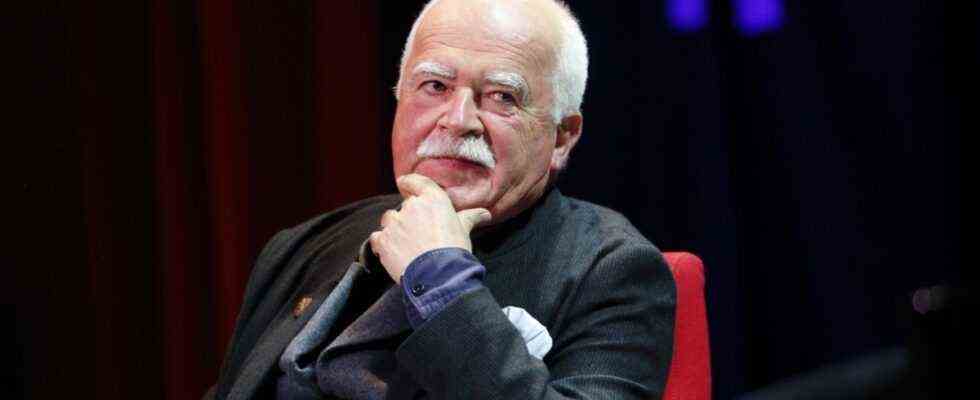

In his 13 years in the Bundestag, from 2002 to 2015, Peter Gauweiler was always considered particularly stubborn. As someone who preferred to stick to his conscience rather than party and government lines and who even sued his own government in the constitutional court. “Only those who have a job in addition to politics are as independent as the Basic Law provides,” postulated the CSU man when his high legal fees once again sparked debates. Discussions about what people’s representatives are allowed to do and collect on the side. With the reputation of the exemplary parliamentarian that Gauweiler had at times, some processes in his Munich office at the time are difficult to reconcile.

This is particularly true of a case from 2012 that has not yet been made public. The law firm Bub, Gauweiler und Partner has used Gauweiler’s Bundestag office in Berlin in at least one case to provide a client with insider knowledge about a legislative proposal by the federal government permit. The information apparently flowed through Union channels. This can be read in notes made by a lawyer from the firm.

According to these notes, the unusual transfer of knowledge took place in spring 2012 from Berlin via Munich to Frankfurt; to Hanno Berger, a tax lawyer who was in great demand with millionaires and billionaires at the time. Berger was feared by the tax authorities as someone who knew all the loopholes in tax law and was able to trick the tax authorities again and again.

A good six months later, in autumn 2012, Berger went to Switzerland as one of the main suspects in the Cum-Ex tax scandal, where he is currently in custody for extradition. There are now two charges against him in Germany, and he faces several years of imprisonment here. Berger denies all allegations. In spring 2012, it was not foreseeable that the Frankfurt tax attorney would later be viewed by public prosecutors as one of the central figures in the cum-ex scandal and prosecuted. However, the process documents that the merging of parliamentary mandate and law firm in the CSU goes back a long way and is not limited to current cases involving the state parliament member and Gauweiler’s current law firm partner, Alfred Sauter.

Berger was very interested in the annual tax law

the SZ Gauweiler and his media attorney described the relevant facts in detail by email last Friday and asked two questions: To what extent he, Gauweiler, was involved in these processes in 2012 in detail. And whether there have been other processes of this kind. Gauweiler and his media lawyer did not answer. Berger’s lawyers also did not comment on request.

One of the notes in which what happened at that time can be read is particularly revealing. On April 19, 2012, the lawyer from Gauweiler’s office noted that she had telephoned the head of Gauweiler’s representative office in the Bundestag. It was about the 2013 Annual Tax Act, which was to be discussed in the cabinet of Chancellor Angela Merkel at the time. Hanno Berger was very interested in the annual tax law. The federal government apparently wanted to tax foreign family foundations of German taxpayers differently and more heavily. According to other documents from Gauweiler’s office at the time, this also affected Berger himself and his clients.

The Munich lawyer recorded in writing what she had learned from Gauweiler’s Berlin office manager. In the Federal Ministry of Finance there is a template for the annual tax law for the cabinet meeting. This template was “but not yet available to him,” said the Berlin office manager. “He might have this on the table at the beginning of next week.”

The Ministry of Finance was then CDU-led, by Wolfgang Schäuble. According to the memo, the Berlin office manager told a few details about the planned annual tax law that he had already learned orally. The lawyer later added a handwritten entry to the note. “I will inform Dr. Berger about this by telephone on April 20th, 2012 at around 2:20 pm.”

The memo and other documents show in detail how Gauweiler’s Munich law firm obtained information from government circles about the planning status of the new annual tax law for weeks via Gauweiler’s parliamentary office in Berlin and thus supplied the firm’s client Berger. And what Berger needed it for. The main issue was whether the new rules for foreign family foundations should not apply until 2013. “This would be fine for Dr. Berger and his clients,” the lawyer from the Gauweiler law firm noted after meeting Berger in the Munich office on April 17, 2012.

However, if the changes apply retrospectively, there will be “problems” for Berger, noted the lawyer. After another meeting on May 3, 2012, the lawyer stated that Berger’s “personal matter” had first been discussed with the tax authorities. “For this, the further progress of the annual tax law is awaited first …” At that time Berger argued with the tax office responsible for him in Gelnhausen in Hesse about the taxation of a foreign foundation called the Willow Tree Trust (Weidenbaumstiftung). This is one of the reasons why Berger wanted to know at an early stage what the 2013 Annual Tax Act would bring him.

According to the documents, Berger expressly asked for information from Berlin

The lawyer from the Gauweiler law firm noted a lot more about the meeting with Berger on May 3, 2012: “We promise to stick to the subject of the 2013 Annual Tax Act”; and to “maintain” contact with the head of Gauweiler’s parliamentary office. The then Berlin office manager commented SZ-Inquiry not about these operations. He is named in the notes not by his function, but by his name. However, it can be assumed that the Gauweiler lawyer knew exactly with whom she was talking about the new annual tax law. Otherwise all the questions from Munich to Berlin would have made no sense.

According to the documents, Berger once even specifically asked for information from Berlin. He had received a hint from a “shop steward” in the capital that the annual tax law might come to the federal cabinet later. “He’s asking me to investigate,” noted the lawyer from the Gauweiler law firm after Bergers called on the evening of April 18, 2012 the following day. The lawyer did as she was told, and did it repeatedly. At least once also by email.

The lawyer asked the Berlin office manager on May 15, 2012 at 10:22 am whether “an appointment had already been made known” when the annual tax law should be dealt with in the cabinet. The next day the office manager replied at 4:22 p.m. via the email address “[email protected]” that an “ambitious plan” provided for the annual tax law to be dealt with in the cabinet within a week. “It may be tight, but officially 05/23 is planned.”