The Securities and Exchange Commission (SEC) has released a report outlining key information on the digital asset market. with information from Trading value of digital assets in Thailand to the price of digital assets in each Thai exchange compared to the world market For information to follow on a weekly basis In the past week, it has been reported as follows:

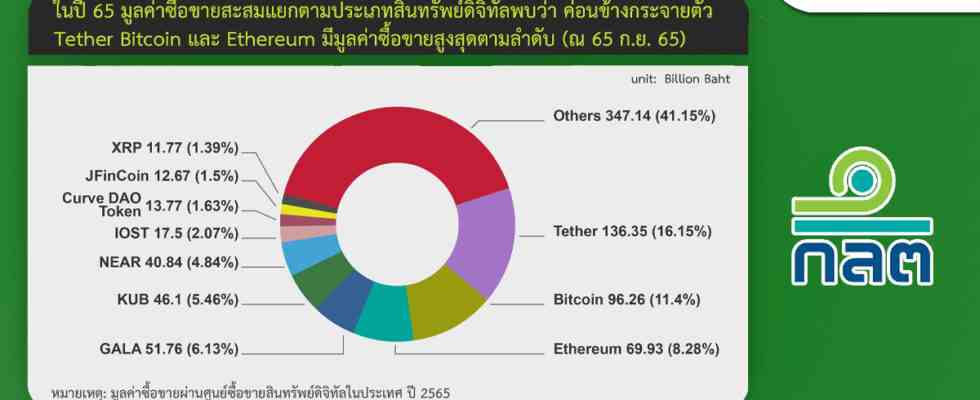

Global digital assets have a market cap of $0.98 trillion, with 38.7% coming from Bitcoin alone. With a daily trading volume of $49.7 billion, investor trading is relatively fragmented, with Tether Bitcoin and Ethereum being the largest, respectively.

