Many of you may have heard of Bitcoin Futures trading on Binance But I’m confused as to what it is. Today, the author will introduce how to make profits in the market. Bitcoin and other altcoins, whether the coin price goes up or down. We can profit from this market. The author has chosen Binance, the world’s number 1 crypto exchange, as an example for us to learn together.

What is Futures Contract Trading in the Crypto Market?

The Crypto Futures Market is a market for trading futures contracts based on the prices of cryptocurrencies in the market.

There are usually two types of futures contracts to trade:

1. Type of contract Long promise to haveincrease in value When the reference price of the coinhigher

But this contract will havedecrease in value If the reference price of the coinreduce

2. Type of contract Short promise to haveincrease in value When the reference price of the coinreduce

But this contract will havedecrease in value If the reference price of the coinmore

that means We can make profits even if the crypto coin price falls in the market. By buying short contracts, but if we predict the wrong way Coin prices go against the type of futures contracts we buy, we also have huge losses. Therefore, the crypto futures market is a very high risk market. We can also adjust the contract leverage to accelerate the multiplier of the contract amount for the profit (or loss) on the contract being traded. Novice traders should carefully consider the amount of leverage they use.

in Binance Futures We can adjust the leverage of the contract up to 125X, meaning that we can use $10 to trade futures contracts up to $10 x 125 = $1,250. Coin prices run against the contracts we have traded. There is a very high chance that our contracts will be liquidated more easily than the lower leverage. Usually most traders set this leverage around 4x – 20x (remember, the more Higher and colder ^^”)

How to open a Binance Futures account

1. Before we can open an account on Binance Futures, we must have an account on Binance Usually, if we don’t have one yet We can click to Binance.com to apply Then follow these steps:

- Enter your email address and create a password. If you have a referral ID, paste it in the ID referral field or use the author’s referral ID: “10085053”

- then click on Create account

- Then a confirmation email will come in. Let us follow the instructions in the email to complete the registration.

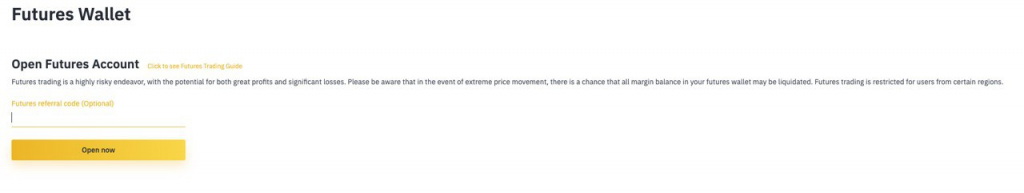

2. Then log into your account. Binance Apply and move the mouse to the top bar of the website where the word Futures and click on it. You will be on the Binance Futures page. You will see the first two letters of the email address associated with your account in the upper right corner.

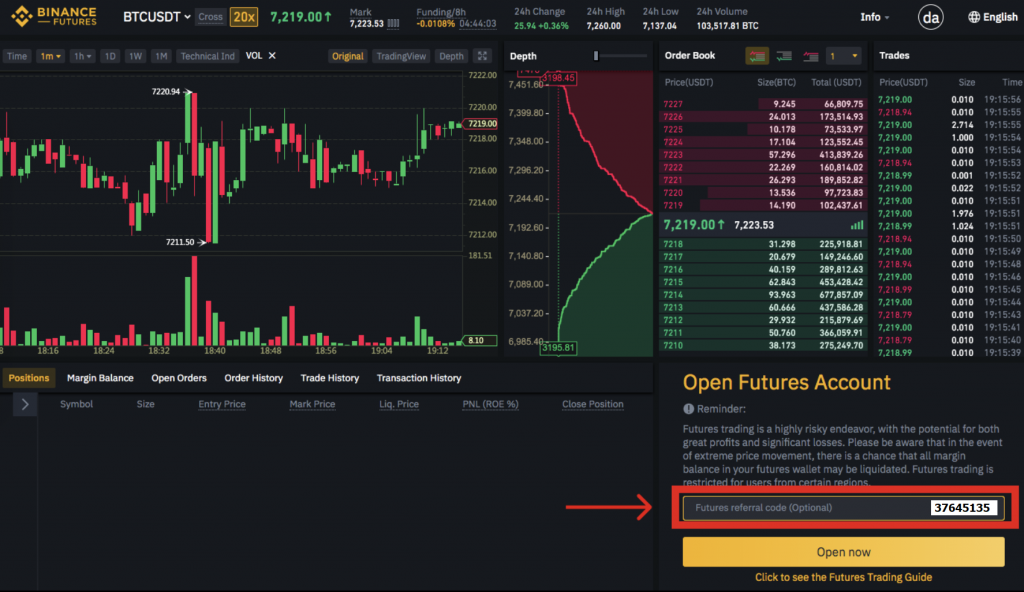

3. Then click on the Open now button in the bottom right corner to activate your Binance Futures account.

special : enter code 37645135 When I started trading the futures market for the first time on Binance Get 10% cashback fee discount on Future Market for free.

