Whether it’s zip code or bank details: consumers’ creditworthiness often depends on questionable factors. In order to change that, the federal government now wants to regulate credit rating agencies more closely.

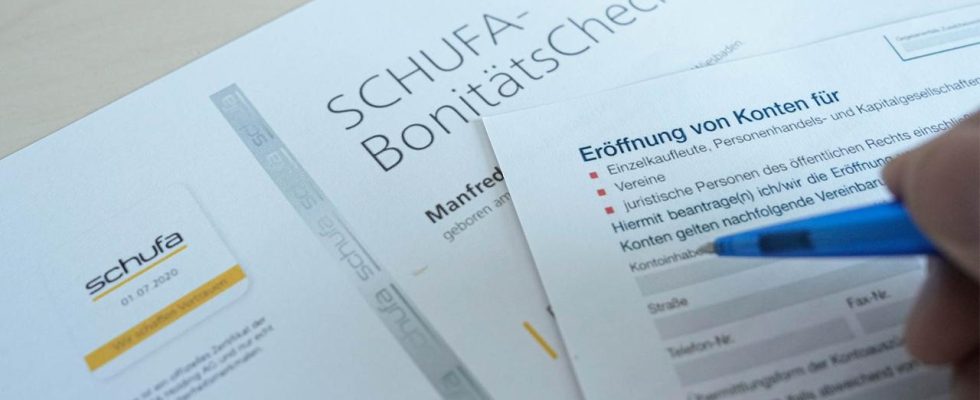

The rights of consumers towards credit reporting agencies such as Schufa are to be strengthened through a reform of the Federal Data Protection Act. The federal cabinet has passed a corresponding draft law.

The federal government is reacting to a ruling by the European Court of Justice (ECJ). The highest European court had ruled that checking consumers’ creditworthiness was only permitted within narrow limits. The data that, according to the draft, may not be used in the future so that companies can assess a person’s ability and willingness to pay includes, among other things, the home address, name or personal data from the use of social networks. Information about incoming and outgoing payments to and from bank accounts is also taboo.

The background to the ECJ decision in December were two cases from Germany. A woman who had been denied a loan sued. She asked Schufa to delete an entry and grant access to the data. Schufa then only provided the score value and general information about the calculation, but not the exact calculation method.

The Schufa score also often plays a role in assessing the solvency of prospective tenants. “In the future, consumers will have to find out straight away which data and categories of data affected their score, how they were weighted and what significance the score has,” said Environment and Consumer Protection Minister Steffi Lemke (Greens).

Measure against Discrimination

Possible discrimination through scoring is now being put a stop to. For example, the planned law, which still has to pass the Bundestag and Bundesrat, excludes the possibility that the postal code decides whether someone is classified as solvent or not.

Interior Minister Nancy Faeser said the draft clearly stipulates that data on ethnic origin and health data may not be included in the automated calculation of solvency.

Facilitations for research

The reform of the Federal Data Protection Act is also intended to make research projects easier. According to the Ministry of the Interior, companies and institutions that process data for historical, scientific or statistical purposes will in future only have to contact one supervisory authority as a contact person when it comes to data protection.

Dietrich Karl Mäurer, ARD Berlin, tagesschau, February 7th, 2024 4:16 p.m