In times of high volatility in market conditions, Sideway can make technical analysis trading more difficult than usual for many. Trading with such a strategy may not be suitable for this situation and may not perform well. as it should But one strategy that has the potential to perform well in this particular market, especially the 24-hour, high-volatility crypto market, is: “Grid Trading”

In this article, we will be introduced to Bybit Grid Bots that looks like Including a review of how to use it in real life. But before taking to get to know Bybit Grid Bots We would like to take you to get to know Grid Trading a bit first in order to understand the concept of Grid Trading briefly before going to use it in practice.

Grid Trading is a trading strategy that is based on the principle that if the price moves up and down within the frame we set. We will be able to profit from the price difference between the grids. If we place the grid well while the price fluctuates within the set grid frame, it will make more profit because it will be a cheap buy at the bottom grid. Keep selling at the top grid, making profit and generating cash flow in the sideway market.

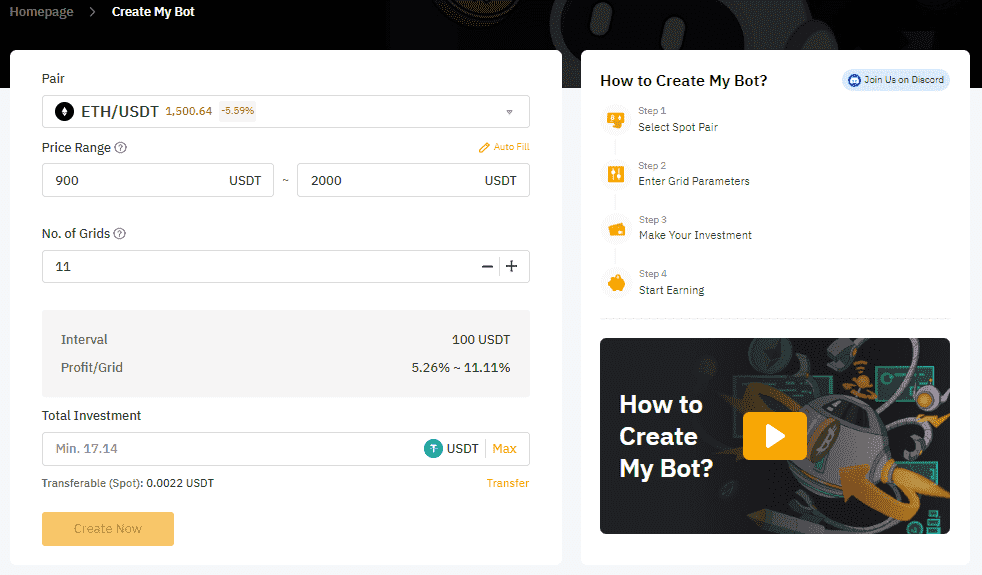

For Grid Trading Strategy, users have to define 3 main parameters which are Upper Price, Lower Price, No. of Grids.

Upper Price is the highest price frame to make a Grid Trading Strategy

Lower Price is the lowest price frame to make a Grid Trading Strategy

No. of Grids is the number of grids to be divided

For example, if we from a lot of things and think that the price of ETH runs sideway in a wide range between $900- $2000 for a while, we can try to set the price frame to do a grid trading of ETH as shown in the picture above.

Upper Price = $2,000

Lower Price = $900

No. of Grids = 11 Grids (price $100 per channel)

| Price (USDT) | Order Type |

| 2,000 | Sell |

| … | Sell |

| 1,600 | Sell |

| 1,500 | No initial orders will be placed |

| Market price: $1,493 | |

| 1,400 | Buy |

| 1,300 | Buy |

| … | Buy |

| 900 | Buy |

The current price in the picture above is $1,493 and once the grid is opened, the order must be set according to the table and the picture above. There are two cases: the price goes down after opening the grid and the price goes up after opening the grid.

Case 1: Price goes down after opening grid

If the price goes down to $1,400, there will be 1 buy and you have to set a Sell Order at $1,500 immediately. When the price goes back up to $1,500, a sell order will occur and you have to set a Buy Order at $1,400 immediately.

