Software as a new business for automobile manufacturers

Digital arms race

In a networked vehicle, software is a crucial lever

© press-inform – the press office

Software is becoming more and more important in the automotive industry. On the one hand in production and value creation, on the other hand as a distinguishing feature of the individual brands. According to a study by the management consultancy Capgemini, the German carmakers are in danger of losing touch.

Herbert Diess seems to be following a special agenda at the moment. “Cycling is fun, healthy and good for the environment. In overcrowded urban centers, cars – including emission-free e-cars – will only be accepted in future if the bike has enough space in the mobility mix,” the VW boss recently announced . Added to this is his recently postulated demand for a significantly higher CO2 price than the one currently planned, which would cause gasoline prices to explode. The response was not friendly. This ?? The drive for these statements is understandable. On the one hand, the group that started the diesel scandal wants to position itself as an environmental leader, and on the other hand, the billions in investments in electromobility must be recouped. When gasoline becomes almost unaffordable, more and more people will buy an electric vehicle, ideally with a VW logo on the front.

That is certainly a veritable project, but the automotive world of tomorrow will not only be defined by electric motors, the much-invoked digital transformation begins with the software and that is where German automakers are in danger of losing touch. Before Germany becomes the land of electric cars, they have to do their homework. The software problems with the VW Golf 8 and the ID.3 are just an ostentatious sign that makes it clear that you have to do your homework in the New World before you bring a car onto the market. In the meantime, the car manufacturer from Lower Saxony has eliminated the errors, has started to install wireless updates for the ID.3 and, with the in-house software company Cariad, is taking digital fate into its own hands. But the competition in the USA and now also in China is not sleeping. The battle on the computers will be even more relentless than the one on the assembly line.

The challenges, but also the opportunities, are extensive. Because the software and the associated applications are increasingly becoming the distinguishing features of vehicles. “Software opens the door to new business models for us,” explains VW Sales Director Klaus Zellmer. According to a study by the management consultancy Capgemini, the differentiation with unique software-based functions and services will enable leading automotive manufacturers (OEMs) to achieve a market share that is nine percent higher than their competitors. The software-driven transformation will also lead to productivity increases of up to 40 percent, cost reductions of 37 percent and an improvement in customer satisfaction of 23 percent in the next five years. “Software redefines mobility and changes the entire automotive value chain. The competition for innovation and growth undoubtedly takes place in the vehicle,” explains Ralf Blessmann, Head of the Automotive Sector at Capgemini in Germany.

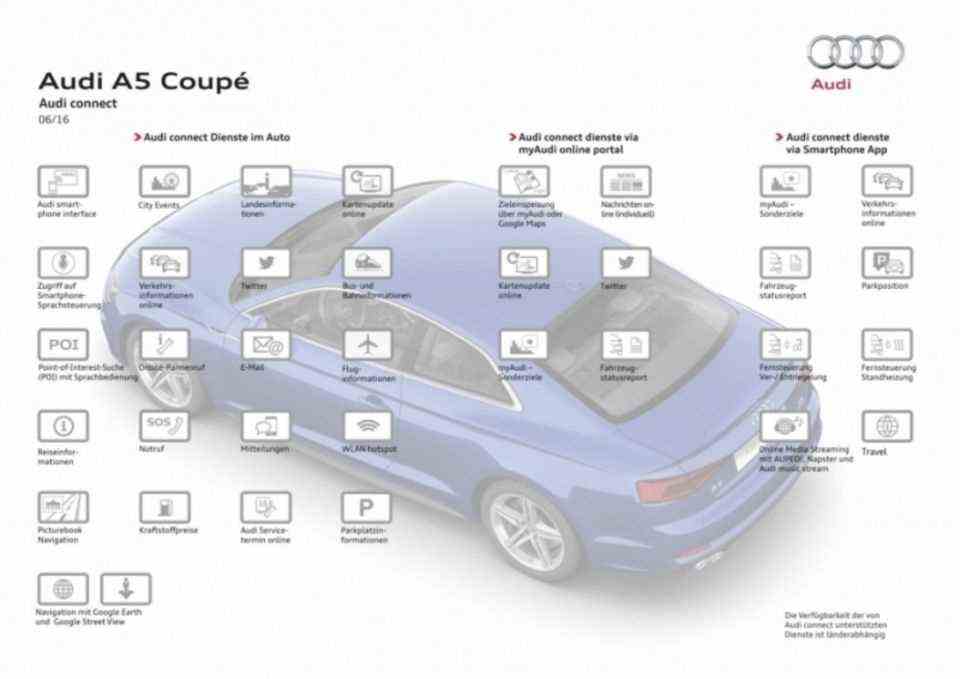

The functions or services that are implemented by the bits and bytes and the corresponding algorithms include further developed driver assistants, autonomous driving functions and, of course, connectivity. An immense business field that can generate billions of dollars. But the 572 executives of automobile manufacturers surveyed around the world are skeptical. In their view, the maturity level is low in the key areas. The 71 percent of global and 53 percent of German companies are in the initial phase of their software-driven transformation and have so far only identified areas of application.

However, the path to the brave new software world is not so easy to follow. Because the car manufacturers would have to cut old braids and give up the traditionally close link between the vehicle architecture and the software applications in order to generate new business models. The study provides a sobering picture. Currently, 93 percent of OEMs use a traditional vehicle architecture, while only 13 percent plan to decouple the tightly integrated provision of the hardware and software architecture. “In order to take advantage of software and gain a competitive advantage, OEMs have to leave legacy architectures behind,” summarizes Ralf Blessmann.

However, there are also dangers lurking on the way to the networked world. Where software is installed, there is also the possibility that hackers could gain unauthorized access to the system. In the case of an automobile, this is particularly tricky, as dysfunctional software can have devastating effects. However, data ownership and cybersecurity remain critical issues. According to the Capgemini study, less than 10 percent of automakers believe they are well prepared to implement cybersecurity measures and 60 percent struggle to ensure that suppliers’ products comply with safety and cybersecurity regulations. Self-knowledge is the first path to improvement. So it is only a matter of time before VW, Mercedes & Co. take measures to protect their cars. It is not that easy. The study reveals that around half of automobile manufacturers are struggling to collect data and derive usable insights from it.