Terra is a smart contract blockchain protocol that, although still relatively small, Terra’s DeFi ecosystem also has one of the most advanced decentralized applications in crypto as well, with Terra Station as a wallet for cryptocurrency. Use those who want to join and interact with the network. Meanwhile, Stake LUNA currently yields more than 7% per year.

Launched in January 2018, Terra is built on top of the Cosmos SDK using the Tendermint Delegated-Proof-of-Stake (DPoS) mechanism to guarantee decentralized and low transaction costs.

However, what sets Terra apart is not its high-performance base technology. But it is the unique and thriving ecosystems built on it, such as Anchor, Mirror, Pylon, Mars and Spectrum, that have unlocked a world of investment and farming opportunities on Terra, attracting hundreds of thousands of users and enthusiasts. A lot of developments have been made into the protocol.

Additionally, after completing the upgrade of the latest Columbus 5, Terra is compatible with other leading blockchains such as Cosmos, Solana, and Polkadot and makes the growing DeFi application ecosystem more accessible to users. It’s easier to participate in these blockchains.

And with cross-chain interoperability also means greater and higher usability for Terra’s flagship — UST stablecoin, with users able to move UST between Terra and Ethereum, Binance Smart Chain, and blockchain. Other chains are easily accessible via bridges such as Wormhole and TerraBridge to serve various purposes in the multi-chain world.

creation Wallet

Getting involved with the Terra ecosystem first requires a wallet. which although there are many options to choose from But the most popular thing is the wallet. Terra Station atCreated by Terraform Labs, it is a non-custodial wallet that includes mobile apps, browser extensions, and Windows and iOS applications. It has a similar functionality to the popular MetaMask wallet, but There are fewer features like token swaps in the wallet. or NFT support

When you download Terra Station fromofficial websiteof Terra, follow a few easy steps. to create a new wallet Make sure to back up your Seed Phrase and keep it in a safe place, as the Seed Phrase will give you or anyone else access to your wallet’s private key. This will give access to your money. Therefore, it is important to write the Seed Phrase on paper and store it in a safe place.

After creating a wallet You will need LUNA token, Terra’s native token, used for governance, mining, and volatility protection tools for Terra Stablecoin.

You must have LUNA in your wallet to pay transaction fees. The easiest way to find LUNA is to buy it through a centralized exchange such as Binance, Coinbase, Phhemex or FTX. After acquiring Luna, simply withdraw the tokens to the Terra Station wallet address. The wallet is located at the top of your browser extension or wallet app.

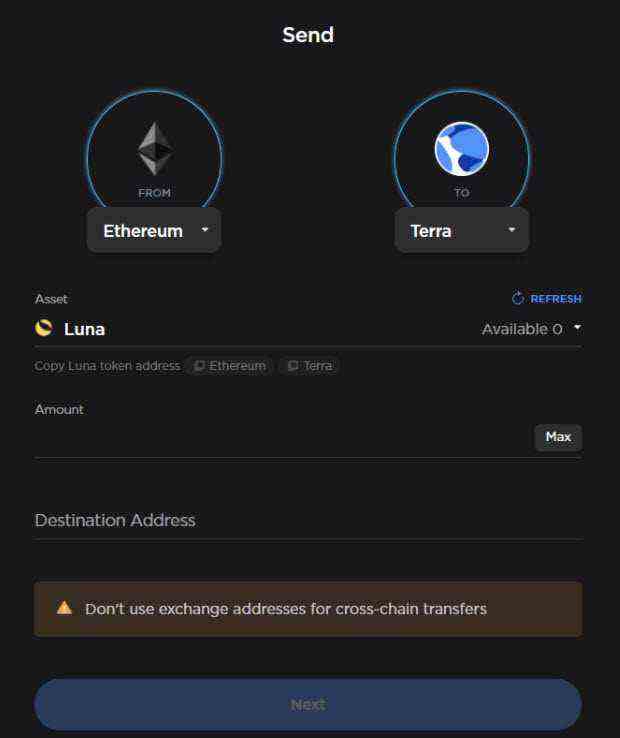

Alternatively, those who have funds in Ethereum can purchase Luna (wLUNA) via Uniswap and transfer it to the Terra Station wallet via Terra Bridge.

use Terra Bridge It’s pretty simple: just connect your Ethereum wallet to Terra Bridge, then select the Ethereum network in the “from” menu on the left-hand side of the app. And on the right side select Terra, then in the “Asset” field select the Luna token and assign the desired and in the “destination address” field enter the address of your Terra Station wallet, then click next.