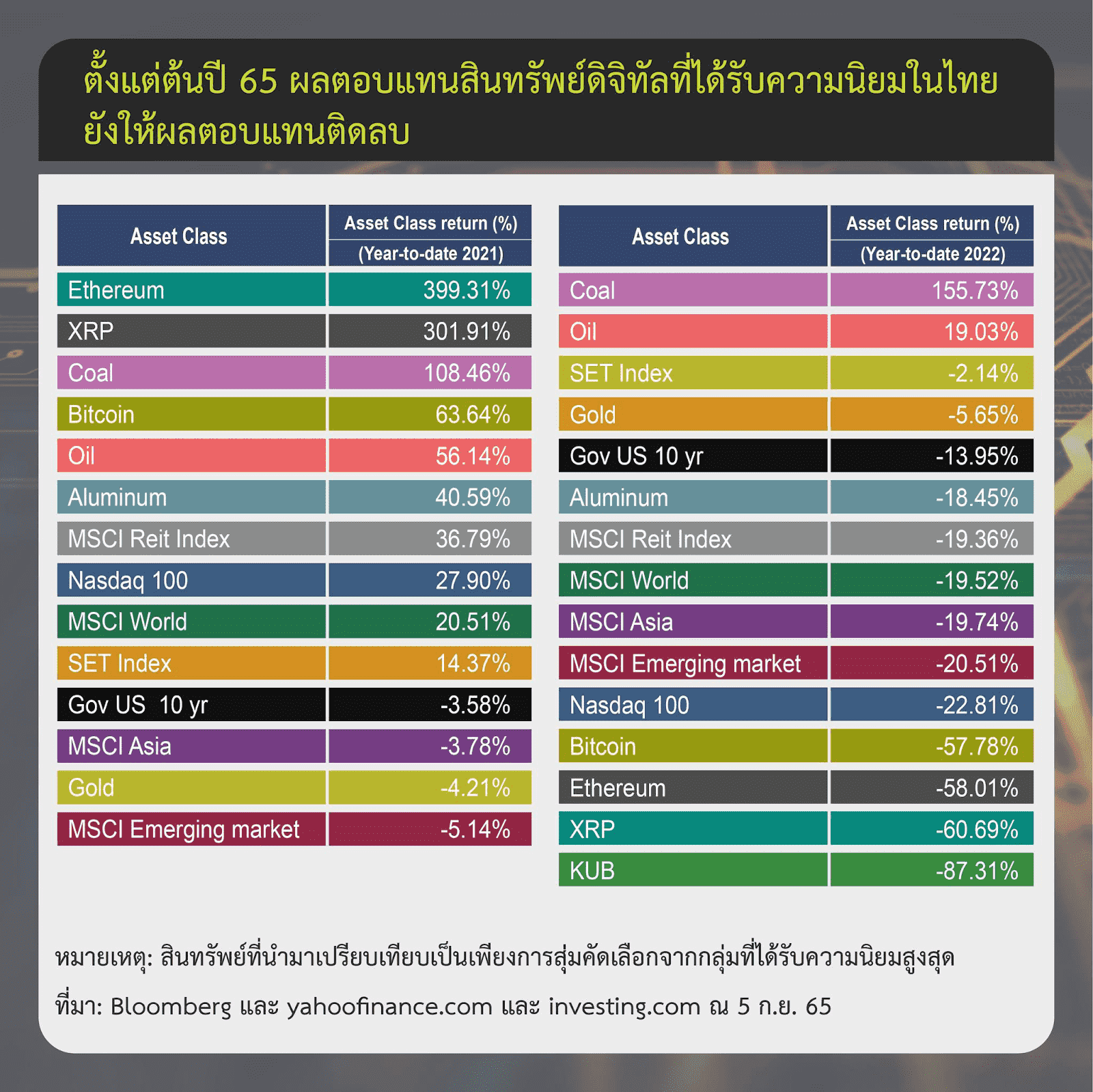

Despite the popularity of investors who have started to invest in digital assets more and more. But returns on assets that are popular in 2022 are still considered negative. The popular asset, Bitcoin, had a negative return of -57.78%, while the Thai project KUB coin had a negative return since the beginning of the year at -87.31%.

