Hello, in the past many people may have heard the term DeFi 2.0 more and some people who are optimistic think that this is going to be a big evolution of this industry. Or some may be pessimistic thinking that this is really going to create a big bubble. Today is a good opportunity for readers to understand one of the platforms in the DeFi 2.0 family, Abracadabra.

This article will take readers to know what Abracadabra is, how it works, and what advantages $MIM Stablecoin has to become the 6th stablecoin, and how $SPELL, its Governance Token, has Tokenonomics, as well as personal opinions. with this platform

Abracadabra

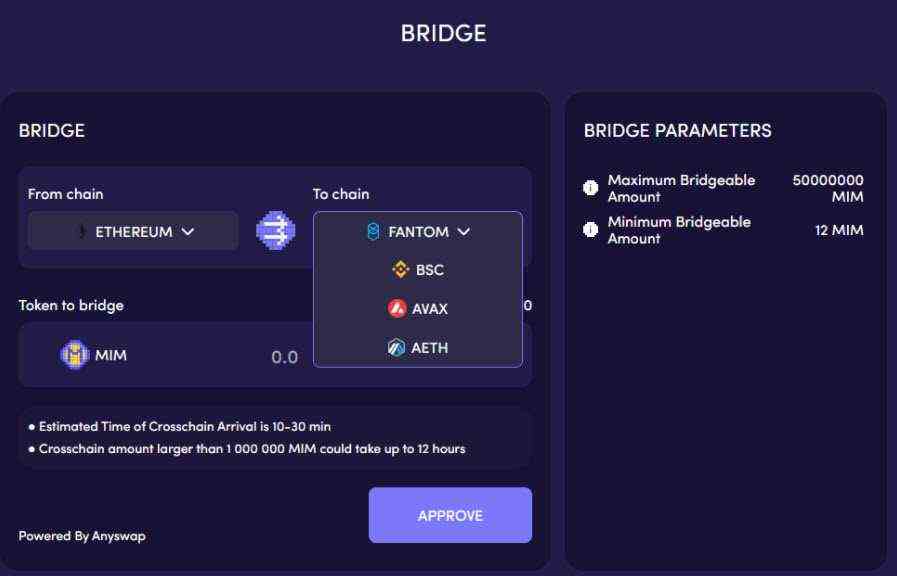

It belongs to the category of the Lending protocol that allows depositors to pledge interest-bearing assets in order to borrow $MIM. If a depositor deposits $MIM in Curve’s MIM-3LP3CRV, they receive three returns: Trading fee, $CRV, and $SPELL. Abracadabra is also available in 6 chains: Ethereum, Avalanche, Fantom, Binance Smart Chain Arbitrum and Terra make it easy to move $MIM back and forth.

Highlights of Abracadabra

- Collateral assets It is a type that carries interest. (Interest-Bearing Tokens (ibTKNs)) means that our collateral assets will continue to grow. It offsets the interest paid and also allows you to borrow more and more over time.

- Multichain With Abracadabra having 6 chains, users can migrate to the cheap gas chain and send $MIM back. And it’s also more convenient to move money back and forth.

- Team One of Abracadabra’s developers is Daniele Sesta or @danielesesta. The people behind famous platforms like Popsicle Finance (had been hacked news link) a multichain yield optimization platform, and Wonderland, a decentralized reserve currency protocol on Avalanche, similar to OlympusDao on Ethereum, are some of the most influential developers in the field of DeFi.

