Terra, a fast growing DeFi toolkit. built on Cosmos It is currently officially the second largest ecosystem in decentralized finance.

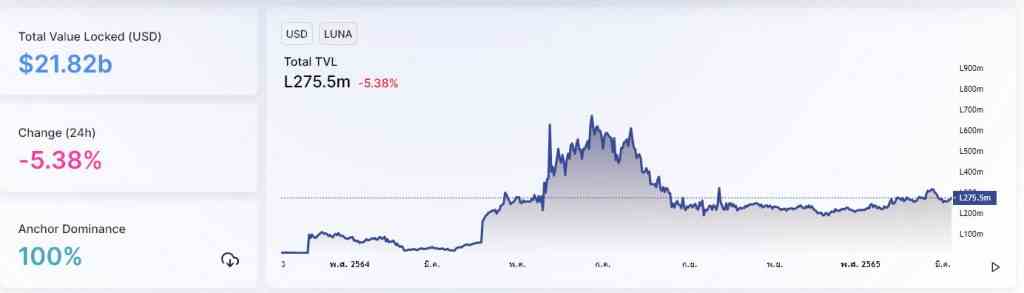

According to the information retrieved from DeFi Llama Terra currently has a locked total (TVL) value of over 21 billion dollars. which hit an all-time high against the US dollar.

That TVL is roughly twice that of BNB Chain (formerly Binance Smart Chain) and Fantom, while Ethereum still accounts for 54% of the total DeFi market, with a $110 billion TVL value.

But if we change the graph to TVL, only in LUNA, the Terra network’s native token, is used to pay transaction fees and vote on governance. You will see a slightly different picture.

From the picture above, it can be seen that TVL’s recent rise appears to be a small one. Compared to last summer

CoinGecko also shows that the LUNA price has risen nearly 38.8% over the past week. and in the same period The original token behind Terra’s largest DeFi project, Anchor Protocol (ANC), has also soared more than 70%. Anchor is Ethereum’s Aave-like money market, where users can earn high interest on their UST deposits. up to 19.49%

More importantly, The protocol also recently allocated $1 billion for Bitcoin as a reserve asset. The money came from the LUNA token sale, where Jump Crypto and Three Arrows Capital led the fundraising on February 23, and the fund is reportedly used to create what is known as the “UST Forex Reserve.”

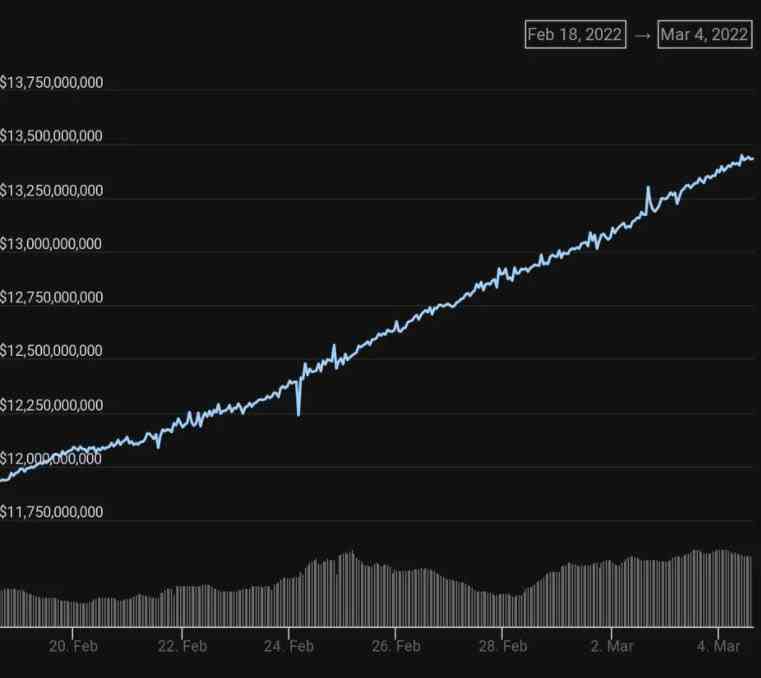

And while UST’s market capitalization is growing every week, the $1 billion figure seems reasonable. This is because large reserves are required to stabilize projects with a market capitalization of more than $13 billion.

Another benefit of using Bitcoin as a backup asset for the Terra ecosystem is that it is censorship resistant and decentralized.

The post Terra officially ranks 2nd in Total Locked Value (TVL), behind just Ethereum appeared first on Bitcoin Addict.