market report

Status: 03/16/2023 3:39 p.m

The ECB is undeterred by the banking crisis and continues to fight inflation. Investors are undecided. Are the markets now waiting for the next shaky candidate?

After the rescue operation for the reeling Swiss bank Credit Suisse, the ECB raises the key interest rate for the euro zone by half a percentage point. Investors seem to be puzzled as to what this signal is supposed to mean. The hectic price movements show how nervous investors are: the DAX fluctuated between gains and losses as a result, then rose sharply – only to fall back again. The leading German index is currently around 0.3 percent up at 14,790 points.

So there is not much to see of a sustained recovery rally. The current situation in the banking sector is too critical and it is by no means certain that other institutions will not get into difficulties in the next few days. The ongoing uncertainty is forcing investors to adopt a cautious strategy.

ECB dares to take the big step

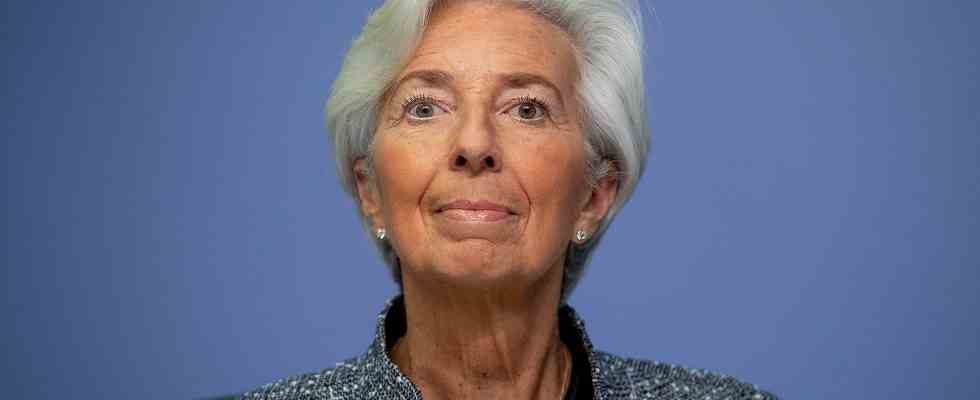

In the dilemma between combating inflation and the banking crisis, ECB President Christine Lagarde decided today to raise the key interest rate by a further 0.5 percent. For investors, this signal should probably mean that the central bank is prioritizing the fight against inflation, considers the situation of the banks to be controllable and the crisis is easily manageable or even over.

“Even the turbulence in the banking system did not deter the ECB from the interest rate it had announced. That expresses justified confidence in the solidity of the European banking system,” comments Ulrich Kater, chief economist at Dekabank. “Nevertheless, central banks and regulators must stand by their guns in Europe in order to be able to stabilize quickly in individual cases,” said the expert. The economy and financial system would have to be weaned from a decade of zero interest rates. That is an arduous task.

Ponder the seriousness of the situation

On the other hand, if the ECB had raised interest rates less sharply or even refrained from raising interest rates, market participants could have interpreted this as a warning of the seriousness of the situation. The result would have been a panic attack on the financial markets, says Christian Henke, market observer at IG Markets.

This could have consequences for the future policy of the central banks, since the looming banking crisis has added another factor that they cannot ignore in their future actions: “Recent developments suggest that the pain threshold for financial stability is at a lower level interest rate level is higher than for the real economy,” writes Johannes Mayr, chief economist at Eyb & Wallwit. “Fighting inflation is therefore increasingly coming into conflict with safeguarding the stability of the financial system,” he concludes.

Update economy from 03/16/2023

Stefan Wolff, HR, 03/16/2023 09:47 am

“Fear of the next Lehman collapse”

Before that, relief was felt on the stock markets that the Swiss National Bank would support Credit Suisse. “The measures should provide some level of certainty so that spillover to the sector can be contained,” said Anke Reingen, an analyst at investment bank RBC Capital Markets. However, the situation remains risky.

Jochen Stanzl, an expert at CMC Markets, sees it that way: “Investors are now puzzling over whether the big end was already here or is yet to come. They are trying to estimate the damage that the central banks have done with interest rates that are too late on the one hand and then too steep on the other have.” Thank you very much that the news about the major Swiss bank Credit Suisse could not have been the last. “There is fear of the next Lehman collapse,” says Stanzl.

Wall Street sinks lower

This fear can still be felt in the USA: The Dow Jones lost 0.8 percent to 31,625 points. The broader S&P 500 fell 0.5 percent to 3,874 points. The Nasdaq index fell 0.3 percent to 11,397 points.

In the US, the ECB’s interest rate hike is weighing on sentiment, as some investors had bet on a slower hike given the looming banking crisis. Concerns about further bad news make investors shy away from buying shares.

US regional banks were hit, most notably First Republic Bank, which fell 34 percent. The troubled private US lender is reviewing several options, including a sale, according to a report. Large banks such as JPMorgan, Citigroup and Bank of America also posted price losses