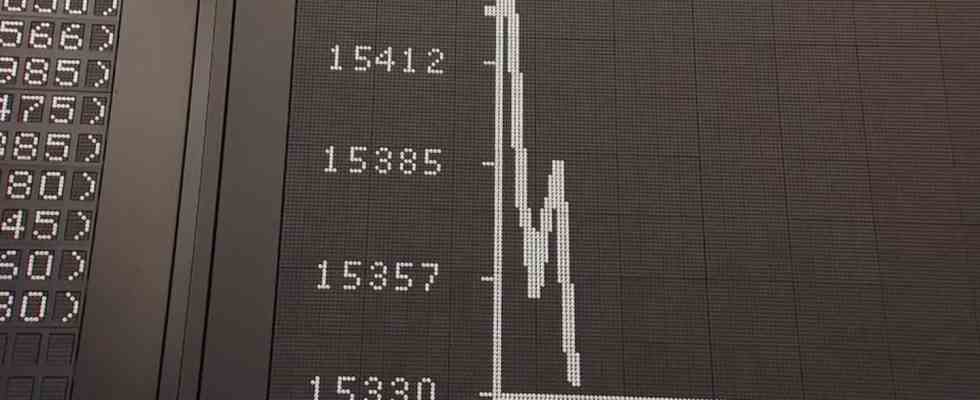

STORY: Concerns about the US banking system pushed the Dax deeper and deeper into the red on Monday. The leading German index fell in the course of trading by 2.5 percent to 15,042 points – the lowest level in almost two months. Market participants are worried about the consequences of the collapse of the start-up financing bank Silicon Valley Bank and Signature Bank in the USA for the entire sector. Commerzbank shares fell to a 12-month low. “Yes, Lehman was significantly bigger. And at that time the supervisors underestimated the whole problem. And this time they want to get the problem under control right from the start. So I don’t think the danger is that big. But Investors are still nervous and are trying to be on the safe side first.” Despite US authorities securing customer deposits, investors fear that other financial institutions could slide into insolvency. “The German banks are indeed involved in the tech sector, but not nearly as extreme as the US banks. And therefore, of course there is a certain risk, but it cannot be compared with what is happening in the USA right now .” The Silicon Valley Bank was closed on Friday after customers withdrew a lot of money in a short time. In the USA, attempts are being made to avoid contagion effects on other institutes. In Great Britain, a takeover for the local subsidiary was arranged at short notice, and in Germany a moratorium was imposed on the local branch. The bank from California has played an important role in financing start-ups.