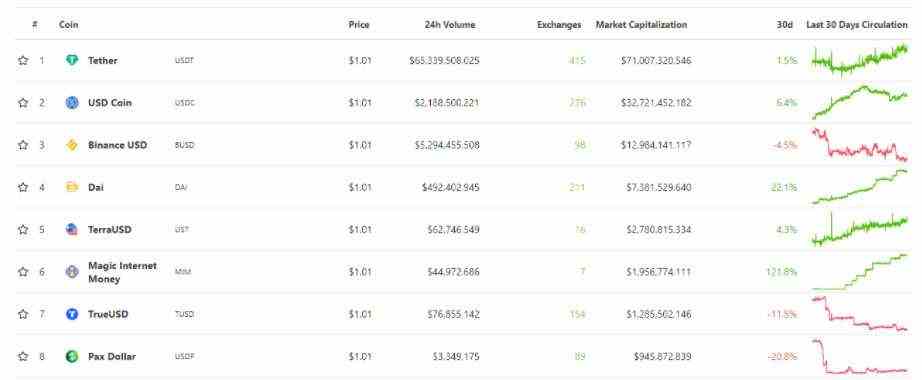

Market Cap from the information of coinecko It has grown exponentially to $1.9 billion today from just $800 million a month ago. This makes $MIM currently ranked 6th in the Stabelcoin category.

$MIM Tokenomics

The purpose of $MIM is to be a decentralized stablecoin. The same is true for makerDao’s $DAI and is asset-backed, but the supporting assets are improved. By doing this, there is no middle man to control. As a result, the law cannot be used to enforce it.

Price fixing principle: similar to stablecoin algorithm The most common is to use arbitrage, or market forces, to bring its price back to $1. If the price is less than $1, someone decides to buy $MIM at a market price below $1, after which $MIM can be repaid on the borrowed debt or held for sale at $1.

Conversely, if the market price of $MIM is above $1, someone will borrow the asset to borrow $1’s $MIM and sell the market for $1 to make a profit.

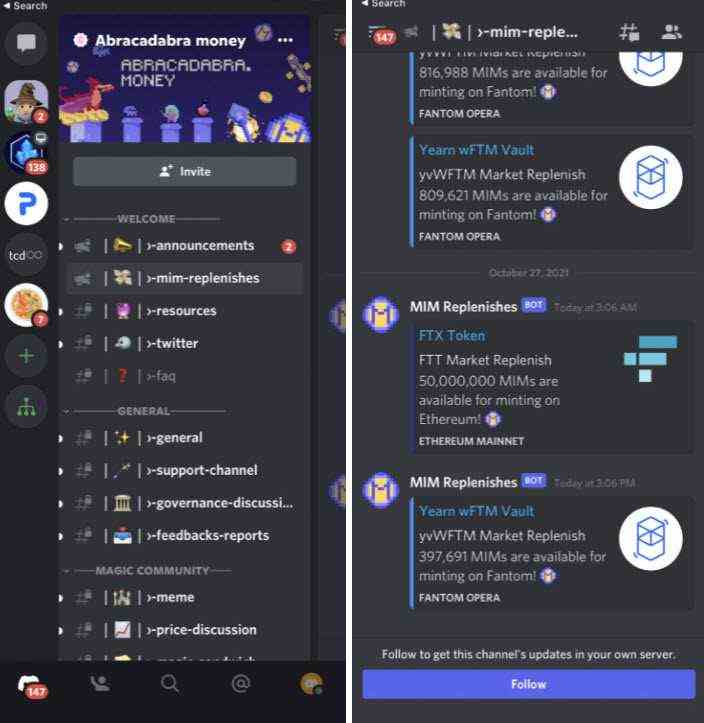

$MIM Coin Generation: Abracadabra uses the Kashi Suite, a smart contract developed by BoringCrypto Kashi will create a collateralized borrowing market called a Cauldron, or a large boiler that holds $MIM in the amount of coins the MultiSign Group has agreed upon. All will have to wait for a new refill. You can follow them on Abracadabra’s Discord.

MultiSign Group: There are 10 groups. To approve the addition of $MIM, 6 out of 10 must be approved to be added. The 10 groups are as follows:

Poolpi (Year Finance)

Leo Cheng (Cream Finance)

Michael (Curve Finance)

Squirrel (Popsicle Finance and Abracadabra Money)

Danielesesta (Popsicle Finance, Abracadabra Money and WonderlandDAO)

0xMerlin (Abracadabra Money)

Julien (Stakedao)

C2tp (Convex Finance)

Georgiy (Popsicle Finance and Abracadabra Money)Sifu (WonderlandDAO)

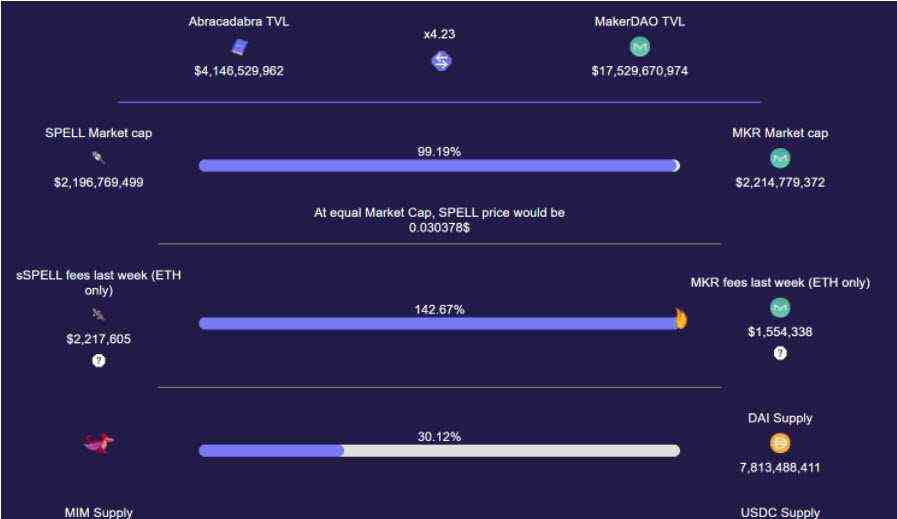

Compare $MIM and $DAI: from the information of ByeByeDai The Abracadabra vs MakerDao comparison site clearly points out that Abracadabra’s performance is many times better than MakerDao because Abracadabra’s TVL is 4.23 times smaller than MakerDao, but the fees the platform receives are 1.42 times higher, and compared to $MIM Supply. And it’s still only 30% of the $DAI Supply, so it’s interpreted that Abracadabra has plenty of room to grow. However, $MIM has not been accepted. widespread use And it went through a market crash as hard as $DAI, so using $MIM is still more risky and it takes time to prove it.

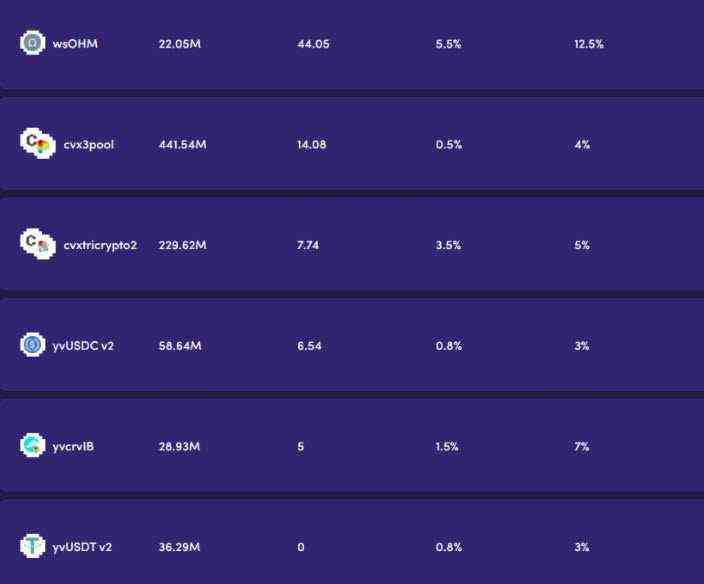

$MIM Borrowing: Currently, more than 15 types of assets can be supported, either LP tokens or coins. There are five landmarks:

- Component: It is a type of collateral asset.

- Left to Borrow: The remaining $MIM amount can be borrowed. Some of them are sold out and have to wait to be refilled.

- Interest fee: Interest expenses in the form of $MIM, for example, if borrowing 100 MIM at 1% interest, it means that there is $MIM, you have to return 101 MIM. Normally, interest expenses will gradually take up the debt ratio, but with the underlying asset such as yvUSDC There is interest in the debt ratio may not grow at all.

- Liquidation Fee: If the Debt ratio is greater than the specified amount, Liquidator will clear our status at a specified discount price.

$SPELL Tokenomics

$SPELL in coins Government Tokens There is a total supply of all 21 billion

- 63% ($132.3 billion): To a Liquidity Provider on the farm. MIM-3LP3CRV In Curve.fi , ETH-SPELL and ETH-MIM and other pools that may be available in the future Or may cooperate with other platforms such as Olympus Pro, Voltium Protocol.

- 30% ($63.0 billion): Go to the development team. The coins will be released gradually within 4 years.

7% ($14.7 billion): To investors who invest in Initial DEX Offering (IDO) of Uniswap and Sushiswap

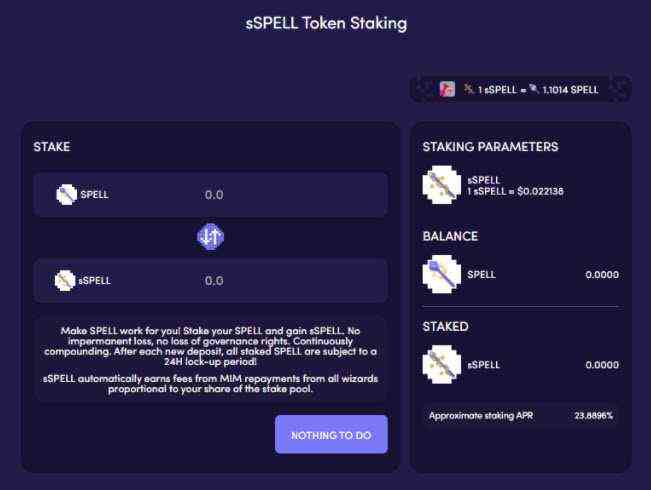

Additionally, if $SPELL is staked in Abracadabra, you will receive sSPELL as a deposit contract. Return on stake $SPELL as follows:

- Borrow Fee: Collect from borrower $MIM 0.05% of the total amount.

- Interest Fee: Collect from borrowers $MIM in different rates according to each pool.

- Trading Fee: 0.04% fee on Curve.fi exchange

- Bridging Fee: Fee 0.1% of total amount to bridge $MIM to other chains.

- Liquidation Fee: 10% of the clearing amount

These fees will be used to buy $SPELL and store it in the SPELL Fee Pool, accumulated over time for sSPELL holders, so over time we redeem our sSPELL back to receive the original $SPELL we deposited including $. SPELL received from various fees added as well. If you think this platform can go a long way, depositing $SPELL is another interesting option.

Taking advantage of $MIM

On this page we’ve explained all the working principles of Abracadabra, and on the surface you might not see the platform’s special abilities other than recovering coins. In this topic, I will present a technique for using $MIM more effectively.

