The US President stated that US banks are in pretty good shape and people’s savings are safe. It will take some time for the situation to calm down again.

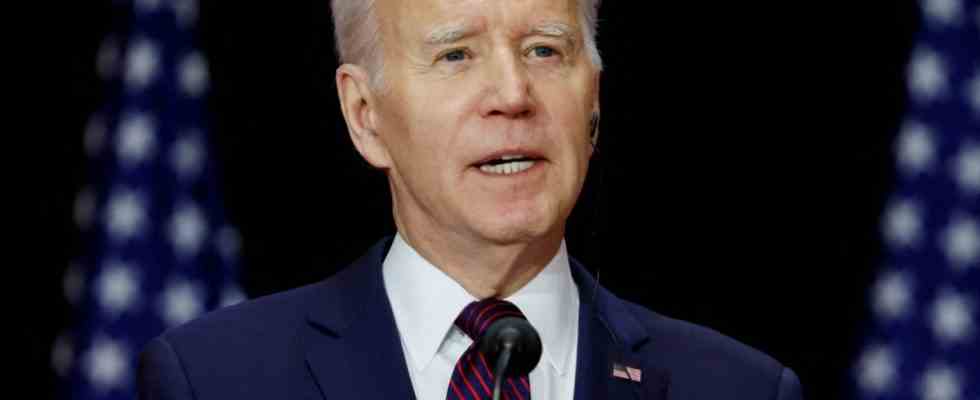

On Friday (local time), US President Joe Biden promised an increase in the US deposit insurance FDIC above the current amount of up to $250,000 if other banks in the US should get into trouble. “If we find that there is more instability than meets the eye, we would be able to let the FDIC use its power to guarantee these[deposits]over $250,000 (…)” he said Reporters at a press conference in the Canadian capital, Ottawa.

Biden went on to say that US banks are in pretty good shape and people’s savings are safe. According to the President, it will take some time for the situation to calm down again. He added that what happened to Credit Suisse in Europe has no impact on US banks.

The trigger for the banking crisis that broke out in early March was the liquidation of the US financial group Silvergate Capital, which is geared towards the crypto industry. A few days later, the US lender Silicon Valley Bank, which specializes in start-up financing, was placed under the control of the US deposit insurance FDIC and closed. Other small financial institutions also stumbled, the Signature Bank collapsed completely. The emergency takeover of Swiss Credit Suisse by UBS also made international headlines.

In the case of Silicon Valley and Signature Bank, the US government guaranteed deposits in excess of the $250,000 legal guarantee limit. US Treasury Secretary Janet Yellen has already signaled that this is possible even if more banks should fail. Biden made a similar statement. If there is more instability, the FDIC could once again act as it has already done, he said.