Too vague a complaint, an unconvincing argument, and too late objections. A US judge has inflicted a stinging setback on the country’s authorities who accused Facebook of anti-competitive practices, by dismissing their complaints filed in late 2020 on Monday, pushing the social network above $ 1,000 billion in market capitalization for the first time . However, this is not the end of the soap opera: a corrected copy can be put back on the table within 30 days.

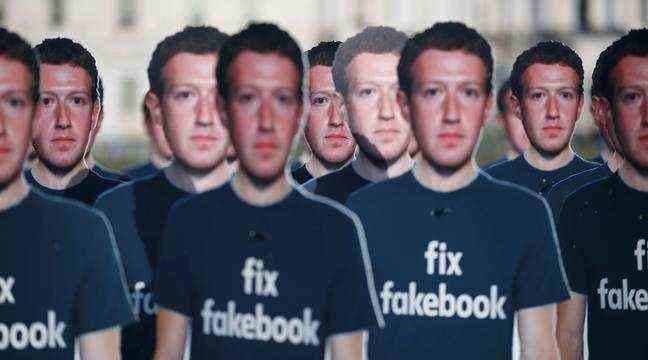

The US competition authority (FTC) and prosecutors representing 48 states and territories believed that Facebook was abusing its dominant position and its well-filled coffers to oust competition and in particular asked the courts to force the company to separate. from Instagram and WhatsApp. But according to Judge James Boasberg, “the FTC failed to present enough facts to plausibly establish” that the group really had monopoly power over social media.

The agency’s complaint “says almost nothing concrete on the key issue of Facebook’s real power (…), it’s almost as if the agency expects the court to approve without flinching the widespread idea according to which Facebook is a monopoly, ”notes the magistrate in his argument.

An opposition to the takeover of Instagram too late

Regarding the allegations made by the attorneys general against Facebook’s takeovers of Instagram and WhatsApp in 2012 and 2014, the judge ruled that, filed in 2020, they were far too late, while the FTC had not found nothing to complain about at the time. He also claimed that the policy according to which Facebook prevented the transfer of data to competing applications such as Twitter, TikTok or Snapchat, was not contrary to competition laws.

The social network welcomed these decisions, which “recognize the flaws of the government complaints filed against Facebook.” “We compete fairly with other companies every day to gain people’s time and attention,” said a spokesperson.

On Wall Street, the action of the group of Mark Zuckerberg, ended in stride up 4.2%, exceeding for the first time the symbolic threshold of 1,000 billion dollars in capitalization.

30 days to return to the charge

The judge, however, leaves a door open: if he rejects the attorneys general’s complaint entirely, he gives the FTC thirty days to present new documents to support more precisely his accusations.

These decisions come at a time when the American authorities are raising the tone against Google, Apple, Facebook and Amazon, the famous Gafa. Other lawsuits have been launched in recent months against Google for abuse of a dominant position, and numerous investigations into the Gafa are still ongoing.

Similar anti-competitive accusations were launched at the end of the 1990s against the computer group Microsoft. After nearly three years of proceedings, however, the Ministry of Justice had failed to dismantle the firm.