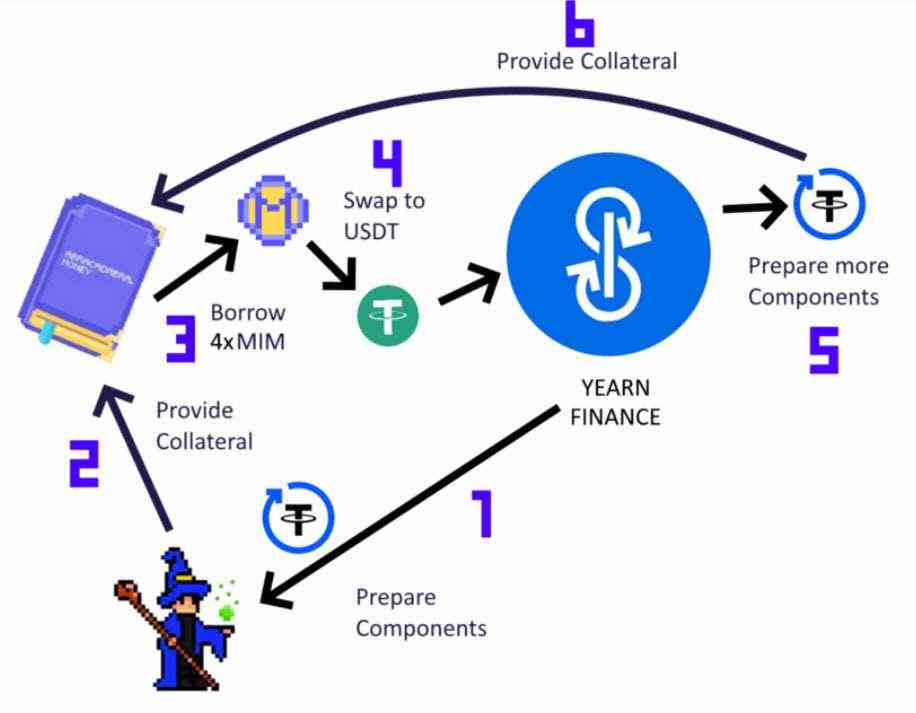

- Arbitrage Yield: The principle is to find an asset for which the interest earned is greater than the interest on the loan, so we don’t have to return $MIM. Until finally offset the interest on the loan, so we don’t even need to return $MIM. I’ll give you an example of Pool yvUSDC.

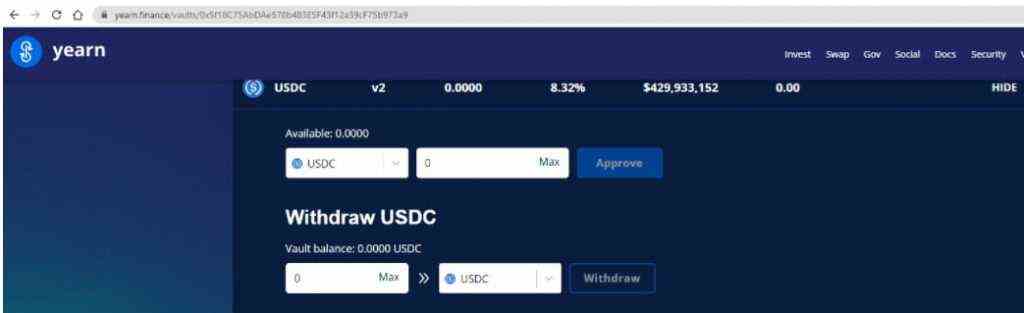

The first step is to deposit USDC into Yearn.finance. That yields 8.32% APY. Yearn then gives YvUSDC as the deposit contract.

