Tag: OECD

OECD warns Germany – economy

According to the OECD, Germany will avoid a recession, but has to step up the pace noticeably on the way to climate neutrality. The Organization for Economic Cooperation and Development…

OECD calls for more speed in climate protection in Germany

Status: 05/08/2023 4:39 p.m According to the OECD, Germany is reducing emissions far too slowly to achieve the planned climate neutrality by 2045. Economically, the industrialized countries organization sees signs…

Wages and salaries are heavily burdened with taxes and duties

Status: 04/25/2023 1:36 p.m The tax burden on wages and salaries in Germany is still high in an international comparison. Taxes and levies weigh on income more than in almost…

OECD warns of false incentives: Germany has the second highest tax burden – economy

According to the OECD, Germany has the highest tax burden of all industrialized countries after Belgium. According to this, a married couple with children has to pay an average of…

Federal government takes action against tax tricks by multinational corporations

From Claus Hulverscheidt, Berlin After years of worldwide debate, the federal government is getting serious about the fight against tax trickery by large corporations. This emerges from a bill by…

LIVE – Pension reform: the OECD flies to the rescue of Macron and Borne – Liberation

LIVE – Pension reform: the OECD flies to the rescue of Macron and BorneReleaseSee full coverage on Google Newssource site

Study by OECD and WHO: EU citizens do too little sport

Status: 02/17/2023 4:39 p.m People in the EU move too little. The corona pandemic has worsened the trend even further. More sport could increase life expectancy and lead to fewer…

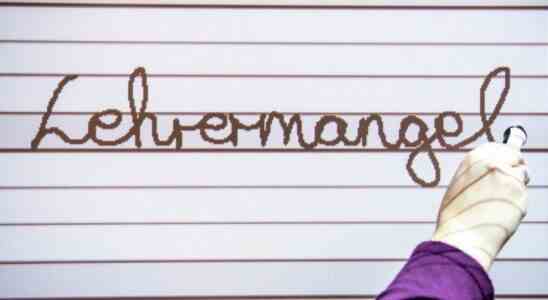

School system: OECD expert: Teaching profession in Germany too unattractive

school-system OECD expert: teaching profession in Germany too unattractive The OECD Education Director Andreas Schleicher calls for reforms in the German school system. photo © Caroline SeidSeidel-Dißmannel/dpa The OECD Education…

In Germany, the rise is easier than expected

Dhe economic rise in Germany has many faces. One of them is that of Nabil Essadik. Essadik has a black beard, a bald head – and a company. Since 2008…

OECD study on the pandemic: life expectancy fell by one year

Status: 05.12.2022 17:37 The corona pandemic has had a significant impact on the mental and physical health of many people. According to an OECD study, the life expectancy of EU…