Twenty years ago, the euro replaced national currencies such as the German mark, the lira and the franc as cash. In a series, the SZ explains why the euro was controversial among economists and which crises the common currency had to survive. You can find all articles on this overview page.

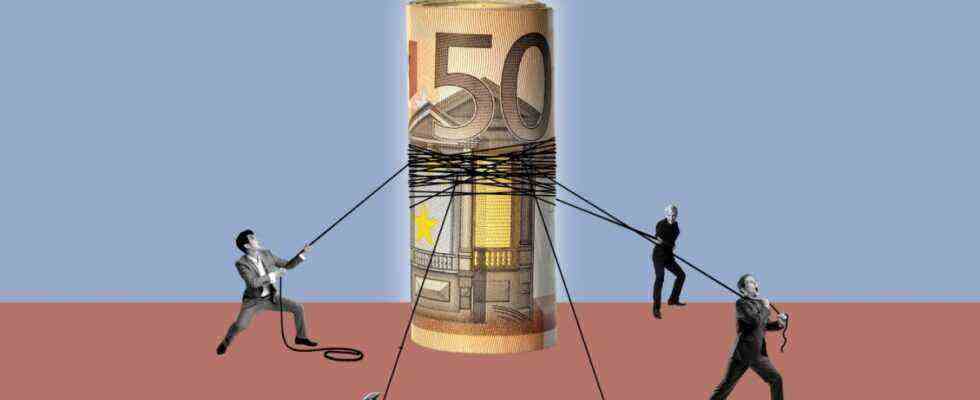

Pacta sunt servanda, it says in Latin, treaties or pacts are to be adhered to. Looking at the Stability and Growth Pact the EU would be more appropriate to “Pacta sunt mutanda”: Pacts are to be changed. Because EU governments repeatedly disregard the spirit or letter of this set of rules for sound budgeting. At the same time, some government almost always demands changes. Indeed, the pact has been amended several times since it was introduced in the Amsterdam Treaty in 1997. In October, the EU Commission hit one new reform debate on. Proposals are expected by the summer.

The most important requirements of the pact are the upper limits for the annual budget deficit of three percent of economic output and the target for the total debt of the state of 60 percent of economic output. Because of the pandemic, the Commission has suspended regulations so that governments can unrestrainedly prop up the economy. However, the pact is expected to come into force again at the beginning of 2023, and According to forecasts That year, only seven out of 19 euro countries will be able to meet the 60 percent mark and only eleven governments will be able to meet the three percent limit. France’s Finance Minister Bruno Le Maire has therefore already described the 60 percent target as “obsolete”. In addition, Paris and Rome urge not counting certain investments when calculating the annual deficit. The Austrian government, for example, vehemently rejects such exceptions. How FDP finance minister Christian Lindner positions himself is eagerly awaited.

The 60 percent and three percent marks are older than the pact. They were established in the Maastricht Treaty in 1992. If you wanted to be there when the euro was introduced, you had to meet them. The then finance minister Theo Waigel (CSU), one of the fathers of the euro, as it is always called, then pushed for it to be stipulated that states must observe these upper limits even after the euro started – the birth of the stability pact. Violations can even result in fines, which of course never happened. The logic behind the agreement: if states share a currency without a common financial policy, it can cause problems. At the very least, the pact is designed to prevent governments from piling up excessive debts as this endangers the stability of the euro.

Demonstrators in front of the Greek parliament in Athens proclaim “No to the stability package”: These EU rules are controversial.

(Photo: Orestis Panagiotou / dpa)

Ironically, however, the federal government of all people quickly undermined the credibility of the pact, just a few years after Waigel’s resignation. In early 2002, just weeks after the euro cash was distributed, the then SPD Chancellor Gerhard Schröder prevented the Commission from sending Germany a blue letter because the deficit was too high. The federal government organized a blocking minority in the Council of Ministers against such a warning and thereby damaged the Commission’s reputation as a serious debt controller. Three years later, Germany and France also implemented a softening of the rules, against the bitter resistance of smaller, more frugal-minded states like Austria and the Netherlands.

Juncker spared France – much to the annoyance of smaller EU countries

In 2011 and 2013, however, the EU states tightened the pact again – a lesson from the sovereign debt crisis, during which Greece was even considering leaving the euro zone. Nevertheless, the results of the regulations are mixed. Although the vast majority of states adhered to the three percent limit for deficits before the pandemic, numerous states failed to vigorously pay off their mountains of debt during the upswing, as the pact actually provides. When the 60 percent limit was established, it was roughly the average value of the debt level. That has long been history: Before the pandemic, the total debt of the 19 euro countries was 86 percent, and in 2023 it should be 97 percent. In Portugal, Spain, Belgium and France this rate is roughly twice as high as the 60 percent from the regulatory framework; in Italy it should be an oppressive 151 percent in 2023, in Greece 192 percent.

Another problem is that governments, especially when they save, are Cap investments instead of pensions and public services. And crumbling motorway bridges, ailing railways and slow data lines then in turn put a strain on economic growth. In addition, the Commission must defend itself against accusations of being too guided by political considerations when applying the pact. Former Commission President Jean-Claude Juncker responded bluntly in a television interview in 2016 to the question of why France is allowed to show excessive debts with impunity: “Parce que c’est la France”. – because it’s France. The statement was not well received by the smaller euro countries. The authorities also turned a blind eye to Italy until an EU-skeptical, populist government came to power in 2018. Suddenly the Commission acted tough and demanded the budget for 2019 to revise.

Is Green Debt Better?

The reform debate that started in October is about making the complex rules of the pact simpler and more comprehensible. In addition, the Commission and governments will have to discuss the 60 percent target. States above this have only twenty years to reach the mark under previous regulations. But that requires Italy, for example, to run completely illusory budget surpluses. One concept that is seen as having a good chance is that the Commission should instead agree individual pathways to deleveraging with individual governments.

The idea, promoted by Italy and France, of treating investments in climate protection more leniently when calculating the annual budget deficit is highly controversial. It is clear that the member states have to invest massively in climate protection and digitization in order to meet the lofty goals of the EU. It is just as clear, however, that such exceptions would make the pact even more complex and difficult to enforce. Therefore, this time too, the following will apply: after reform is before reform.