4. If you are not familiar with futures trading, check out the article. What Are Forward and Futures Contracts? and What Are Perpetual Futures Contracts? Take a look, including if you want to test out the platform without actually spending any money. You can try Binance Futures to try

How to fund your Binance Futures account

You can transfer money back and forth between your wallet in Binance and your Futures wallet (the wallet you use in Binance Futures). Transfer located in the bottom right corner of the Binance Futures page, then set the amount you wish to transfer and click on Confirm transfer You will see the increased balance in your Futures wallet.

Binance Futures interface page

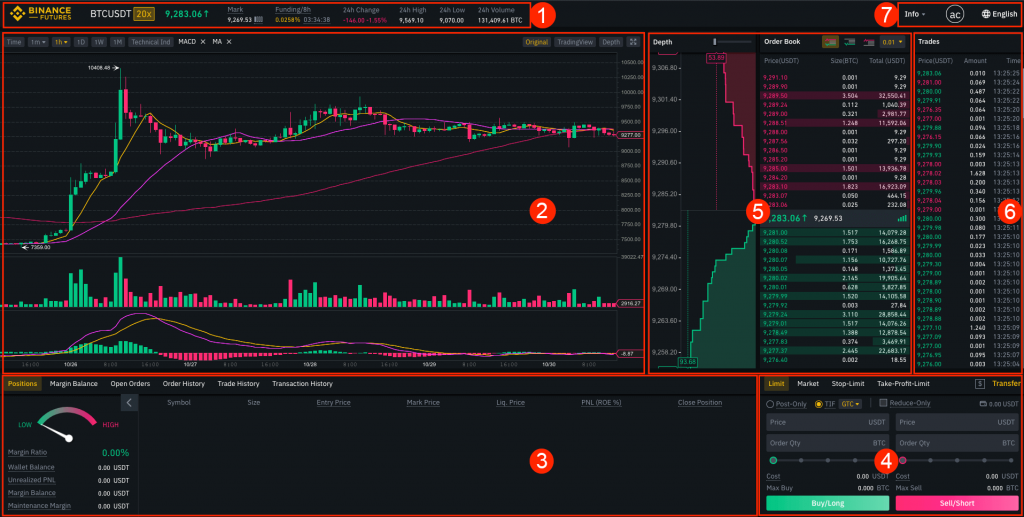

number 1 You can choose the contract you want to trade, adjust leverage (default 20x), switch between cross margin and isolated margin , check the Mark Price (this is the value you need to focus on, since liquidations will occur according to the Mark Price) , check the expected funding rate , check your position in the auto-deleverage queue (this is an important value in periods of high volatility) and check other information such as 24-hour price changes and 24-hour trading volume.

number 2 This is your chart. In the top right corner of this area you can switch between the Original and TradingView charts or see the depth of the order book in real time.

number 3 Here you can track your trading activities. Easily switch between different tabs to check your current positions, your margin balance, view open orders. and your previous actions, view full trading and transaction history for a specified period.

number 4 Here you can enter your order. and switch between different order types. Also here is where you can check fee levels and transfer funds from your Binance account.

number 5 This is where you can view order book information, including the different order depths.

number 6 Here you can view live feed of trade history on Binance Futures.

number 7 You can view the Futures Trading FAQ or FAQ, check the Insurance Fund’s past funding rates and current balance, and if you want to leave Binance Futures, you can do so from here.

Adjusting the leverage of futures contracts

Binance Futures allows you to trade multiple contracts and adjust the leverage level for each contract manually. To select a contract, go to the top and hover over the current contracts (default is BTC/USDT).

To adjust leverage, click and drag by sliding left and right. to get the leverage you need Then click on Confirm.

The larger your position, the less the amount of leverage. Conversely, the smaller your position is. You will only be able to adjust the amount of leverage more.

but please note that The use of high leverage carries a high risk of liquidation (forced closing loss). Beginner traders should carefully consider the amount of leverage they use.

For example: If you have 100 USDT and you want to trade a futures contract at 10x leverage, you can trade a contract size of 1000 USDT (from 100 USDT x 10). $1 is as if the coin price in the contract has moved up or down $10 (based on $1 x 10). Of course, if we choose 20x, 50x or 100x leverage, we use the same formula to calculate it. That’s why the higher the leverage, the higher the risk.

Setting the Mark Price and Last Price trigger prices for various Stop orders.

To avoid unnecessary liquidation (forced close of the contract) during high volatility, Binance Futures offers us the option to set the Last Price and Mark Price.

Last Price is the last price at which the contract was traded. In other words, the last trade in trading history determines the final price. using PnL (Profit and Loss) calculations

Mark Price It is designed to prevent the owner’s price manipulation in a particular market. Calculated using a combination of funding data and basket of price data from multiple crypto exchanges. The price at which you will be liquidation (forced contract closing) and unrealized PnL will be calculated based on this Mark Price.

