On July 1, the largest EU-wide sales tax reform since the creation of the internal market in 1993 came into force. The reform affects all traders who sell products online across borders in Europe or deliver products to Europe from third countries: small internet retailers in and outside the EU, corporations such as Amazon, international manufacturers and brands that deliver directly to end consumers in the EU – and ultimately also Consumers. Because for some products the prices are likely to rise. The most important things in summary:

What is all this for?

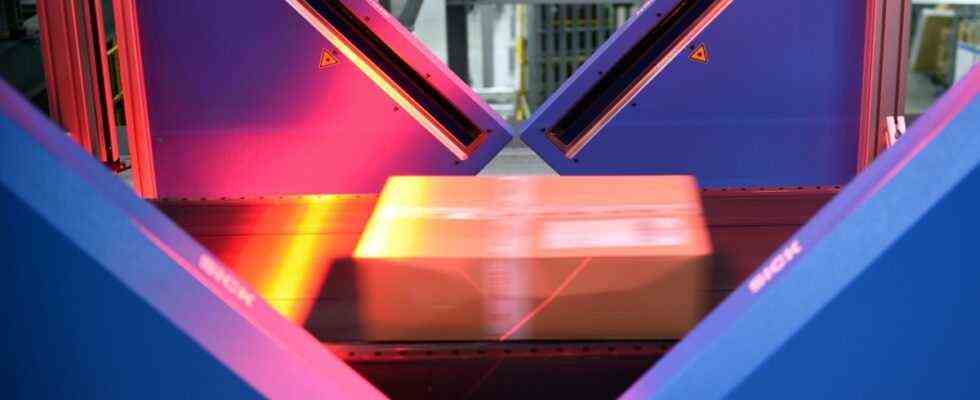

The reform aims to create fair taxation within the EU and with traders outside the EU. Or as André Schwarz, deputy chief executive of the Federal Association of Wholesale and Foreign Trade (BGA) puts it: “This is intended to prevent competitive advantages from being gained by fraudulent sales tax not being paid.” In short: Smartphones from Asia should no longer be able to be declared as pacifiers. Every parcel from a non-EU country will in future go through customs and must be registered digitally, says a spokesman for the General Customs Directorate in Bonn.

What exactly is new?

Shipments of goods from outside the EU with a value of less than 22 euros will no longer be exempt from import sales tax. Rather, they are taxed at the VAT rate applicable in the respective EU country. In addition, the threshold above which sales tax must be paid within the EU drops to a total of EUR 10,000 across the EU. This means that many more EU dealers than before will have to pay sales tax in other EU countries in the future. Sales below the threshold will continue to be taxed at the local tax office.

What does this mean for dealers?

EU dealers are no longer disadvantaged in terms of tax compared to their competitors from non-EU countries. But because of the low EU-wide threshold of 10,000 euros “significantly more retailers than before have to come to terms with much more bureaucracy. Smaller retailers in particular will be in trouble,” says Moritz Lukas, Vice President Sales at Taxdoo, a provider , which automates the processing of international sales tax. BGA spokesman Schwarz added: “All products must be provided with the tax rates of the countries of destination, this involves considerable manual effort.” And a great source of error. “The big danger here is having to pay additional sales tax claims out of your own pocket,” says Schwarz. Conversely, double taxation is also conceivable.

The reform also changes a few things for global mail order companies like Amazon: “From now on, a retailer registered on an Internet marketplace will not deliver to consumers under VAT law,” says Ralph Brügelmann, Head of Taxes and Finance at the German Retail Association, “but the platform itself , the platform owes and pays the sales tax. ” Schwarz adds: “From July 1, 2021, platforms such as Amazon, Ebay etc. will then be made more responsible for sales tax and therefore also have their own interest that not only they, but also those who sell products via the platform meet tax obligations. ” The same applies to Chinese platforms that deliver directly to private customers in Europe.

How is that supposed to work?