But in the other case, going down $1,300 would be a buy of $1,400 and $1,300 a total of 2 times, and when the price hits $1,400, a buy order that was bought at $1,300 would happen, and when it hit $1,500, it would. A sell order that was bought at $1,400 occurred.

Case 2: Price goes up after opening grid

If the price goes up to $1,500, no buy/sell will occur. You have to wait for the price to hit $1,600 before placing a Buy Order at $1,500 and when the price drops to $1,500, a buy will occur. When a purchase occurs, you must place a Sell Order at $1,600 immediately.

But if the price continues to rise to $1,700, an additional buy order of $1,600 and $1,500 will be placed, a total of 2 points.

Grid Trading Risk

The risk of Grid Trading is that if we narrow the upper and lower price frames, there will be no trading. And if the price goes down, it will only trigger a Buy Order, but will not generate a Sell Order at all, which will cause it to be stuck.

And if the grid is placed too often, it may not be worth the trading fee that you have to pay per trade, so you have to calculate it carefully. There are also other risks that are not mentioned here, such as the timeframe that we use. And the timing of using this strategy must be appropriate for the price framing.

Overall summary

In summary, the overall picture is If a purchase occurs If there is a sell, a buy order must be placed on the grid above that price immediately. The profit will be generated by the work of the grid that is multiplied by the number of cycles. The grid must be calculated separately because each grid will have different profits. for example

The top grid at a price between $1,900 and $2,000 would have a profit per grid of about 5.26%.

The bottom grid at a price between $900 and $1000 would have a profit per grid of about 11.11%.

Note : The above example is Arithmetic (same price range but different profit margin) but there is another type called Geometric (Each period profit is fixed as a fixed percentage by gap. will be different)

With all of the above, it can be seen that the overall Grid Trading strategy is good in the volatile sideway market as mentioned above if we correctly predict that the market will be sideway and within the range we expected. the event itself

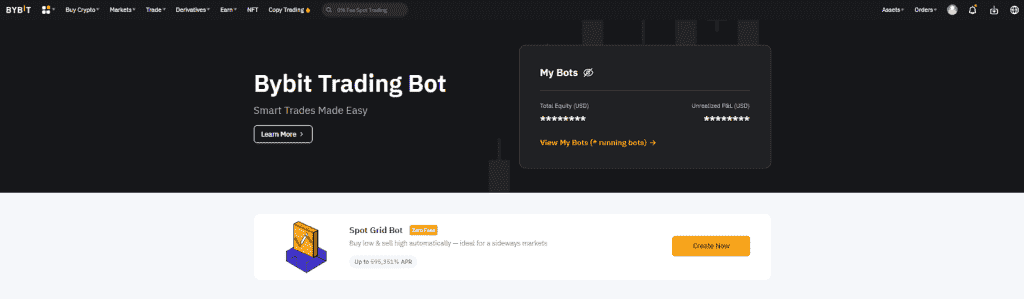

After getting to know Grid Trading, this section will talk about the details. Bybit Grid Bot What is it and how useful it is?

Usually if we want to do this strategy then In addition to having to headaches with strategy planning, forecasting market conditions, setting a good price frame. And including other factors, we need to sit and watch the chart in case of trading if the price goes to the trigger orders that were set in the first place if we don’t have a helper like a bot, so those who want to use this strategy must buy a bot. The outside that has already been written to be connected to the Exchange so that there is no need to monitor the graph. But most of them have costs in the part of the bot to be an additional cost.

Exchanges like ByBit have seen this pain point and created a grid bot that can be used directly within the exchange andThere is no fee for using the bot. Moreover, at the time of this writing, Bybit does not collect Trading Fee for Spot Trading, making Bybit’s Spot Trading Grid Bot fully profitable, but if after Bybit cancels 0% Fee Spot Trading, it will Must pay at 0.1% per order

Bybit’s Grit Bot, users just need to adjust the parameters for themselves. After that, the Bot will automatically execute the Grid Trading strategy. (Only supports Arithmetic)

At Bybit, up to 15 grid bots can be enabled simultaneously, and multiple grid bots can be created for the same currency pair. and can adjust the number of Grids between 2 – 100 Grids