Once you have authorized the transaction in your MetaMask, Terra Bridge will automatically switch wLUNA to LUNA and deposit it immediately to your wallet address in the Terra network, or if you have funds in Solana you can follow the same steps. to move money using Wormhole Bridge

Staking on Terra Station

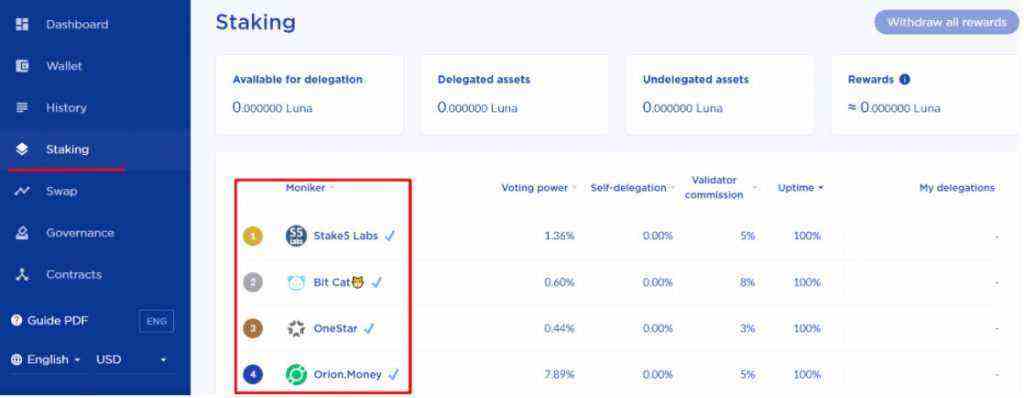

After creating and having Luna in the wallet The first thing you might want to do is insert the LUNA you bought for staking on it. Terra Station Since Terra is a Proof-of-Stake with 130 validators to verify, clear transactions, and secure the network. And in exchange for their services, validators and delegators can continue to generate revenue from transaction fees. This is currently around 7.07% for delegators and 7.47% for validators.

To become a validator on Terra, users must either bond their LUNA tokens for at least 21 days and be one of the top 130 largest stakers, or have other users delegate their LUNA. Everyone takes their LUNA tokens to use by staking or delegating to validators, where a portion of the revenue they earn will be shared with their delegators.

