Reforms undertaken as part of the European Green Deal, including the recent update of the EU Emissions Trading Scheme (ETS), are helping to accelerate the EU’s decarbonisation, write Gabriel Papeians and Stefan Feuchtinger.

Gabriel Papeians is a market analyst at Vertis Environmental Finance. Stefan Feuchtinger is the head of market research and analysis at Vertis Environmental Finance.

The EU ETS is the cornerstone of European policy to tackle climate change and encourage the decarbonisation of heavy industries. It is a market-based mechanism, meaning that the price companies must pay to emit greenhouse gas emissions varies with supply and demand.

As part of the Fit for 55 package, the recent market reform has brought important changes, especially tightening the supply from next year onwards. This has created the expectation that EUAs, emission allowances, and, therefore, polluting costs could only go up.

Yet, the timing and interrelation of how supply interacts with demand make it a less straightforward conclusion.

First half of the year was less bullish for EUAs than expected

In the first half of 2023, power emissions experienced a significant drop of around 17% compared to the previous year, translating to approximately 125 million allowances annually should this trend persist until the end of 2023.

Few had expected such a significant drop, at least by the beginning of the year. A warm winter, low industrial demand, high renewable penetration, and dropping gas prices led to this situation.

Our model anticipates a slightly less bearish but still remarkable decline of approximately 14.8% in power emissions for the entirety of 2023 compared to 2022.

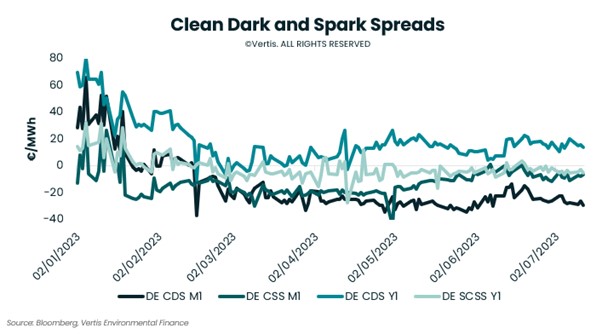

Cheaper gas triggered a shift in favour of gas-powered generation over coal, hence leading to the Clean Spark Spread (CSS), representing the theoretical profit margin of an average gas power plant, surpassing the Clean Dark Spread (CDS), reflecting the profitability of an average coal power plant.

Consequently, utilities that had previously hedged their coal power production began to unwind their hedges, at least partially. In other words, it means a sale of EUAs back into the market.

This fuel-switching phenomenon implies that when the costs of switching from coal to gas are below zero, it becomes economically advantageous to do so. The margins for fuel switching vary depending on the efficiency of different coal and gas turbines, making it a gauge for the profitability of running gas over coal.

In the near term, the negative fuel switching costs have prompted utilities to sell back EUAs previously locked up in hedges.

However, hedging for coal-powered generation in 2024 is still economically viable, and utilities are expected to continue hedging their year-ahead generation, albeit slower.

The expectation is for utility hedging speed to gradually increase in 2023. The main point of uncertainty is whether it will reach pre-crisis levels.

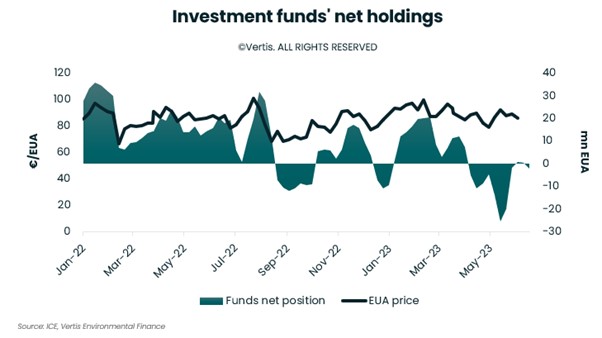

The data on investment funds’ behaviour, covering most hedge funds and trading houses, has shown shifts from consecutive net length to net short positions since H2-22.

Hedge funds have ventured into net short positions three times since August 2022. A record net short position of 25 million EUAs by the week ending June 2nd triggered a short squeeze, leading to bullish pressure and subsequent covering of short positions. As a result, CO2 prices increased to around €94.85 by June 20th before settling at €89.08 on June 30th.

Since then, hedge funds’ net positions were hovering around the level of 0, confirming our hypothesis that they were waiting on the sidelines after the short position blew up. The latest data contradict the views that funds were staying on the sideline, they are now 8.5m long.

Mid-term Outlook for 2025 is neutral to bullish – with volatility

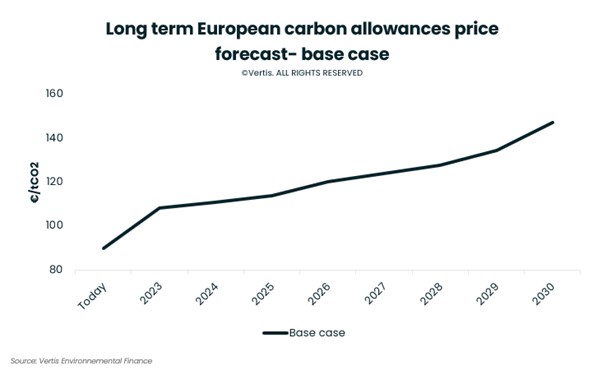

Based on the supply and demand analysis, EUA prices are expected to trade largely sideways on conflicting fundamentals, with an eventual uptick. The forecast predicts an average price of €108 in 2024 and €112/EUAs by the end of 2025.

The long-term Outlook to 2030 remains bullish unless…

In the long term, we expect price fundamentals to be bullish due to the yearly decreasing cap, in line with “fit for 55” targets. The TNAC (Total Number of Allowances in Circulation) is expected to shift downward by 2026 due to a combination of cap reductions, RePowerEU volume frontloading, and the shipping sector’s shift to a significant short position by 2026.

The balance between decreasing supply and demand reductions is expected to tilt towards a tighter market in the decade’s second half.

The main risk exposure of this bullish development is even more substantial emission reductions – i.e. massive decarbonisation in the industrial sectors, whether by better technology or due to carbon leakage. No one has a crystal ball on this, but one thing is clear: EUAs will not see a ceiling any time soon without major decarbonisation.

The fact that hard coal and lignite are pushed out of Europe’s power mix results from several factors, including the EU ETS. If EUAs keep rising, we expect the power sector decarbonisation to accelerate over the following years.

Industry, meanwhile, had been shielded from the full impact of the ETS for years. With the latest ETS reform, that seems to be a thing of the past as changing free allocation rules will mean that every euro of EUA price increase will often mean hundreds of thousands of euros taken out of the pocket of industrials – unless they find ways to decarbonise.