If anyone needs to know more about this new aircraft, it’s Cham Chi. The former China Eastern Airlines pilot is in the process of launching a new airline in Brunei called Gallop Air. And Gallop Air is said to be the first non-Chinese airline to launch the short- and medium-haul aircraft C919 from the Chinese manufacturer Comac.

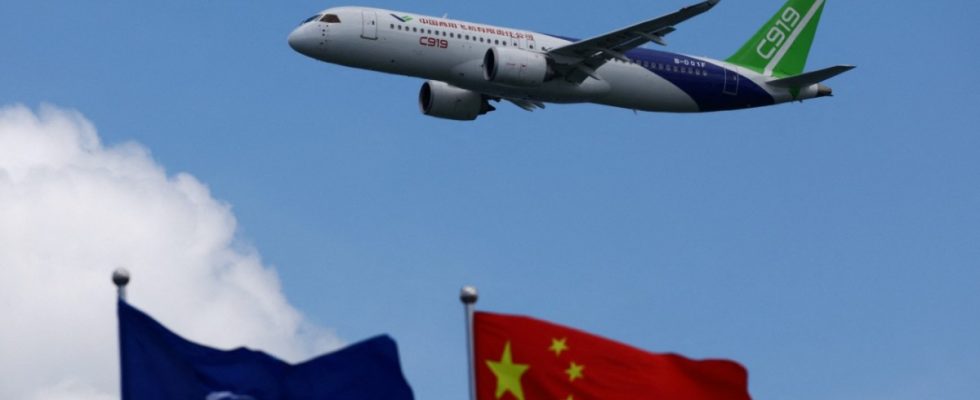

Comac dominated the Singapore Airshow this week, at least in its external image. Usually aircraft from Airbus, Boeing, Embraer and Bombardier are parked on the apron – all well-known brands – and the orders that they quickly negotiated in the exhibition chalets in the hours before are announced in the conference rooms. But this time it’s different: Boeing didn’t send any top people and certainly no plane. Comac gratefully took over the freed-up space on the site and parked three machines there. The C919 and the Airbus A350-1000 were the only passenger aircraft that took part in the daily flight demonstrations.

The C919 is China’s answer to the western best seller Airbus A320 and Boeing 737, the first four aircraft fly with China Eastern Airlines. The two manufacturers have dominated the civilian market in Asia for decades, but that is about to change. China is building its own aviation industry with the C919 at the top. Even Airbus Commercial boss Christian Scherer thinks this is “pretty legitimate”. And so Chinese state airlines in particular have ordered around 800 machines of the new type, most recently Tibet Airlines 40, as Comac announced in Singapore.

The only question is what the aircraft can actually do and whether Airbus and Boeing have to take it seriously as competitors. Comac itself had hardly any answers to this in Singapore. The company declined interviews, saying management was too busy talking to customers. Brochures were displayed at a large stand in the exhibition hall, and Comac had miniature models parked on a wall.

The machine is currently only registered in China

A few people were able to take a look inside the real aircraft in Singapore. Pictures show a modern cockpit, very similar to that of an Airbus, in which the jet is controlled using a sidestick, a very tidy cabin with large storage compartments as well as kitchens and toilets as we know them from western jets.

A comparison of official figures shows the following: The C919 carries up to 174 people over 3,000 nautical miles (5,556 kilometers). The Airbus A320 and the Boeing 737 have a maximum of 194 or 210 seats and 3,400 or 3,550 nautical miles. In other words: Calculated per seat, it should C919 be significantly heavier than its western competitors and therefore also significantly worse in terms of fuel consumption. In addition, it is C919 so far only approved in China. Completing this in Europe and the USA with the leading aviation authorities European Union Aviation Safety Agency (EASA) and Federal Aviation Administration (FAA) is a complex process, but in principle possible. Every new aircraft also requires an expensive network of maintenance stations and must be reliably supplied with spare parts. It will take a while for all of this to happen.

And Comac is ramping up production only slowly. In 2024 there should be between 20 and 30 machines, in 2025 around twice as many and in 2029 around 70 – that would be fewer than Airbus builds in a month. It is not possible to tap into a large share of the global market; for the time being, it will probably only be enough for Airbus and Boeing to take some of the orders from domestic airlines.

The question arises as to how Chinese it is C919 actually still is. Essential components such as engines (CFM International), landing gear (Liebherr) or avionics (Collins Aerospace) are supplied by Western specialists; aircraft design and final assembly in particular are in Chinese hands. This is an advantage because China is not yet that advanced in many specialist disciplines (including aircraft engine construction), but it is also a risk: if political tensions escalate with the USA, for example, Comac could one day lose access to important components before the skills are available country itself are present. Russian aviation, which has been hit particularly hard by economic sanctions, is currently experiencing what something like this can lead to: the new one MS-21also an aircraft for short and medium-haul routes, must therefore be re-equipped in key areas – which takes years.

Chinese banks with cheap leasing offers for the aircraft

Gallop Air boss Chi has 15 C919 ordered. He wants to use the machines to open up a route network in Southeast Asia from Brunei. But he doesn’t yet know when he will get his first plane. “Probably in two to three years,” he says. Operational data from the first months of operation at China Eastern is difficult to obtain for other customers. In return, Chinese banks are luring people with extremely cheap leasing offers for the aircraft.

Airbus manager Scherer sees Comac “as a competitor in the future.” In other words: not today. The plane, which he can view from the Airbus Chalet in Singapore, “looks like something that Airbus and Boeing already offer today.” Therefore the C919 “don’t rock the boat”.

Not everyone sees it that way. Peter Bellew, head of Saudi Arabia’s Riyadh Air, holds the C919 for the “best kept secret” among aircraft, as he said at a panel discussion in Singapore. “I wouldn’t underestimate Comac for a minute. They’re a force to be reckoned with.” Of course, Bellew doesn’t speak without ulterior motives: “It would be great for the airlines to have a third force among the manufacturers.” If only to be able to push prices down a little in the next purchase negotiations.