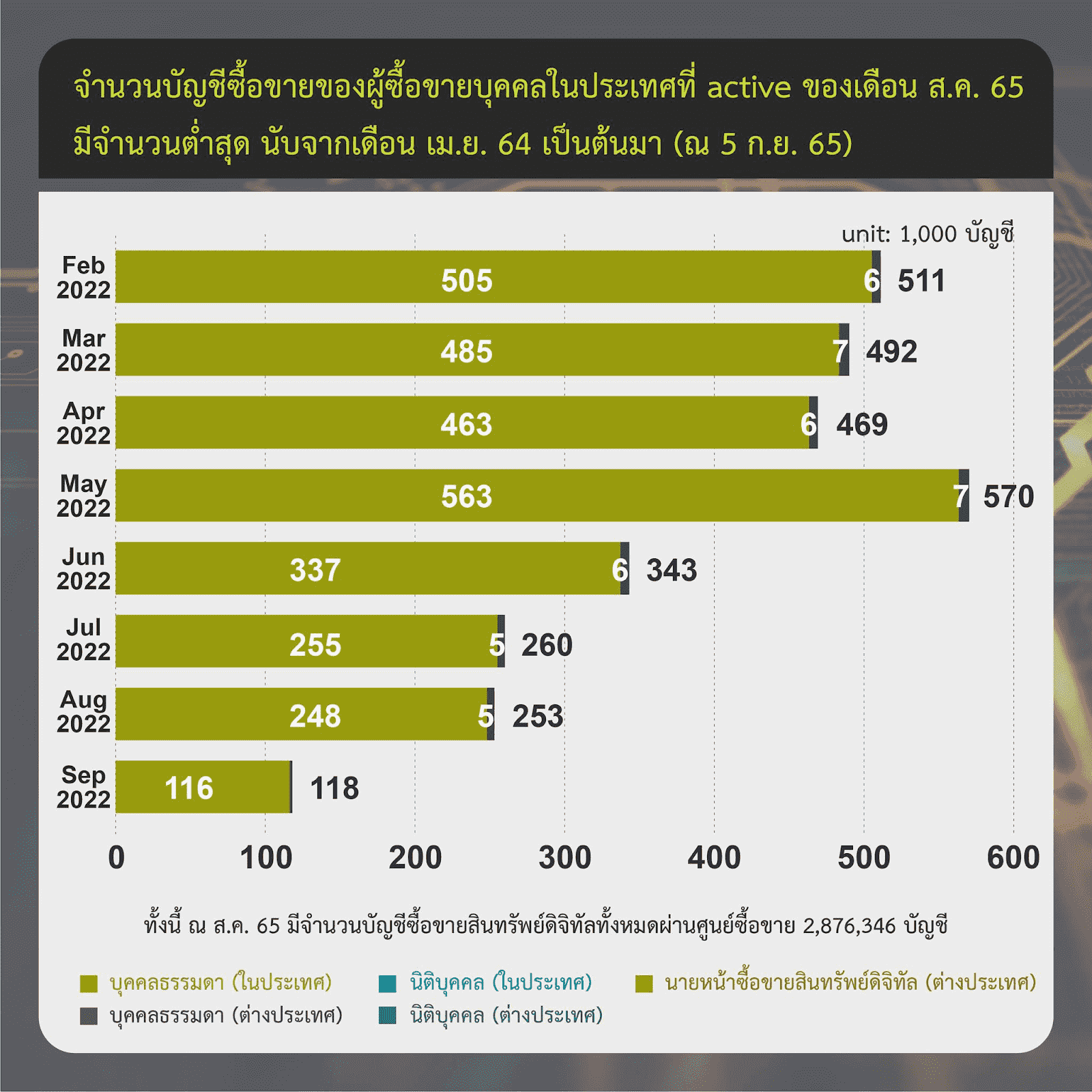

The number of active individual trading accounts in Thailand has also decreased significantly. By the past August It was the month with the biggest decline since April. This could be a Domino effect from the collapse of the Terra blockchain and result in massive losses. Until many people decide to stop investing in digital assets.

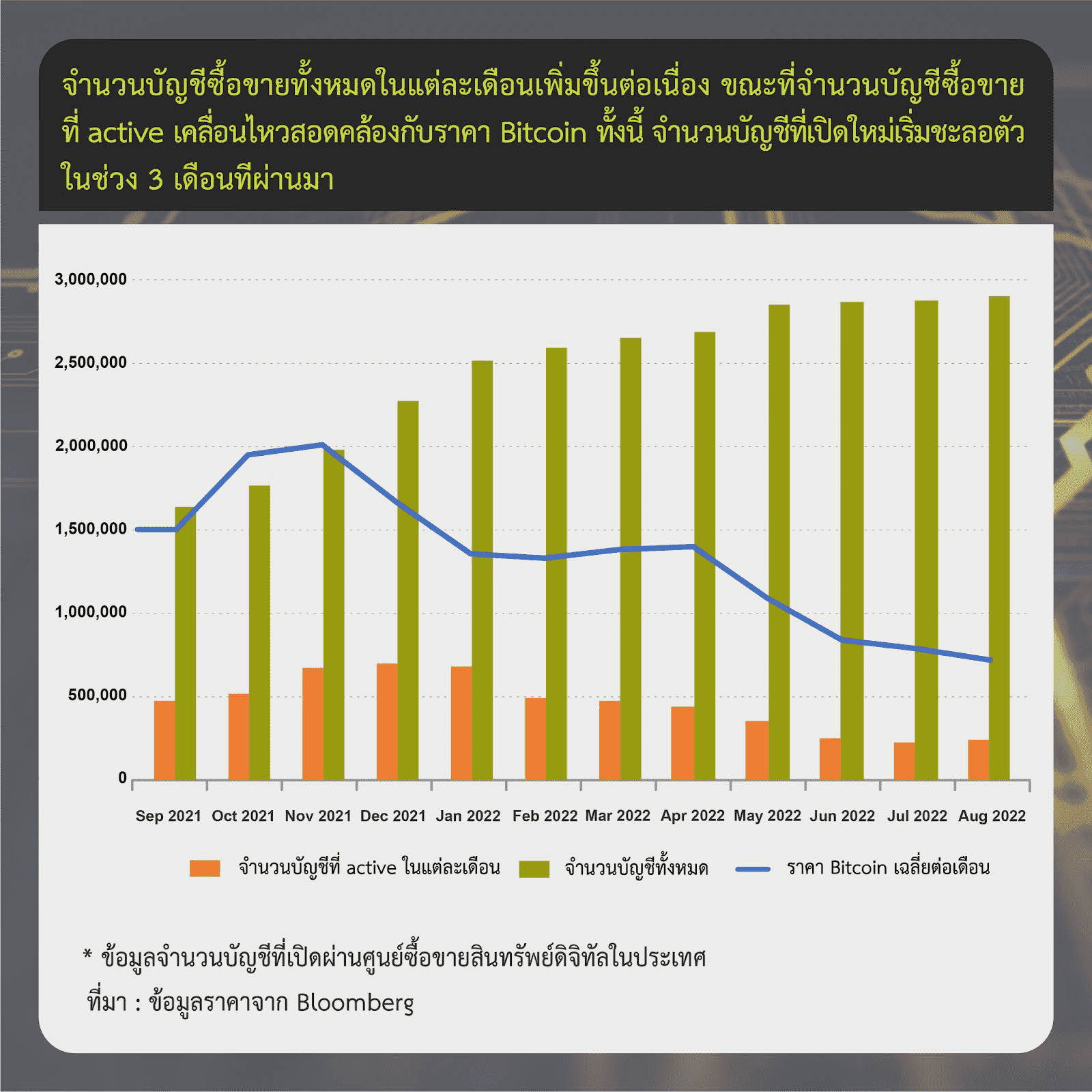

However, even the number of active users is greatly reduced. But the number of investor accounts continues to increase. This is saying Thais have become more interested in investing in digital assets. Meanwhile, the price of Bitcoin has dropped somewhat, but it is still in the sideway range, running between $21,000 and $22,000, falling to the $20,000 range. lar occasionally