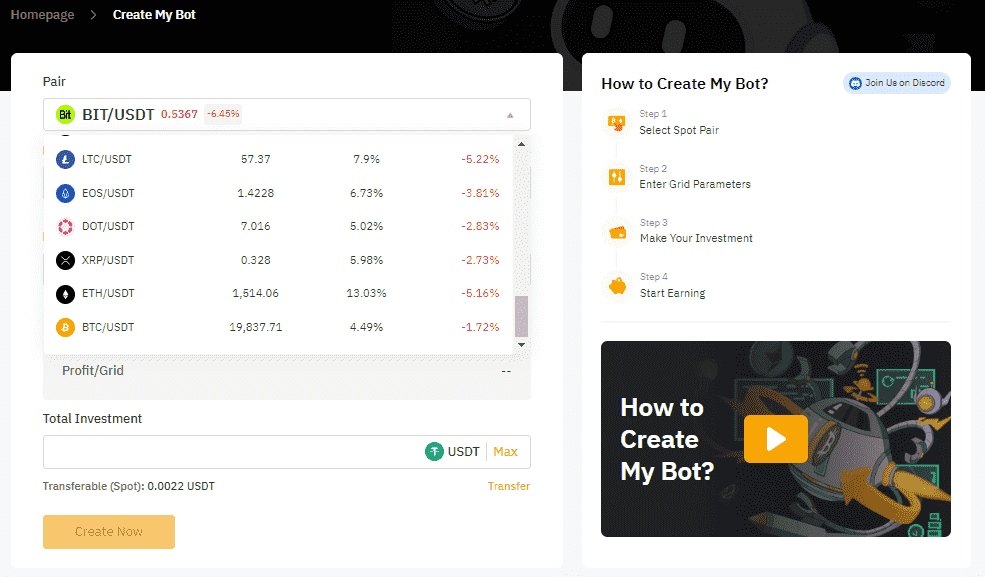

Currently, Bybit has a total of 28 supported coins for Grid Bot such as BIT/USDT, BTC/USDT, ETH/USDT, XRP/USDT, MANA/USDT, SOL/USDT, MATIC/USDT, ADA/USDT, LINK/USDT. and DOT/USDT etc.

