As of: 09/26/2021 01:08 p.m.

The pandemic brought an upturn in digital education, but only one of the leading startups comes from Europe. Why are the opportunities of the market not being used better?

The market for digitized education has gigantic potential: in 2020 alone, more than $ 16 billion in venture capital was invested in innovative learning solutions and business models – more than twice as much as in the previous two years. According to figures from the market research company HolonIQ, investments will increase to up to $ 404 billion by 2025.

Digital learning platforms such as Coursera, Udemy or Udacity are now among the so-called unicorns. These are young technology companies that are valued at a billion dollars or more by international investors. The US company Coursera, for example, specializes in providing online training courses. The courses usually consist of several hours of video lectures combined with performance reviews, such as quizzes.

EdTech

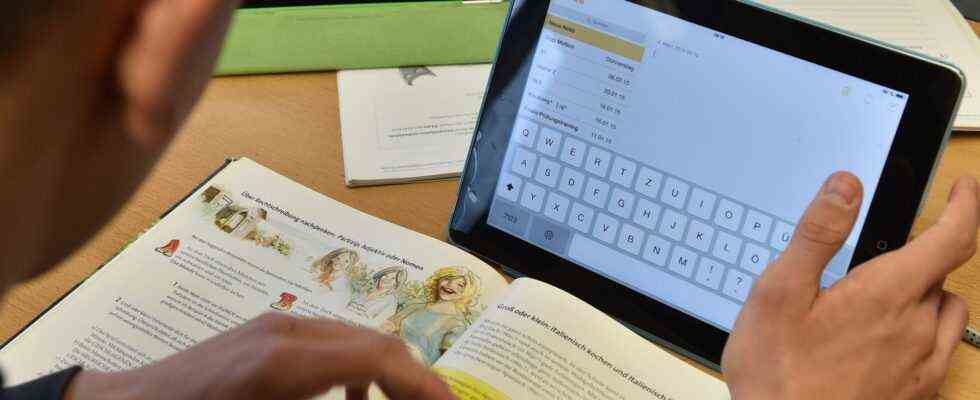

The acronym EdTech (education and technology) refers to the industry that develops educational technology. These are technological developments such as software solutions, services or tools that are intended to support learning or teaching. This means that content from decimal calculations to playing guitar is conveyed interactively and playfully via websites or apps. To do this, EdTech companies use technologies such as speech recognition, live video calls or recorded videos.

The market is often dominated by startups that adapt technological innovations such as virtual reality, mobile apps, tablets or artificial intelligence (AI) for educational purposes in order to convey teaching content. For example, a French university uses a digital campus that students use avatars to move around while sitting on their laptops at home.

Europe is behind in international comparison

So far, however, European companies have hardly benefited from the boom: The Go Student tutoring platform from Vienna is the only European start-up that is listed by HolonIQ among the “30 Global EdTech Unicorns”. In total, the 30 EdTech unicorns are worth over 90 billion dollars worldwide, the majority of the companies come from the USA or China. The GoStudent principle is simple: the platform connects students with selected tutors in a live video conversation.

There are also some start-ups on the German market, but the number is manageable, explains Florian Schoner, doctoral student at the Center for the Economics of Education at the Ifo Institute: “In general, the share of start-ups in the education sector is in the single-digit range In addition to Go Student, there are Simpleclub, Sofatutor, knowunity and eSquirrel on the German market. ”

German start-ups are also growing

The Knowunity app, co-founded by teenager Benedict Kurz during his A-levels, aims to turn students into learning influencers. The young founders have a “kind of Spotify for everyday school life” in mind. This means that students create content such as explanatory videos themselves – students help students. And particularly active users could even earn money with their offers. The start-up has now received growth capital from the Berlin start-up fund Project A and well-known business angels such as football professional Mario Götze and entrepreneur Verena Pausder.

Learning platforms, which are primarily aimed at students, were also able to benefit from the upswing in the industry during the Corona crisis. The German HV Capital invested two million euros in the Simpleclub learning app, and its competitor Sofatutor was taken over by investment companies. Sofatutor offers learning videos, exercises, homework chats and individual tutoring. “Offers that offer personalized content and immediate feedback are particularly effective. In view of the increasing availability of methods in the field of artificial intelligence, it should be possible to make these offers even more effective in the future,” explains Schoner, explaining the technical possibilities.

Difficult starting conditions for startups in Germany

However, the administrative effort of the companies is high, explains Ulrich Schmid, managing partner of the mmb Institute in Essen: “Until you are in the market, you have to put in an enormous amount of marketing that start-ups actually cannot handle.” Because start-ups in Germany have to struggle with considerable hurdles compared to markets such as China or the USA. “Germans are often unwilling to spend money on education. One is used to education being organized by the state and costing nothing. In addition, the education sector – schools and universities – is so heavily regulated that a start-up can sometimes agree 16 ministries of culture have to deal with it. It is not worthwhile to be active in this area, “explains the expert from the mmb Institute in Essen. The mmb Institute sees itself as a think tank and impulse generator for the innovation of education and learning.

In contrast, the demand for free offers is enormous, YouTube now sees itself as an educational platform. For many, it is the first point of contact, regardless of whether it is about integral calculation or changing a bicycle tire. For young founders, however, this is hardly promising, as it is difficult for them to generate income here.

EdTech offers from Germany have so far been limited mainly to the unregulated market of leisure education, or tutoring offers that are not subject to any state regulation. Therefore, success in the market for leisure education is much easier to achieve; also a consequence of the Corona crisis: “The pandemic has given companies that are digitally on the move. In Germany, too, digital cooking courses or guitar lessons are now running pretty well,” says Schmid.

Educational offers are limited to the leisure market

However, providers of such offers are often limited to a very small market. Because German educational offers are aimed at a German-speaking audience, and expansion into markets outside this language area is difficult to manage, explains the mmb expert: “Companies from the USA have an easier time there; English educational offers can be marketed anywhere.” He therefore sees the danger that Germany will be left behind in the competition for new companies in this area, and that American companies will quickly gain a foothold in this country too.

Germany must therefore take action to make start-ups easier, says Ifo expert Schoner: “In order to promote more start-ups regardless of the sector, it is worth looking at the demands of young entrepreneurs: dismantling and digitizing bureaucracy The latest IHK survey of 350 young entrepreneurs shows that 79 percent of those questioned believe that the reduction of bureaucracy would enhance Germany as a start-up location. “

Opportunities for private investors

One of the best-known German EdTech companies is Babbel. The language learning provider, founded in Berlin in 2007, even wants to go public, but recently had to postpone its plans due to unfavorable market conditions. The proceeds from the issue are to be used not only to expand into the USA but also to expand the range of learning opportunities.

Babbel would not be the first company to woo private investors internationally: For some time now, for example, Allianz has been advertising that investors could improve educational opportunities for all people through appropriate funds. According to HolonIQ, just four percent of global technology spending goes into digital education, and investments in the German market are negligible. Private investors are now supposed to close these gaps. For example, the number of listed companies will rise to over 100 by 2025.

“A large part of the global private capital investments in the education sector in recent years has gone into offers that tend to replace traditional educational institutions, that is, in apps or educational platforms that enable independent, autonomous learning beyond institutions and traditional teaching and learning settings,” says expert Schmid from the mmb institute.