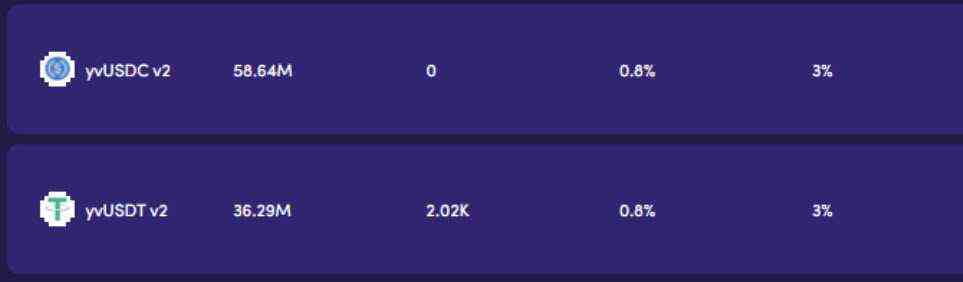

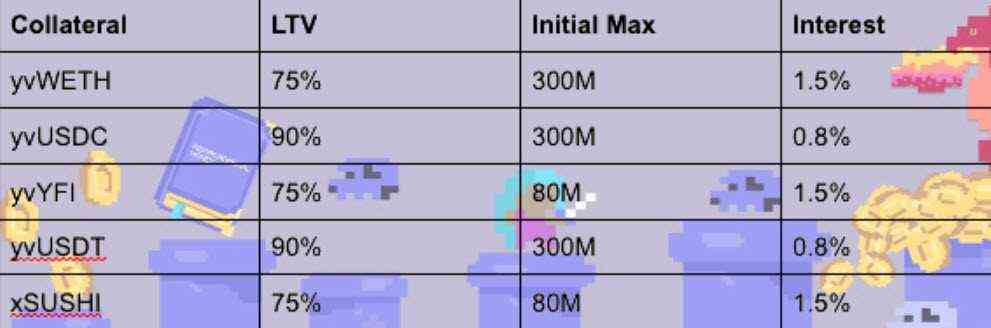

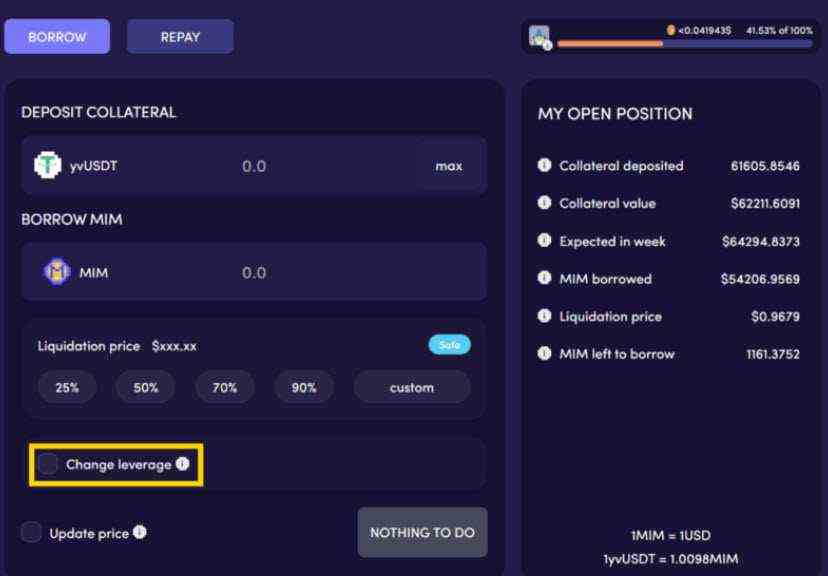

We put that promise in Abracadabra.money, which yvUSDC Pool only charges 0.8% interest for our loan, means that the interest is more than 7.52%, so there is no way to liquidate it because USDC is a stablecoin that does not fluctuate in price and has a higher interest rate than borrowing. After that, we borrow $MIM, how much we can borrow depends on the platform. according to the table below

Then we swap $MIM into other coins and transfer back to Exchange to exchange for Thai baht. And when the time has passed until the interest income is high enough to buy $MIM to close the loan, it’s over.