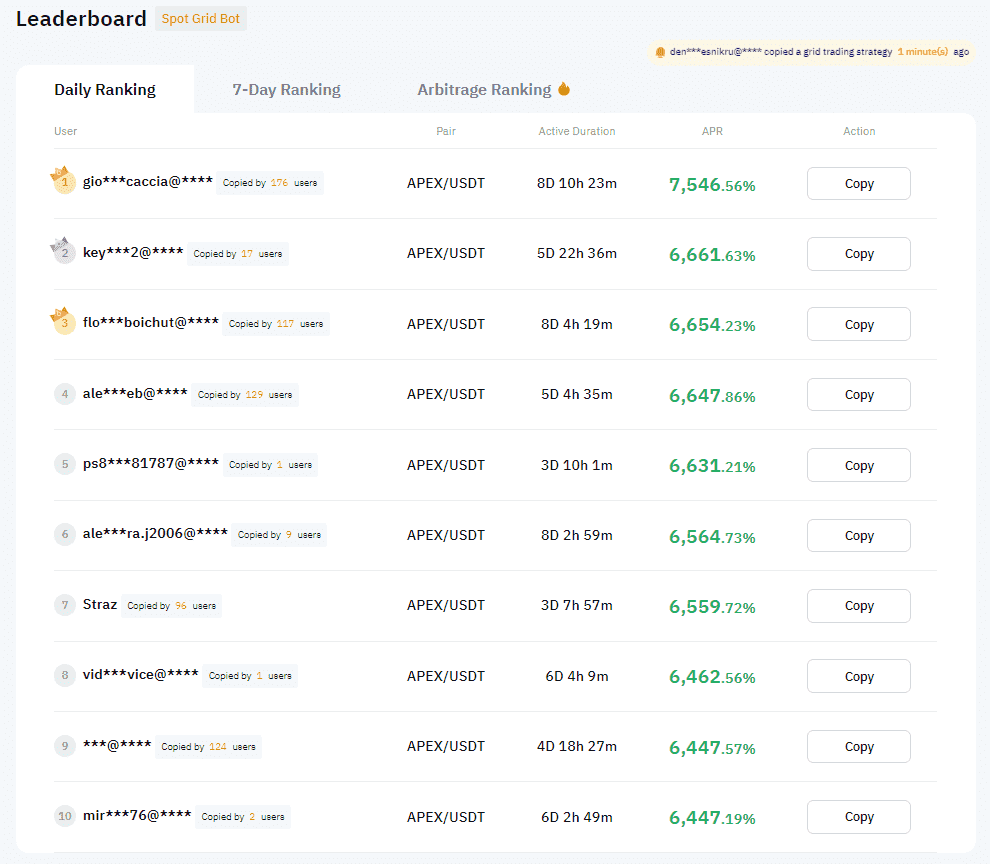

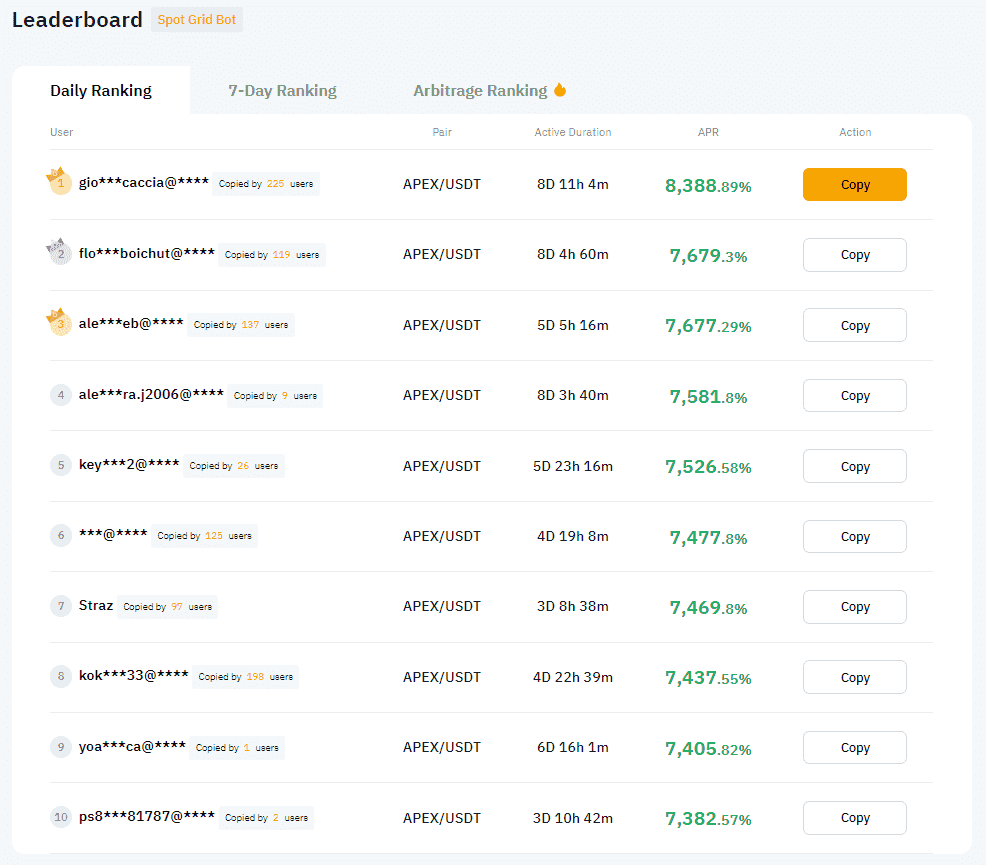

And most importantly, Bybit hasCopy Trade function for Grid Trading The system will rank the most profitable strategic people according to Daily Ranking and 7-Day Ranking, based on Total Annual Percentage Rate (APR).

How to get started with Grid Trading on Bybit

Step 1: Click on Trade and go to Trading Bot

Step 2: Click on Create Now.

Step 3: Configure the following parameters for Grid Bot.

- Pair

- Price Range

- No. of Grids

- Total Investment

Then click on Create Now and Confirm is done.

