The Merge The Ethereum Mainnet to proof-of-stake (PoS) Beacon chain is expected to occur at 8:30 AM on September 15, 2022. This period is subject to change. It depends on when the Paris upgrade as part of the execution layer is completed. which is when proof-of-work (PoW) chain to Terminal Total Difficulty (TTD) is 58,750,000,000,000,000,000,000,000,000

One hour before The Merge, at approximately 07:30 on 15 September 2022, Bybit will suspend deposits and withdrawals of ETH, ERC-20 and NFT tokens, ERC-721 standards, deposits and withdrawals of ETH assets on The Arbitrum, Optimism, BSC and zkSync networks will be temporarily suspended until the airdrop is issued. Any ETH deposited during the period when deposits and withdrawals in the Arbitrum and Optimism chain are suspended will not be included in the snap. shot

Please note that this time is approximate. This depends on when the TTD value is reached.

Please make sure there is enough time for deposits and withdrawals.

The following two possible scenarios may arise from The Merge.

Scenario 1

No new tokens are created. Bybit will continue to deposit and withdraw ETH, ERC-20, NFT of the ERC-721 standard and other ETH-related product functions. Users will be notified through the Notification Center. and our social media channels

Scenario 2

The fork-chain hard fork will create two competing blockchains and a new token, Ticker for the Ethereum PoW Mainnet, and the forked token will be “ETHW.” Bybit will take a snapshot of the ETH asset of The user and the forked token airdrops, ie, ETHW, to the user in a ratio of 1:1. The forked ETHW tokens will be airdropped to your Bybit spot account. Success will be announced in order.

for asset safety It is recommended to deposit ETH on Bybit in advance for users holding ETH and ERC-20 tokens. Bybit will handle any technical issues. arising from The Merge and potential Hard Fork tokens. The solution is as follows.

A. Airdrop Rules

A.1 Snapshot time

At the time of the Paris layer upgrade, once the TTD value is reached, Bybit will take a snapshot of the user’s ETH asset.

Note Because the split-chain hard fork time cannot be estimated correctly, Bybit takes snapshots every minute after the TTD value is reached. The snapshot data approximates the split hard fork time. The chain is treated as the final snapshot result.

In the event that the market is highly volatile Please avoid transfer of assets, trading and other functions. to ensure that the snapshots are accurate. The assets in your last account are determined by the snapshot.

A.2 snapshot parameters

Main Account and Sub Account, Spot Account, Derivative Account, Unified Margin Account, Bybit Earn Account (including Bybit Savings and Liquidity Mining), Custodial Trading Sub Account, Capital Account, Trading Bot Account.

A.3 Snapshot rules

Unprocessed ETH deposits and pending ETH withdrawals while snapshots are not included in the snapshot data. Please make sure to deposit and withdraw ETH in advance.

Unrealized gains and losses on derivatives accounts are excluded from snapshots.

If you have any outstanding ETH loan while taking the snapshot You will be required to repay the airdrop tokens generated by the lender’s ETH.

A.3.1 Bybit Earn account

– Pool ETH Function ETH/USDT Liquidity Support Airdrop The user’s liquidity consists of the corresponding amount of ETH and USDT. Only the main ETH balance is calculated in the snapshot and the USDT balance is not included in this balance. If the user chooses to use leverage when increasing liquidity. The loan amount will be deducted for calculation.

– Due to the nature of the Dual Asset product, the user’s principal payment currency and interest cannot be determined before maturity. Therefore, it is not included in the scope of the snapshot.

A.4 Completion time

Bybit estimates that it will complete the airdrop distribution of the Forked token, ETHW, within eight (8) hours of completion of The Merge. Deposits and withdrawals of the Forked ETHW tokens will open at a later date. Ethereum PoW Mainnet is enabled and considered stable.

B. About Bybit products

spot trading ETH spot trading and other ERC-20 network tokens will not be affected. ETH Spot currency pairs will be PoS tokens after The Merge is complete.

Margin Trading Margin trading on ETH pairs will not be affected. The lending function will be suspended from 7:00 AM on 14 Sep 2022 to 7:00 AM on 16 Sep 2022. Users who purchase ETH by borrowing non-ETH tokens will Still getting airdrops if ETH prices fluctuate greatly. Your position may be liquidated. Please manage your risks according to the circumstances that may arise.

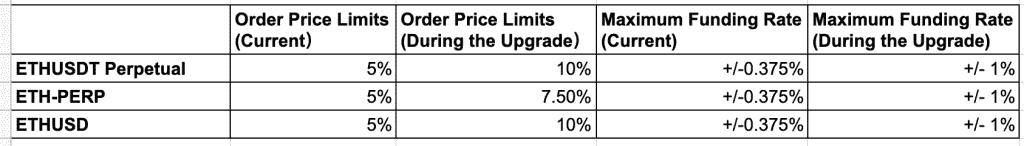

Derivative Derivatives Trading of ETH-related derivatives is not affected. Bybit derivatives may be subject to additional safeguards, including:

1. Adjusting margin levels and related trading parameters such as maximum leverage. Position Value and Margin Maintain

2. Updates on the Funding Rate, Price Index, and Mark Price related calculations.

3. The maximum funding rate and order price limit are as follows.

If a new token is created after the Hard Fork, the price index will track the ETH ticker of the major spot trading platforms. If there is a change in the underlying asset, Bybit will post additional details and/or updates.

options Options trading on ETH-related contracts will not be affected, while the strike price of the current options contract will remain unchanged.

Options related to ETH may temporarily alter how margins are stored. This includes standard Margin Patterns and Portfolio Margin Patterns, which are subject to potential market risks. If a new token is created after the hard fork, the options price index tracks the ETH ticker of the main spot trading platform as an index and underlying asset.

Over-the-Counter Lending (OTC) OTC lending is not affected. If you hold ETH assets, liquidation can occur when prices fluctuate significantly. Please manage your risks according to the circumstances that may arise.

Bybit Earn Users will not be able to add liquidity to the ETH/USDT Liquidity Mining Pool for 15 minutes during The Merge. Liquidity removal from the ETH/USDT Liquidity Mining Pool will not be affected.

Other ETH-related products in Bybit Savings (Fixed or Flexible) and Dual Assets are not affected. During hard fork, prices can fluctuate wildly. Please ensure you understand the potential risks and invest wisely.

buy crypto Bybit’s crypto buying functionality will pause ETH-related transactions and pause advertising during The Merge. The estimated pause time will begin at 2:00 PM on September 14, 2022, and will begin Reversible after completion of The Merge. Affected products include card/wallet payments, balance-related transactions, third-party transactions. and P2P trading

NFT Market Place Bybit NFT Marketplace will temporarily suspend ERC-721 NFT deposits and withdrawals at the time of The Merge. After confirming the stability and security of the Ethereum network upgrade, NFT transactions will resume.

Stay up-to-date with the latest news by following us through the following channels: