Dhe turn of the year should bring relief. On January 1st the Spanish government lowered VAT on many groceries in order to help the poorest households in the inflation crisis. By the middle of the year, Spanish consumers will no longer have to pay VAT on staple foods such as vegetables, bread, rice or cheese. For other foods such as meat and fish, only a reduced tax is due.

Prime Minister Pedro Sánchez is reacting to the increasingly precarious situation of many households. The prices of staple foods such as milk and bread have risen by almost a third in Spain in a year.

This is a particular burden for low-income households, to which the government in Madrid is transferring additional food aid. In fact, consumers and voters in other European countries are also concerned about their standard of living. This is shown by a number of surveys, most recently the most recent EU-wide survey by the Eurobarometer.

Accordingly, no other topic is currently driving people in Europe as much as the loss of purchasing power. In the survey commissioned by the European Parliament, 93 percent of those surveyed stated that they were worried about rising prices for food and energy, for example. This is linked to a second concern: 82 percent of Europeans fear poverty and social decline.

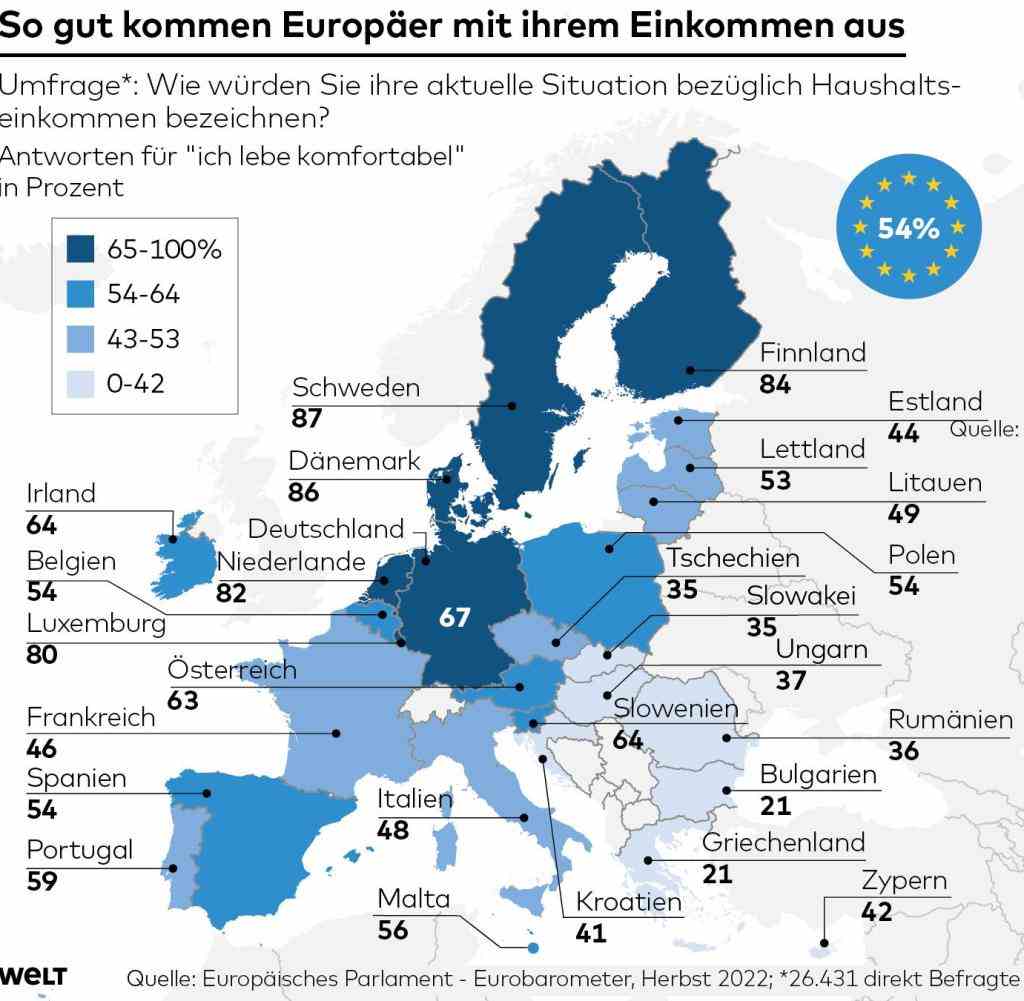

Only behind them are other developments, such as climate change, the danger that the war in Ukraine will spread to other countries and the danger of a nuclear accident or attack. In contrast to such partly abstract developments, the rising prices were clearly felt by people in the survey months of October and November. After all, 45 percent of the Europeans surveyed stated at the time that they could hardly or only with difficulty manage with their current income.

However, the need is unevenly distributed across the continent. In Germany, for example, more than two out of three respondents were able to live comfortably with their household income. The serenity is even more pronounced in the Nordic countries, the Netherlands and Luxembourg.

Source: Infographic WORLD

In these nations, which traditionally have high living costs, 80 percent or more of the population stated that they could live comfortably with the current household income. In Sweden and Denmark it was 87 and 86 percent respectively.

The situation is very different in the south-west of the continent: there are signs of an impending poverty crisis stretching from Slovakia through Hungary and the Balkans to the Aegean Sea. In this region, only a minority of respondents get by on their own income.

In Bulgaria and Greece in particular, the inflationary crisis has reached mainstream society. According to their own statements, only one in five respondents in these countries can live comfortably on their household income.

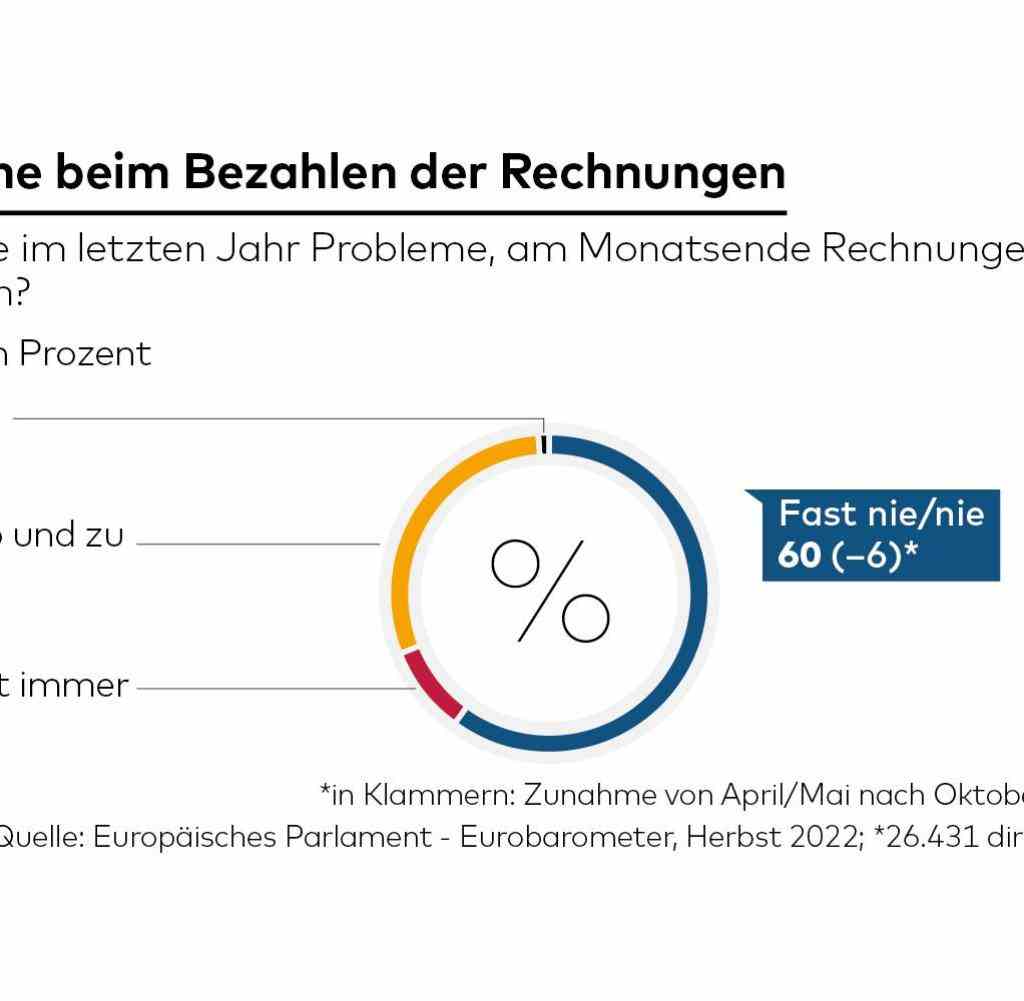

39 percent of Europeans find it difficult to pay their bills

So it is not surprising that, according to the study, 39 percent of Europeans have difficulties paying their bills at the end of the month. This is an increase of six percentage points compared to the previous survey in spring 2022.

Only 14 percent of the Greeks surveyed never or almost never have money problems at the end of the month. In Italy, Portugal and Bulgaria, this also only applies to slightly more than every third person. A middle class that is in secure financial circumstances seems to be collapsing in these countries.

Those affected have two options: either they limit themselves or they go into debt. Two out of three Greeks already have relatives for money or credits have to ask to earn a living.

Source: Infographic WORLD

This is the result of a survey by the French organization Secours Populaire, whose aim is to fight poverty. The opinion research institute Ipsos had interviewed 6,000 people in six European countries on their behalf last summer.

One in four participants stated that they were currently in a financially uncertain situation. However, this survey also showed a division of the continent similar to that in the current study. While 51 percent of respondents in Greece stated that they would not be able to cope with unexpected expenses, in Germany it was only one in five, although this proportion is high.

The outlook remains critical: inflation is likely to remain high. In December, for example, it fell to 9.2 percent in the euro zone. However, this is still high and the increase in food prices even reached a new high in December.

Many households are under double pressure in this situation. They are not only suffering from high inflation, which was additionally fueled by the Ukraine war last year. They are also troubled by the rising interest rates that the ECB is using to fight inflation.

In Spain, for example: the Spanish central bank, Banko de España, warned in late autumn that the double burden of high inflation and rising interest rates could ruin many Spanish households. More than 1.5 million households in the country spend more than 40 percent of their income on debts repay.

One reason: The standard Spanish mortgage has a variable interest rate, which can also be used for ongoing mortgages based on the development of the Euribor, an interest rate between banks. The sharp rise in interest rates has made it more expensive for households to service existing mortgages. This is throwing financial plans from the times of low and negative interest rates upside down, not only in Spain.

Also in the UK, a country of homeowners, a significant proportion of mortgages are variable rate. That’s where what the British press calls the “Cost of Living Crisis” hits particularly hard. The proportion of British households that have little or no disposable income has doubled over the past year from 20 percent to 40 percent, according to the British economic institute CEBR.

A foundation warned in the summer that seven million families had given up essentials such as heating, toiletries and even showers in the past few months in order to save money.

“Everything on shares” is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast at Spotify, Apple Podcasts, Amazon Music and deezer. Or directly by RSS feed.