Please note that Mark Price and Last Price may differ. When you set a stop order as a trigger at any price, you can choose the price you want to use as a trigger between the Last Price or the Mark Price. Select Mark Price to be used to set Stop orders.

What order types are there and when to use them?

Limit : limit order A limit order is an order that you place in an order book that has a limit price you specify. When you place a limit order, a trade is executed only when the market price reaches your limit price (or better), so you may use a limit. orders to buy at a lower price or sell at a price higher than the current market price.

Market : market order is an order to buy or sell at the best current price. The limit orders that were previously placed in the order book are executed. When you use a market order, you pay a fee as a market taker.

Stop-Limit : The easiest way to understand is Stop order Limit type. It is divided into stop price and limit price, where stop price is the price that caused the limit order and limit price is the price of the limit order that is called, which means that when the stop price is reached. your price and your limit order will be placed in the order book immediately.

* You can use the Stop order price trigger as Mark Price and Last Price.

Although stop and limit prices are the same. But in reality it is safer to set your stop price (trigger price) slightly above the limit price for sell orders, or slightly below the limit price for buy orders. This increases the likelihood that your limit order will be filled after. to stop price

Stop-Market: Like stop-limit orders, stop-market orders use stop price as a trigger. However, when the stop price is reached, it will immediately result in a market order.

* You can use the Stop order price trigger as Mark Price and Last Price.

How to use Binance Futures calculator

You can find calculator next to the Transfer button in the lower-right corner. It allows you to calculate values before long or short positions. You can adjust leverage in each tab to use as a basis for calculating your contract.

The Calculator has 3 tabs:

PNL – Used to calculate your Initial Margin , Profit and Loss (PnL), and Return on Equity (ROE) based on entry and exit price and position size.

Target Price – Used to calculate the price at which you will exit your position for the desired percentage return.

Liquidation Price – Use this tab to calculate your estimated liquidation price based on your wallet balance, entry price and position size.

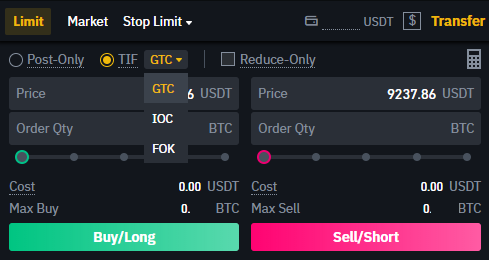

What are Post-Only, Time in Force(TIF) and Reduce-Only?

When you use limit orders, you can set additional values along with your order, in Binance Futures, selecting Post-Only or Time in Force (TIF) and further configuring your limit orders.

Post-Only This means that your order will always be added to the order book first and will not process any existing orders placed on the order book. This is only useful if you want to pay maker fees. You can do this by hovering your mouse over the $ sign next to the Transfer button.

TIF instructions It allows you to specify how long your order will remain valid before it is executed or expired. You can choose one of these options.

GTC (Good Till Cancel) : The order will remain active until the fill order is full or cancel.

IOC (Immediate Or Cancel) : Orders will be processed immediately. (either full or partial), if only partially executed The unsuccessful portion of the order will be cancelled.

FOK (Fill or Kill) : The order must be completely filled, if not it won’t execute anything at all.

Also, when you use a limit or market order, please tick the Reduce-Only box to ensure that the new orders you set will only decrease and not open additional positions.

When are your positions at risk of being liquidated (forced closing) ?

Liquidation occurs when your Margin Balance is lower than the required Maintenance Margin. Margin Balance is your Binance Futures account balance, including unrealized PnL (Profit and Loss). So your profit and loss will change the residual value of your account.

Maintenance Margin is the minimum value you need to open positions, it varies depending on the size of your positions, larger positions require a higher Maintenance Margin.

You can find useful tools under the Positions tab in the bottom left corner of the page. This will help you to quickly track the current risk of your open positions. If your Margin Ratio reaches 100%, your position will be liquidated.

When liquidated occurs, all your open orders will be cancelled. Therefore, you should keep track of your positions to avoid being automatically liquidated for which you will incur additional fees. If your position is close to being liquidated, we recommend that you close the position manually rather than waiting for it to be automatically liquidated.

Summary of advantages and disadvantages

- It can be profitable whether the coin price goes up or down. (Coin price goes down, buy short contract to make profit, coin price goes up, buy long contract to make profit)

- Use less capital, get more profit from leverage (the bigger X amount, the higher the risk).

- Use hedging the risk of the price of the coin held. For example, if we are confident that the coin price will definitely go down. Short futures contracts can be purchased to balance the value of the coin held.

- There is a chance of being liquidated (forcing a losing contract) when the coin price runs against the contract we bought. For example, when we buy a short contract, the coin price goes up sharply.

Special 10% discount for futures traders

enter code 37645135 When I started trading the futures market for the first time on Binance Get 10% Rebate Fee Rebate on Free Futures Markets