Status: 02/01/2023 11:25 a.m

Microchips come mainly from Asia and North America. But Germany wants to catch up – for example with the construction of one of the world’s largest silicon carbide chip factories in Saarland.

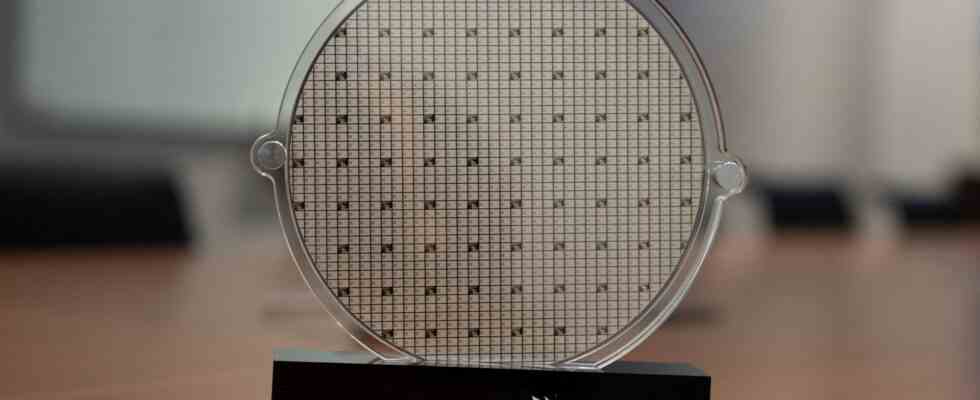

It looks and sparkles like a black crystal but is synthetically produced silicon carbide. It has been used in sandpaper for many decades. Because of its special capabilities as a semiconductor, the material has attracted the attention of the automotive industry in recent years. “Silicon carbide chips convert direct current into alternating current very efficiently and can thus increase the range of electric cars,” explains Stefan Bratzel from the Center of Automotive Management in Bergisch Gladbach.

The US manufacturer Wolfspeed is to build one of the world’s largest silicon carbide chip factories on the site of the former coal-fired power plant in Ensdorf, Saarland. According to the company, the listed company employs around 3,500 people in 17 countries.

Investment in structural change

For Saarland, which is heavily dependent on the auto and steel industries, having its own semiconductor factory would be “a milestone on the road to successful structural change,” says Carsten Meier, Managing Director of the Saarland Chamber of Industry and Commerce.

But such a factory would have signal power far beyond the Saarland borders, explains Ondrej Burkacky, semiconductor expert at the management consultancy McKinsey. From a European point of view, the step would be very important in order to become more independent of the production sites in Asia and North America. During the corona pandemic, many car manufacturers’ production lines in Europe stood still for weeks because there were no semiconductors.

Silicon carbide market growing

The global market for silicon carbide chips, such as those manufactured by Wolfspeed, is currently still quite small. According to Burkacky, sales last year were around one billion US dollars. “We’re expecting an increase of about 23 percent over the next few years, so by 2026 it’s going to be about $2.5 billion.”

Experts assume that demand will continue to rise in line with the growing e-car market. “Wolfspeed is now not one of the really big companies in the chip area,” says Bratzel. “But in this growing market a very important player.”

The fact that Germany is so early in the development of this market with its own factory could be “another cornerstone for the value chain for the automotive industry, which is very important in Germany,” says Burkacky.

EU wants to lure chip manufacturers with subsidies

There is no precise information on the amount of Wolfspeed’s investment. In industry circles, however, there is talk of a sum in the billions. Usually, according to Burkacky, chip manufacturers expect public funds amounting to 30 to 40 percent of the investment costs. Bratzel assesses the chances that Saarland will receive EU funding as very good.

The EU wants to adopt the “Chips Act” by the summer. With billions in funding, the European share of global chip production is to increase from ten to 20 percent by 2030. Know-how and jobs are to be settled in the future-oriented microchip industry in Europe.

Up to 1000 new jobs

There is talk of up to 1000 jobs at the Wolfspeed settlement. The manufacture of semiconductors takes place in the clean room and is largely automated. Engineers will be in demand above all, but there will also be a large number of technicians who will maintain the machines.

In about four years, the first silicon carbide chips for electric cars could then be produced in Saarland on the site of a former coal-fired power plant. It would be a symbol and a positive example of structural change. When the settlement of Wolfspeed is officially announced in the afternoon, Chancellor Olaf Scholz and Economics Minister Robert Habeck should also be there.