background

The Augsburg arms supplier Renk wants to go public on the second attempt. Even if business in the industry is booming, finding investors is still not easy for companies.

With Russia’s attack on Ukraine on February 24, 2022, the security question in Europe suddenly emerged. The attack revealed the vulnerability of the continent – including Germany. That’s why urgent investment needs to be made now, experts demand.

“Germany’s ambitions to provide the most powerful army in Europe are disproportionate to the resources provided,” complains Christian Mölling, deputy director of the DGAP research institute and head of the Center for Security and Defense, in an interview with tagesschau.de. A special fund of 100 billion euros is not enough as an investment. “The turning point is only half successful.”

Big gap among NATO countries

According to the Ifo Institute, the gap to the two percent of economic output that each NATO member should invest annually in defense is an average of 25 billion euros for the years 2026 to 2029. In Germany, inflation and interest payments worth billions are eating up parts of the loan-financed Bundeswehr special fund.

There are new challenges, says researcher Mölling. One should not rely solely on the NATO partners: Germany and Europe must take care of their own defense – regardless of who will rule in the White House in the future. “We can already see that the majorities in the US Congress are preventing defense spending.” The United States also expected partners strong enough to provide assistance themselves.

Trillions for armaments

In 2022, countries around the world invested a record amount in the military: a total of $2.2 trillion. Europe is the region in which the SIPRI Institute for Research on Violent Conflicts, Security and Peace recorded the largest increase compared to the same period last year: 13 percent. The USA has the highest defense spending, followed by China and Russia. Germany ranks seventh.

However, the SIPRI data also showed that the demand for weapons is high due to the geopolitical situation; that the 100 largest weapons manufacturers in the world sold 3.5 percent less in 2022 – mainly due to supply chain problems and a lack of employees, which particularly affected smaller companies.

German armaments in demand

Meanwhile, sales at the large German companies Airbus and Rheinmetall have increased. German defense companies are considered highly specialized worldwide and have a good reputation. They are in high demand on the market and have therefore even had to expand their production.

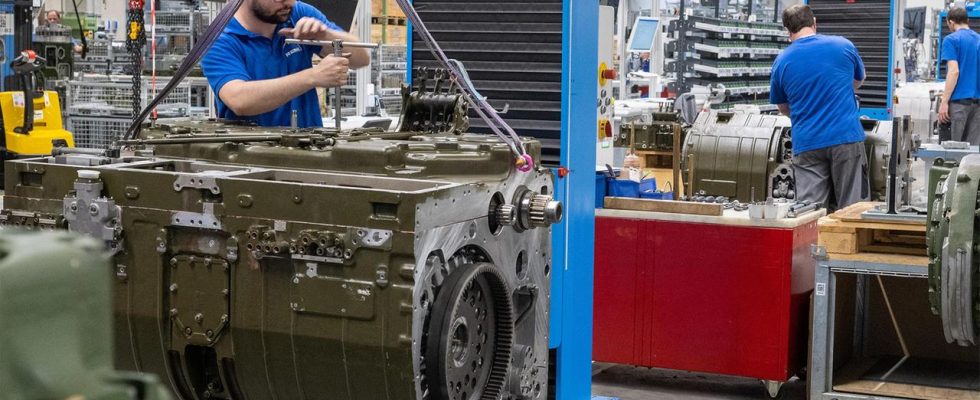

The Renk company from Augsburg is one of these specialized manufacturers and is the world market leader for tank transmissions. The company, which currently has more than 3,400 employees and an annual turnover of 850 million euros, produces 70 percent of its products for the defense industry. In the first nine months of the last financial year, Renk booked 24 percent more orders than in the same period last year.

Russia is arming itself faster

“Many companies in the defense industry have realized how great the need is,” says Christian Mölling. Some took risks with appropriate investments. But armaments projects in Germany take twelve to 15 years from development to implementation, the expert calculates.

That is too slow to keep up with a potential military opponent, Russia. “However, recent estimates suggest that it will only take three to five years from the end of the main fighting in Ukraine until Russia has rebuilt its army to the point where it poses a threat to NATO. We must prepare ourselves for a possible conflict with Russia set.”

Difficult search for donors

In order to be able to pick up the pace, investments in armaments are considered crucial – but investors are difficult to find, most difficult in Germany, Renk boss Susanne Wiegand recently reported at the Handelsblatt security conference. According to her own information, she has held around 600 meetings with investors.

Expert Mölling confirms this. Some defense companies reported that the so-called ESG sustainability criteria had a negative impact on their business development. “The criteria leave a negative footprint on your banks and suppliers. The amount for the state defense goal is assessed negatively,” says Mölling. Here he sees a need for optimization in the EU. “You can’t compare defense with tobacco.”

A question of Delivery ability

Overall, industry experts report, the perception of the defense industry has changed since February 2022. Despite increasing military spending in many countries around the world, the ability of defense companies to deliver is a problem because they are often highly specialized, operate in niches and do not produce large quantities.

The question is therefore how quickly demanded products can be delivered in the desired quality at the planned costs. Smaller companies in particular quickly reached their limits: production takes time, even if the products have long been developed.

Defense stocks are experiencing a boom

One way to reach your goal faster is through financial commitments. Defense companies are experiencing more demand on the stock market: Since the Russian attack on Ukraine, Rheinmetall’s share price has more than tripled. Hensoldt shares, which have only been listed on the stock exchange for three and a half years, have doubled in value since the outbreak of war.

Renk is going public today. KNDS – a merger of the defense companies Krauss-Maffei Wegmann and Nexter – acquires Renk shares for 100 million euros and receives a place on the supervisory board. He is one of Renk’s biggest customers. The asset manager Wellington Management is buying shares for a further 50 million euros.

Small investors are left out

The manufacturer Renk originally wanted to return to the trading floor in October 2023 – exactly 100 years after its first IPO in 1923. But the company canceled the plans a few hours in advance.

Renk is designing the new attempt differently: Instead of a public offer like in October, Renk is relying on a so-called private placement. This means that shares are only given to a certain group of investors. The public and small investors are initially left out.

Bianca von der Au, HR, tagesschau, February 7, 2024 8:36 a.m