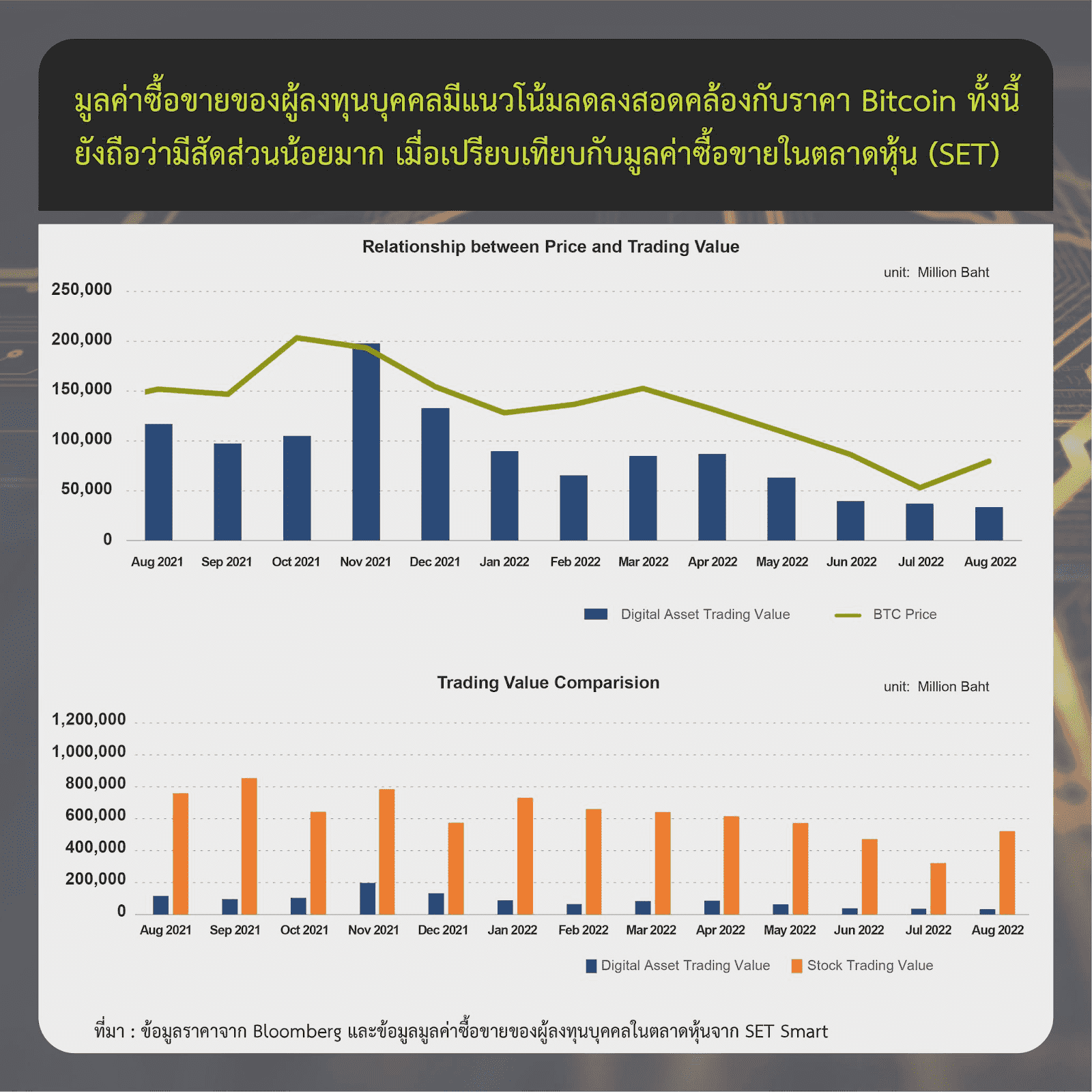

In addition The report also indicated that the trading value of individual investors is likely to decline. This is in line with the Bitcoin price, having dropped to below 50 billion baht from a peak of 200 billion baht in November 2021, but still a small percentage. Compared to stock markets like the SET

Information from: The Securities and Exchange Commission (SEC)