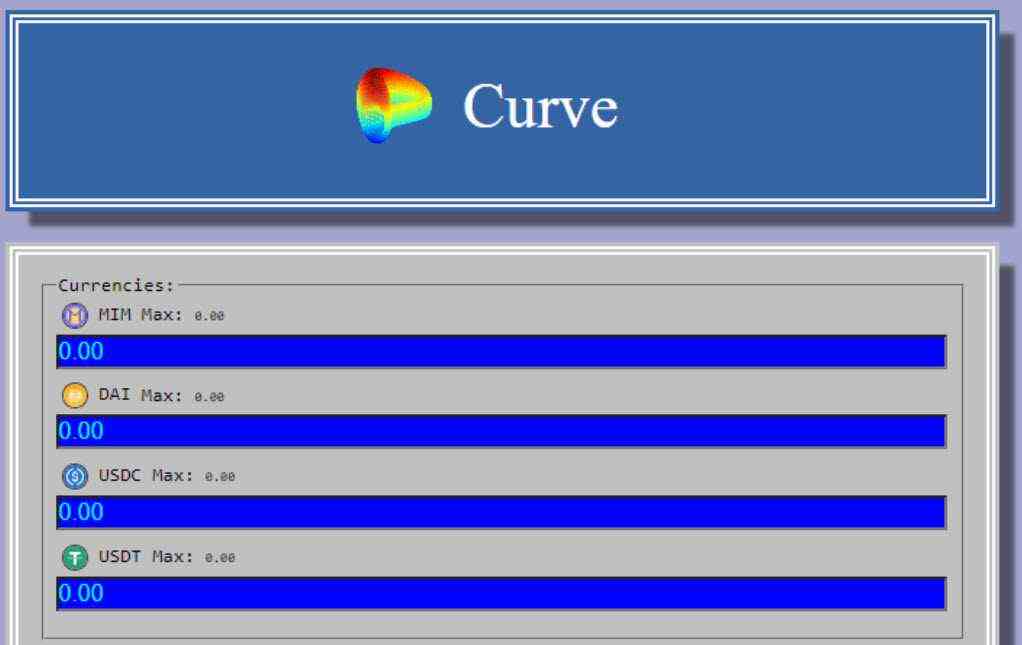

2. Bring $MIM Deposit Curve to get Fee: This method starts with depositing assets and borrowing $MIM, then bringing $MIM to Provide Liquidity in MIM-3LP3CRV In Curve.fi, you will get $Spell coins and then take $SPELL to stake to get Fee. Think about it carefully and you will get many returns.

- Return on supporting assets such as yvUSDC APY 8.32%

- MIM-3LP3CRV on Curve.fi has a total APR of over 32% from Trading fee + $CRV + $SPELL

- Stake $SPELL from Curve.fi about 23% APR in Abracadabra

3. Leveraged Yielding: The principle is similar to Method 1, but we take the $MIM that has been exchanged for USDC and deposit it at Yearn.finance and then deposit yvUSDC to borrow new $MIM. Repeat this cycle until satisfied, it will allow us to get multiply higher returns without increasing risk because this method uses all stablecoin which is The key to this platform is to grow quickly.

Which Abracadabra facilitates by adding a Change Leverage button, the thing that needs to be taken into account is how much $MIM will be borrowed per cent of the guarantee amount. And the number of times you want to spin from the Choose your Loops button, the more $MIM you borrow or the more spins, the more risky. We leverage up to 6.51 times.