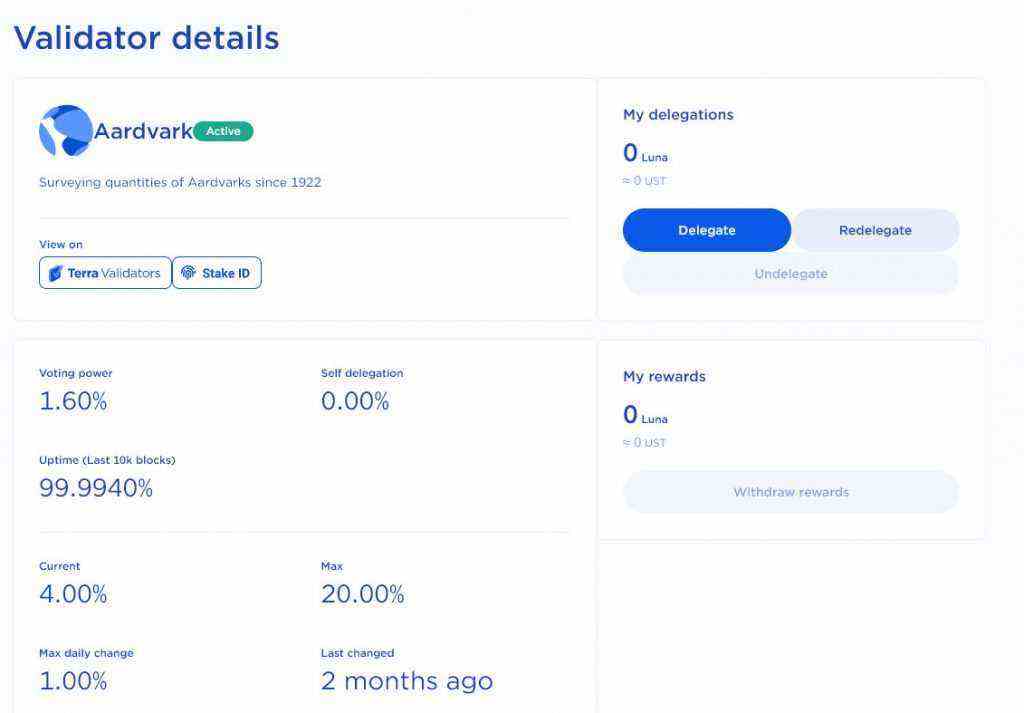

To delegate LUNA, go to Terra Station and select “staking” in the menu on the left. You will then see a new dashboard showing a list of available validators. After you select the validators you want by clicking on their name. Another dashboard will open for you to delegate your LUNA by clicking the “delegate” button.

You’re all set and your LUNA will automatically generate returns.

Withdrawal of winnings from Staking

The winnings will begin to accumulate when you Staking Luna and once you have enough rewards. and want to withdraw the prize money Follow these steps.

- Open Terra Station and click Staking.

- To receive all rewards, click “Withdraw all rewards” at the top right corner of the page. by withdrawing the reward from a single validator Instead, click on their name in the list and click Withdraw on their page. Then a new window will appear.

- Check the amount and specify the coins you want to use for paying fees.

- Enter your password and click withdraw.

However, if this was not enough You can also use LUNA tokens on the protocol. Anchor To earn more by depositing Luna to mint bLuna to use for borrowing UST, Anchor will also give you ANC token when borrowing UST and you can deposit that UST back on the same protocol to get fixed interest rate. at 19.49%

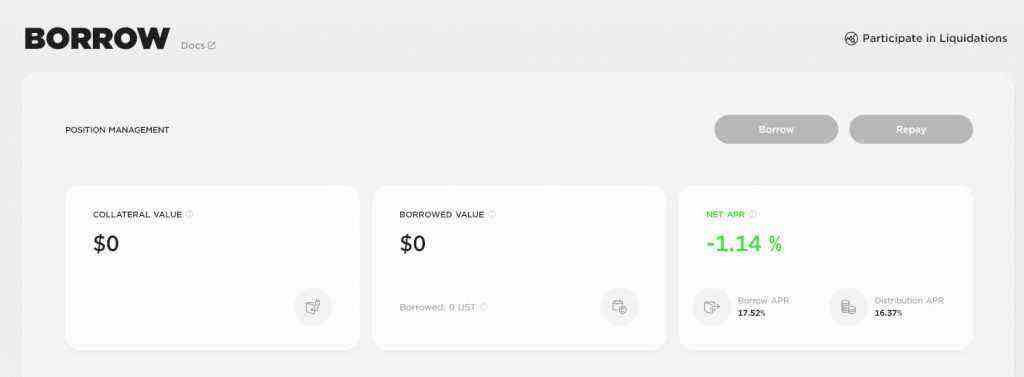

Borrowing on Anchor is very simple: just go to the “borrow” page of the app, click on the “borrow” button, then set your desired loan-to-value ratio and deposit your bLUNA collateral. your wallet which you can use for anything you want. as well as purchasing other Terra-native tokens on TerraSwap Or invest in synthetic stocks, or increase liquidity in the Mirror, or farm on the Spectrum Protocol.

Some decentralized applications such as Anchor and Mirror were successful and large enough to compete with some of the DeFi “blue chips” of Ethereum, while the Luna token made its way into the top 10 cryptocurrencies. digital by market capitalization With the LUNA price surging above $100 for the first time, and with protocols like Mars, Spar, Loop Finance and Alice expected to launch in early 2022, Terra is well positioned to see increased adoption. in the future