The Spartan Nash Co. of The Grand Rapids, Michigan, learned last year what it means to do business with a giant. The online group Amazon, which the company has been supplying with fruit, vegetables and other products since 2016, offered to buy goods worth eight billion dollars for its grocery delivery service Amazon Fresh over a period of seven years.

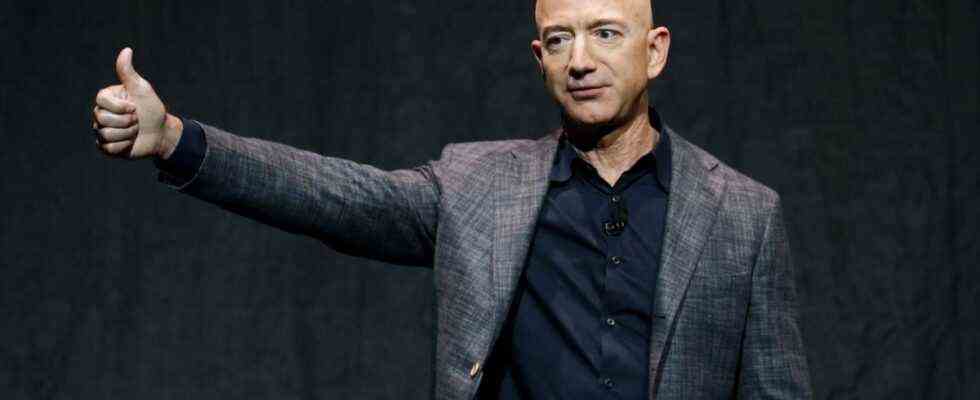

Amazon’s conditions: The wholesaler Spartan Nash must give Amazon the opportunity to buy up to 15 percent from him – and in case of doubt at dumping prices. If a competitor wants to take over the supplier, he also has the duty to inform Jeff Bezos’ mega-company in advance and to give him a ten-day period to submit a counter offer.

The Spartan Nash leadership – not exactly a small business itself – was shocked but eventually agreed. After all, it is probably not wise to upset a business partner like Amazon.

What sounds like borrowed from a Mafia film is said to have happened dozens of times over the past few years. At least that’s what active and former employees of the companies involved have Wall Street Journal reported that published the exclusive information on Tuesday evening.

Amazon has exploited its market power in at least 85 cases

Accordingly, Bezos’ group used its market power in at least 85 cases to persuade business partners with good future prospects to provide him with so-called entitlement certificates. They allow the owner to buy shares in the company for a set amount over a period of time. If the stock exchange price rises significantly above this amount, the beneficiary can stock up at a bargain price.

The revelations of the renowned business and financial newspaper are grist to the mills of all those critics, some of whom have accused Amazon of abusing its dominant market position for years. On the one hand, the group maintains an electronic platform through which countless providers sell goods to their customers. At the same time, however, he also offers products himself that are often strikingly similar to those of smaller providers, but are cheaper.

Critics have long complained that Bezos’ company purposefully collects data in order to identify particularly popular products, copy them and then undercut the original suppliers with low prices. The company founder, who recently withdrew from the operational management of the group, has repeatedly denied the allegations, including at a hearing in the US Congress.

According to Wall Street Journal But Amazon is also unabashedly exploiting its market power in other areas. For example, the company requires business partners in a company division to also use the services of other group subsidiaries – for a decent payment, of course. The group of companies is also using its investment fund to specifically look for startups that could complement or threaten Amazon’s own business.

According to the report, an Amazon spokeswoman admitted that business partners had issued authorization certificates. However, only one percent of all contracts with suppliers and customers are affected.

Nevertheless, the group has to be careful: In Congress, six bipartisan bills are currently being discussed that deal with the great market power of Amazon, Apple, Google and Facebook. Even some Republicans are no longer afraid to think about the previously unthinkable: the smashing of the big tech companies.