opinion

Most valuable company in the world

Apple’s market value surpasses $ 3 trillion – the symptom of a fiscal policy that’s gotten out of hand

Apple is now worth three trillion dollars. Certainly a reason to be happy for CEO Tim Cook (archive image)

© Getty Images

The stock market values of the big tech companies keep rising. Apple was the first to break the 3 trillion dollar mark – an absolutely insane record. And a dangerous one.

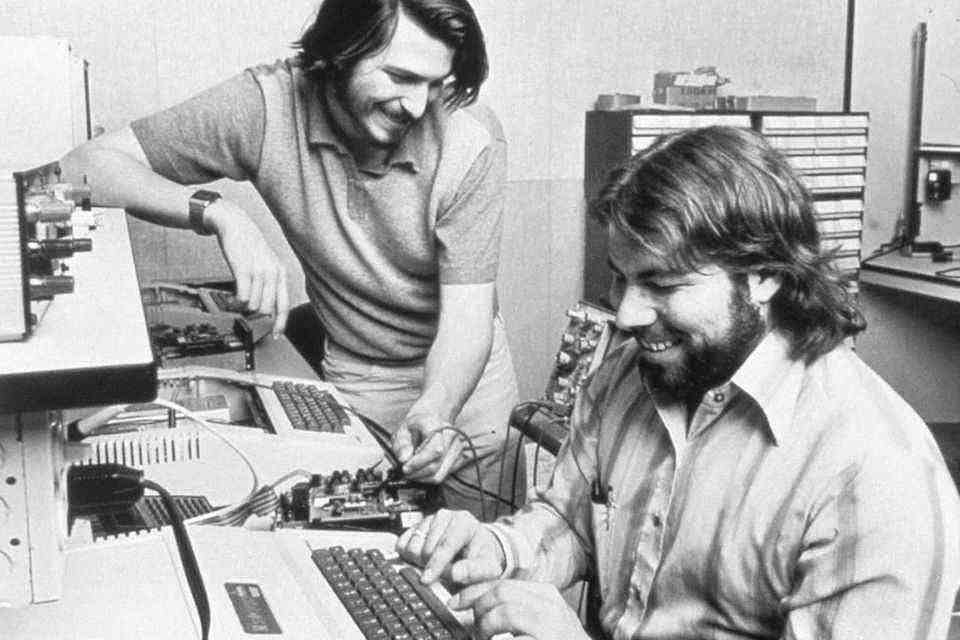

If heaven really exists, Steve Jobs will probably have looked down at us mortals in his turtleneck with a smile. His company, or rather his life’s work, was the first to break the $ 3 trillion mark in terms of market value. For the people who don’t actually deal with quasi-unrealistic numbers: that’s three thousand billion dollars. “Hats off!” One can only say about the smartphone manufacturer from Cupertino, California.

And that is meant completely seriously. Because God knows Apple itself cannot blame itself for being rated the most valuable company in the world. Nevertheless, it would make sense to think briefly about what it means that a single company is worth so much that it could take over the German state budget for about six years on its own.

Stock market valuations are castles in the air

A rating like Apple’s is a symptom of global monetary policy that borders on perversion. Stock market values have long had nothing to do with the real economy. Since the world banks, whether the European ECB or the American Federal Reserve Bank, have been pumping money into the market free of charge to keep the economy going, stock market values have risen. Climate crisis, corona pandemic, goods bottlenecks, inflation – none of this could harm the stock markets. It has long ceased to be a question of whether a company is successful or innovative, or whether dividends are in prospect. Stock market valuations are castles in the air. Built on the hope of growth. Real money is a minor matter, after all, it always comes in fresh and, as in previous years, almost unlimited in time.

And so the wheel continues to turn. Always faster. To an ever greater extent. Powered by free money from central banks. It is no coincidence that companies like Apple, Tesla, Alphabet or the Facebook parent company Meta have grown so big in recent years. A similar success story would have been unthinkable in the 1980s or 90s. No matter how innovative, successful or popular a company would have been – such market power probably would not have existed. If this system reminds you of a snowball rolling down a slope, you are not so wrong. But every snowball – even if it turns into an avalanche – arrives in the valley at some point. And that often has no pleasant side effects.

Under what circumstances the share prices rise – that may not matter to investors at first. The returns over the past few years will certainly prove you to be right. But even if it seems like it: the big stock market players are not completely decoupled from the global real economy. The stock exchange is a reflection of the world situation, it is often said. It’s about transnational tensions, crises, power politics. All of that can affect stock prices.

But this picture is gradually falling apart. When some countries in the world are on the verge of financial collapse due to the corona pandemic and its effects on the economy, but the stock indices, which are actually supposed to track the economy, continue to skyrocket, at some point they become implausible – the system begins to collapse . Because it is often forgotten that at the end of the chain, real people have to buy real products. Should they at some point no longer be able to afford this, there is a shift in the shaft. It doesn’t matter how high a company is traded on the stock exchange.

Money has to be worth something again

So what can you do? Exactly what the World Banks have been gracing themselves with for years: raise key interest rates. Means of payment have to be what we expect from them when we go shopping in the supermarket: they have to be worth something. This would also raise interest rates for every ordinary citizen. That would not only mean that loans would no longer be granted indiscriminately, but also that our savings would earn interest. Money would suddenly have value again. Perhaps the savings account would celebrate its comeback – but of course it’s not that simple.

The central banks have circulated so much money over such a long period of time that hike in key interest rates could crash the world economy overnight – like sticking a stick between the spokes of this wheel. Without the currently unending stream of new money, many companies would be insolvent within a very short time. With a sudden increase of several percent, Black Friday 1929 would probably be a coffee party.

So it’s only going slowly and carefully. But better as if nothing happened. At the moment the central banks seem about as helpless as Goethe’s sorcerer’s apprentice: “I can’t get rid of the spirits that I have called out”.