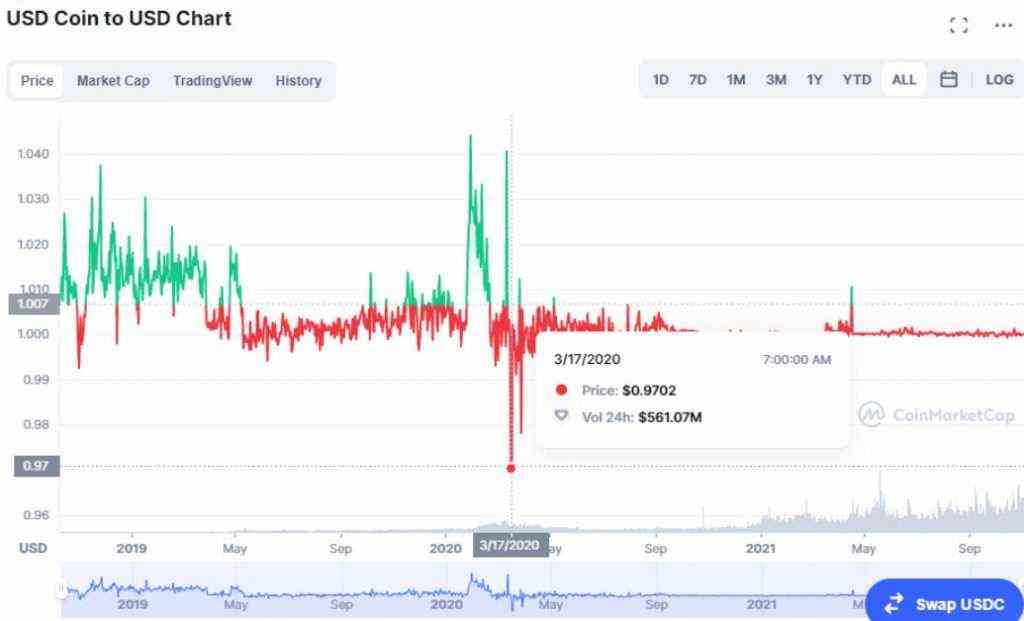

Therefore, it is better to keep the liquidation price of USDC below $0.97. because from the information of Coinmarketcap USDC hit a low of 0.972 on March 17, 2021, however, leverage is always risky. Therefore, use it carefully.

Partnership

Terra: On October 14, 2021, Daniele made the announcement in Twitter As far as working with Terra, $UST Algorithmic Stablecoin on Terra Chain can also be collateralized, which can borrow up to 90% like other stablecoin LPs. Behind the scenes work after we deposit $UST. Bridge is deposited in Anchor on Terra Chain for 20% annual interest.

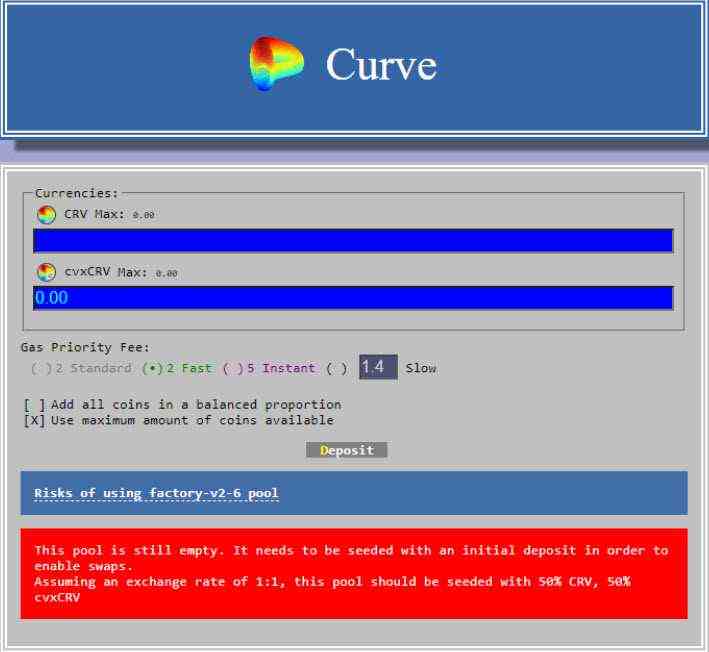

Convex Finance: after deposit MIM-3LP3CRV In Curve.fi we get $CRV we can stake $CRV in Covex Finance to receive fees from Curve and various Airdrops and receive $cvxCRV as a deposit contract that can be deposited in Curve.fi to be used as collateral for the $MIM loan again as well

risk

A lot has been said about the advantages of Abracadabra, but it’s not without risk at all. Because as you know, this method, although relatively new and has already been demonstrated in Anchor, where it can deposit an UST and use an aUST contract to guarantee short farming, but the duration is not even half a year. The risk of code bugs is possible even after being audited by Certora, and liquidate risk management needs to be cautious as well. There must be assets to support the borrower. Unlike other Lending Protocols where the lenders place assets for the borrower to use, $MIM is like new money that suddenly happens to cross chain easily as well. We may see a big bubble after this, and it will continue to grow bigger as more platforms are starting to be interested in using this method as well. We never know when this bubble will burst. All investors should be careful with themselves.

This article was researched and compiled by Parit Boonluean.

Reviewed and edited by Adhan