Alphabet scores well

Tech rally causes euphoria on Wall Street

April 26, 2024, 10:53 p.m

Listen to article

This audio version was artificially generated. More info | Send feedback

While Facebook parent Meta is currently scaring investors away, tech companies like Microsoft and Alphabet are encouraging US investors to buy. A shoe manufacturer’s rosy business prospects are also creating a rosy mood on the US stock exchanges.

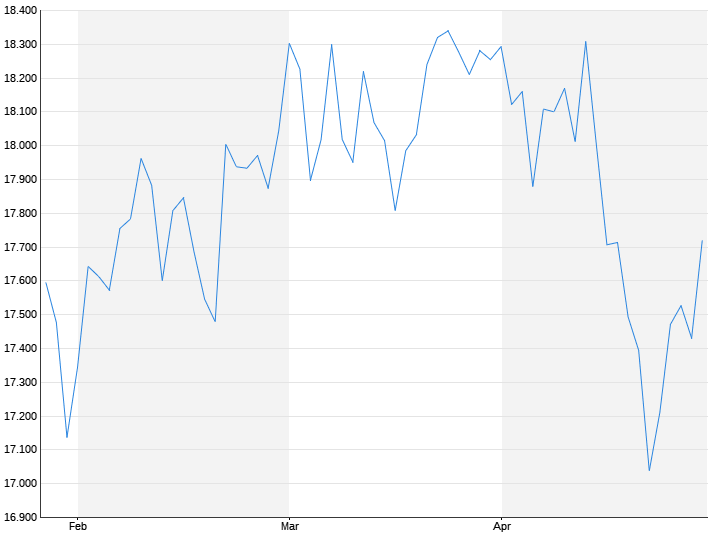

US investors were encouraged to buy stocks on Friday by renewed euphoria in the tech sector. The Dow Jones Index the standard values closed 0.4 percent higher at 38,239 points. The technology-heavy one Nasdaq moved up two percent to 15,927 points. The broad one S&P 500 increased one percent to 5099 points. The Google parent company Alphabet scored points with investors with a surprisingly strong increase in profits, its first-ever dividend and a share buyback. The shares climbed by up to twelve percent to a record high of $174.71.

The market value thus exceeded the two trillion dollar threshold. Microsoft also beat investors’ expectations for revenue and profit in the quarter, thanks largely to its rollout of artificial intelligence (AI) across its cloud services, driving its shares up 1.8 percent. “After Meta’s failure, this was exactly what the markets needed,” said Johan Javeus, senior SEB economist.

The Facebook parent had frightened investors with the prospect of high costs and longer waiting times for relevant sales for AI products. “Many investors who had been waiting impatiently for AI investments to deliver higher revenues probably breathed a sigh of relief when Alphabet’s CFO Ruth Porat said, ‘We are seeing increasing contributions from our AI solutions,'” Javeus said. Snap stocks were also on the rise, increasing by almost 28 percent. The Snapchat parent company exceeded market participants’ sales expectations thanks to adjustments to its advertising platform.

Skechers on the rise

Positive business prospects also boosted the shares of US shoe manufacturer Skechers, which climbed by more than eleven percent. Skechers sees full-year earnings per share in the range of $3.95 to $4.10, compared to analyst estimates of $4.01. The losers included Intel, which fell by more than nine percent. Second-quarter revenue and profit fell short of estimates as demand for traditional data center and PC chips fell. ExxonMobil’s profit was also meager than hoped. The oil company’s business was hit in the first quarter by weaker refining margins and lower natural gas prices. The papers lost around three percent.

A few days before the US Federal Reserve’s interest rate decision, investors were also watching economic data like a hawk. US consumers were quite willing to spend in March despite stubbornly high inflation. They increased their consumption by 0.8 percent compared to the previous month. However, when it came to consumer spending, which is widely used as a measure of inflation by the US Federal Reserve, there was little insight into the further path of interest rates.

For the year, the PCE price index was 2.8 percent, compared to forecasts of 2.7 percent. “That’s a good number that doesn’t affect the Fed’s confidence that inflation is moving in the right direction. But it doesn’t necessarily increase its confidence that it’s moving toward its 2 percent target in a sustained manner,” Steve said Wyett, investment strategist at BOK Financial. Stock marketers are currently expecting that the Federal Reserve will maintain its tight monetary policy line on May Day and possibly also at the meeting after next and see a first interest rate cut in September.

You can find everything else about today’s stock market events here.