Market report

As of: 10/21/2021 7:46 a.m.

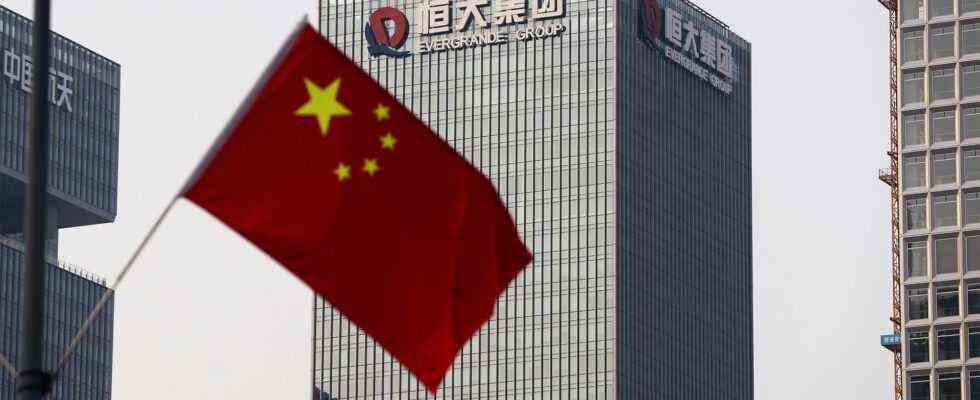

The good specifications from Wall Street care little for the DAX. Because there is once again bad news from the stumbling Chinese real estate developer Evergrande.

The DAX should start the new trading day with losses. Banks and brokers are currently assessing the 40 German standard values 0.3 percent lower at 15,469 points. The day before, the DAX had posted a slight plus of 0.1 percent to 15,523 points.

The good guidelines from Wall Street fade into the background in the morning. Instead, the markets have to deal with new bad news from the distressed real estate company Evergrande.

The second largest Chinese real estate developer said its plan to raise liquidity by selling its property management business to a smaller rival has failed.

In other words: Evergrande is still heading for a default, in the course of the month interest payments for offshore bonds are due, for which the 30-day grace period expires.

China Evergrande Group shares are plummeting almost twelve percent in Hong Kong, and China Evergrande Property Services shares are falling by more than six percent.

Investors’ concerns are once again revolving around the possible contagion effects of an Evergrande bankruptcy for the global financial markets. That depresses the prices on many Asian stock exchanges.

The Hang Seng in Hong Kong is currently losing 0.8 percent. The Japanese Nikkei traded 1.5 percent lower shortly before close of trading in Tokyo.

In view of the new developments in China, there is also a risk that the good guidelines from Wall Street will fizzle out in this country. On the New York stock exchanges in the middle of the week, optimistic forecasts from several pharmaceutical companies created a good mood.

The Dow Jones marked a record high at 35,669 points during trading and ultimately closed 0.4 percent firmer at 35,609 points. The broad S&P 500 rose 0.4 percent to 4536 points. The technology-heavy Nasdaq lost 0.1 percent to 15,121 points.

According to the CoinMarketCap platform, the cryptocurrency Bitcoin is trading again at around $ 65,000 this morning. The day before, the oldest and most important cyber currency had reached a record high above 66,000 dollars.

The plus of the past four weeks added up to roughly 50 percent. In particular, the debut of the first listed US fund (ETF) for Bitcoin this week had given the cryptocurrency a powerful boost.

The euro has already lost its early gains. The European common currency is currently trading sideways at $ 1.1651. It has made up significant ground since its low of $ 1.1523 in mid-October.

The gold price rises slightly in early trading. One troy ounce of gold currently cost $ 1,784, 0.2 percent more than the previous day.

Among the individual stocks in the DAX, the focus is on SAP. The Walldorf-based software giant has increased the pace of relocating its core business to the cloud. The cloud revenues contractually guaranteed for the next twelve months with the flagship product S / 4Hana Cloud rose in the third quarter by 58 percent adjusted for currency effects to 1.28 billion euros. He expects a further acceleration, said CFO Luka Mucic to journalists.

The recovery in gastronomy gave the Metro wholesale group a strong final quarter. Sales rose in the fourth quarter (to the end of September) by 9.5 percent to 7.1 billion euros and were thus well above the level from before the pandemic. With this, Metro clearly exceeded the expectations of the analysts.

The pharmaceutical company Novartis and the biotech company BioNTech have signed a new production agreement. As Novartis announced today, the filling and production of the mRNA-based corona vaccine from Pfizer-BioNTech will be expanded. Novartis will use the sterile production facilities at its Ljubljana site in Slovenia to fill at least 24 million cans in 2022.

According to insiders, the Internet payment service PayPal is planning a billion-dollar takeover of the Pinterest online pin board. PayPal wants to bring the purchase together by the beginning of November and is said to have offered 70 dollars per Pinterest share. With the resulting purchase price totaling $ 45 billion, the deal would be the largest takeover by a social media company to date.

Despite the global chip crisis and delivery problems, the US electric car manufacturer Tesla earned more in the third quarter than ever before in a quarter. In the three months ending September, earnings rose 389 percent year over year to $ 1.6 billion. Sales grew 57 percent to a record $ 13.8 billion.