analysis

8:17 a.m., March 11, 2024

- VDAX NEW – WKN: A0DMX9 – ISIN: DE000A0DMX99 – Price: 12.99 points (VIX)

- DAX Index Future – WKN: 846959 – ISIN: DE0008469594 – Price: €17,759.00 (EUREX)

- DAX – WKN: 846900 – ISIN: DE0008469008 – Price: 17,814.51 points (XETRA)

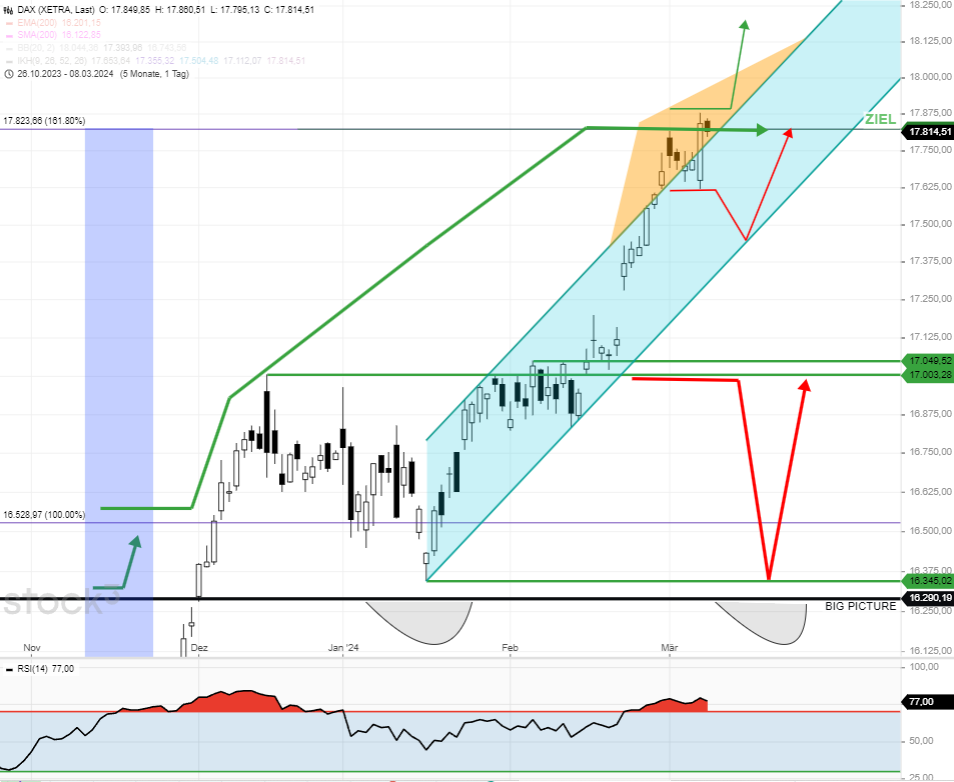

- The DAX had reached a large typical price target of 17824 as a result of the completed summer/autumn correction of 2023. The buyers failed at 17824 twice within a few days.

- The index is partly overheating and is emerging from its current trend channel.

- The week of the big derivatives expiration begins, which only happens 4 times during the year. The highlight of the derivatives event will be Friday at 1 p.m. The DAX is overshadowed by special effects in the run-up to this date.

Current status:

- XETRA DAX closing price: 17815

- DAX pre-market: 17750

- VDAX NEW: 12.99

Resistances of the XETRA DAX

➡️ 17816/17824 ➡️ 17879/17910 ➡️ 17935 ➡️ 18000/18005

🔵 Main variant

- The DAX starts weaker today, because after a weekly closing price of 17815, the previous stock market points to a start at ~17745.

- A reasonable little intraday support can be found at 17750/17720.

- The DAX is also trading in an upward trend above 17619. So far, every hint of weakness has been turned into new highs by determined buyers,

Because there has been a very special and very rare rising phase of particular bull strength for weeks. This is also supported by the very low VDAX NEW (12.99). - The DAX level 17816 represents a small resistance.

- Trading above DAX 17745, or at least above DAX 17619, there are still chances of further DAX highs at 17879, 17910 or 17935 and 18000/18004.

DAX 17935 would mathematically be the ideal target of the upward movement that has been evident since February 13th (start at 16831.53). However, the market can already be satisfied with the level of 17879 that has been reached.

In general, the XETRA DAX target zone has been and continues to be at 17824/17935 since February. The DAX has entered the target zone since Thursday.

Supports the XETRA DAX

🔴 Bearish:

- According to my evaluation, the DAX is about to begin another sideways phase lasting several days, which will reach the 17620/17480 area, especially since the double candlestick sequence of a “bearish harami” appeared on Friday, which is a warning signal in the upward trend.

- A clouding of the chart picture would occur today if the DAX were to settle below 17745 at the hourly close. Today’s daily pivot S3 at 17721 speaks against this.

- A sell signal occurs if the DAX falls below 17619 at the end of the hour from now on.

➡️ 17745/17721/17718 ➡️ 171619 ➡️ 17480 ➡️ 17415

With the premium ADT service you also receive intraday analyses, trading setups and sample portfolio trades

In addition to all of this, in my service you also benefit from technical chart analysis of interesting individual stocks (Germany, USA), updates as well as regular webinars and personal contact.

You can find out which stock I am currently watching for a possible portfolio entry in the exclusive analysis in the premium service ADT.

👉 Meinen Analyse- und Tradingservice “ADT” 14 Tage testen, um meinen Premium Content LIVE zugestellt zu bekommen

Good luck, Rocco 🙂

charts

Arrow logic:

🔵 BLUE ROUTE is favored; has a high probability of approx. 60%

🟢 GREEN = best case history

🔴 RED = worst case scenario

Upcoming ADT Webinars

👉[–>Zu den Webinaren

Other Recommendations

🔍 Rocco’s world of knowledge

👉[–>Roccos Top3 – Das sollten Trader als oberste Gebote beim Start in die Traderkarriere beachten…

👉[–>Roccos Top3 – Folgende Sentiment-Werkzeuge und deren Lesart sollte jeder Trader kennen…

👉[–>Roccos Top3 – Folgende Indikatoren-Setups sollte jeder Trader kennen..

🔍 Read all posts by Rocco Gräfe on the stock3 platform

👉[–>Hier klicken