Note: The larger the number of grids, the greater the number of grids. The lower the price range, the lower the price. This means that in a volatile market Your orders may be triggered more often, but your profit will decrease due to multiple trading fees.

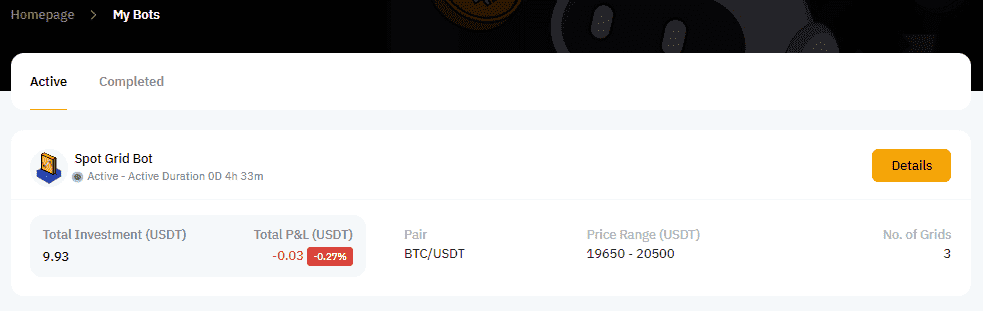

After clicking Create Now, the page will automatically be redirected to My Bots to allow you to view Grid Bots that are currently in use. And you can click Detail in the top right corner of each Grid Bot to view more information.

Grid Bot: Copy Trade

If you want to find someone to copy trade or get ideas, you can go to the homepage of Bybit Trading Bot and scroll down to see the Leaderboard provided by Bybit.

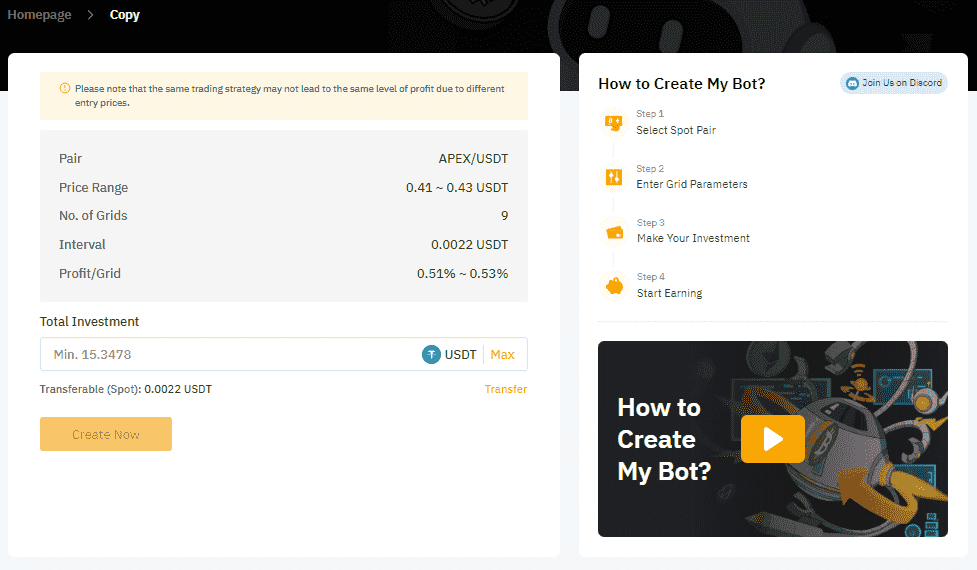

If anyone is interested, they can press Copy on the right hand side. Then the system will show the details of that person how they are set up. If assuming that the first person chooses to view, the details will be as follows.

The system will display Pair, Price Range, No. of Grids, Interval, Profit/Grid, users just need to invest their money. And then click Create Now and you’re done.

overall Bybit Grid Bot It’s quite easy to use and easy to understand. Just enter a few parameters and you can easily open the grid without any bot fees. Plus, at the time of writing this article, it’s celebrating 10 million users on Bybit. So there are no fees for spot trading which includes Spot Grid Bot Bybit as well, no matter how often you trade, you don’t have to worry about fees.

Source: Bybit Learn Bybit Learn Bybit Bybit Help Bybit Help Bybit Blog Bitcoin Addic