggests Ninety One Global Total Return Credit, which has a mix

of developed and developing market bonds. ‘Bonds can provide a counterbalance to equities in a portfolio,’ he says. ‘They are often seen as safer investments, as they have a fixed maturity date and promise to repay the principal amount at maturity.’

45-55

Accounts to consider

Brewin’s John Moore, describes this age as ‘the decade that finance becomes important’. ‘You are considering some of the big financial questions: What are my life goals? What do I want my investments to do? What can I put in extra savings?’ he says. Topping up your pension is a sensible strategy at this age so as to benefit from as much tax relief as possible.

How to invest or save

You may wish to invest in more cautious funds if you are likely to need the money soon to help fund retirement. However, many now leave their pots invested well into retirement, so if this is your plan you may be able to take more risk.

Vanguard’s Lifestrategy tracker funds are a cheap way to buy both bonds and shares. You can choose your ratio of bonds and shares depending on how much risk you are happy to take by picking between its funds that offer 20, 40, 60, 80 or 100 per cent equities and the rest in corporate and government bonds.

Moore also suggests funds that generate some income. He likes Finsbury Growth & Income, which he says offers exposure to ‘a range of tried-and-tested companies’.

55 plus

Accounts to consider

Financial advisers often refer to this as the ‘decumulation stage’, when you start to spend retirement money rather than add to it.

However, it is a point in life at which individuals’ finances can really differ. Although many can access their pensions from 55 – rising soon to 57 – others will need to work until their state pension kicks in at 66-67 or beyond.

‘It’s still not too late,’ says financial adviser Ian Dempsey, when asked whether those of this age can make use of £10,000 to make their finances more resilient. He suggests that those 55 or older should looking at overpaying their mortgage first and ensuring they have an emergency savings pot.

Assuming you have these sorted, you can still put money into your pension. Even if you’ve already accessed it, you can put in a maximum of £10,000 a year. It’s worth remembering that your pension sits outside your estate for inheritance tax purposes, which makes this a particularly good way to pass down money.

How to invest or save

Ring-fencing capital is often the name of the game for older investors, says Tillit’s Admans. They will also want to keep pace with inflation and generate income.

Andrew Prosser, head of investments at ETF group Investengine, also suggests holding inflation-linked bonds as inflation becomes a larger risk when relying on your portfolio to fund your lifestyle.

One way to track these is using an ETF such as the Lyxor Core UK Government Inflation-Linked Bond UCITS ETF (GILI), which tracks a domestic index. It has a low ongoing charge of 0.07 per cent.

Admans’ suggestions for more focused funds include Trojan Ethical, which includes government bonds, gold and cash, as well as Jupiter Gold and Silver, which is exposed to physical gold and silver and mining companies.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.