Merchants can pay VAT centrally for all EU countries via a so-called one-stop shop (OSS) – that is, in Germany via the Federal Central Tax Office, to which companies must register with their VAT identification number. This is intended to simplify tax processing. A company that is established in only one EU country and supplies its customers in other EU countries only has to file a tax return in its home country. It does not have to register with the local tax authorities in every country to which it delivers and pay the VAT there, says Patrick Oppelt, legal assessor at the European Consumer Center in Germany.

Companies from outside the EU can also register for the OSS system. The advantage here is that the goods do not have to be taxed through customs, but can be delivered directly to the end customer.

Basically, if you want to use the OSS notification procedure in the third quarter, you have to register by June 30th. Register for it – according to surveys, many retailers did not know anything about the reform until recently. And: OSS only applies to B2C retail, i.e. shipping from the company to the end consumer.

What is IOSS

IOSS (Import-One-Stop-Shop) is the code for the new regulation for goods deliveries from third countries such as China, USA and Great Britain. “In most cases,” says HDE expert Brügelmann, “the platform or interface now owes the tax and pays it.” IOSS is supposed to be the lever against tax fraud. Here, registered online retailers can pay the import sales tax directly to the tax authorities in the EU for goods up to a value of 150 euros. The previous standard procedure, which the parcel delivery service takes care of, applies to shipments with a value of 150 euros and more. In addition to the import sales tax, customs duties may also be due, depending on the goods.

Does that help against fraud?

“When using the IOSS, misuse cannot be completely ruled out,” says HDE expert Brügelmann. Customs only checks the validity of the IOSS number and not whether the IOSS number also belongs to the company that uses it. A trader from a third country could therefore provide an IOSS number that has not been assigned to him and would then be exempt from import sales tax. Subsequent applications for exemption or reimbursement for returns, subsequent inquiries or legal remedies are also a challenge in the IOSS, according to the Foreign Trade Association.

And the prices?

Items from China such as cell phone cases, which previously cost ten euros, could be up to 80 percent more expensive, calculates the tax processing company eClear, whose supervisory board chairman is incidentally the former finance minister Peer Steinbrück. The reason is that the 22 euro threshold is falling and 19 (or reduced seven) percent import sales tax and around six euros postage are due instead. “Parcels with a goods value of more than 22 euros could also be more expensive, since up to now incorrect information on the value of goods was often given when importing,” says Moritz Lukas from Taxdoo. “Now sales tax is always due from the first cent on imports.”

In addition, consumers who shop on online platforms have to be prepared for the fact that other prices will be displayed to them when they complete the order, says Schwarz when this was initially done in the shop. “Because it is only when you enter the delivery address that it is determined which national regulation will apply and which tax rate is to be applied.” According to the HDE, this could lead to surprises, as many consumers do not even know that they are ordering from non-EU countries.

Additional costs may also apply for more expensive items of more than 150 euros. In addition to the regular import sales tax of 19 percent, the customs costs for textiles from the Far East amount to, for example, twelve to 13 percent of the value of the goods.

Customs also informs that consumers in Germany should note that, as before, the commissioned post, courier or express service provider will usually take over customs clearance and pay the import duties due in advance. “The consignee then pays the disbursed import duties back to the deliverer upon delivery. Online buyers should take into account that the transport companies generally charge a flat-rate service fee for completing the customs formalities.” So far, cheap purchases via Wish, Alibaba and Amazon from China could come to an end.

For gifts sent from private individuals to private individuals, according to customs, nothing will change. The value limit of 45 euros continues to apply here. The value limit of 150 euros for goods-related customs duties will also remain unchanged.

What is missing?

“One omission is clearly the lack of an EU-wide database based on the customs tariff numbers and the identification of the national tax rate allocation,” says Schwarz from the BGA. The company eClear complains that the EU data are incorrect and incomplete. Overall, the number of exemptions from sales tax in all EU countries should be 60,000. In addition, there is a lack of a mechanism, criticize critics, that reflects the dynamics in cross-border e-commerce. The EU VAT package was initiated a good ten years ago, today the warehouse is often in a different country than the delivery address. This development, for example, is not reflected in the reform.