Status: 01/20/2023 2:04 p.m

A floating LNG terminal arrived in Brunsbüttel today, eleven in all. Federal Network Agency boss Müller doubts that all terminals are necessary. Experts see it the same way.

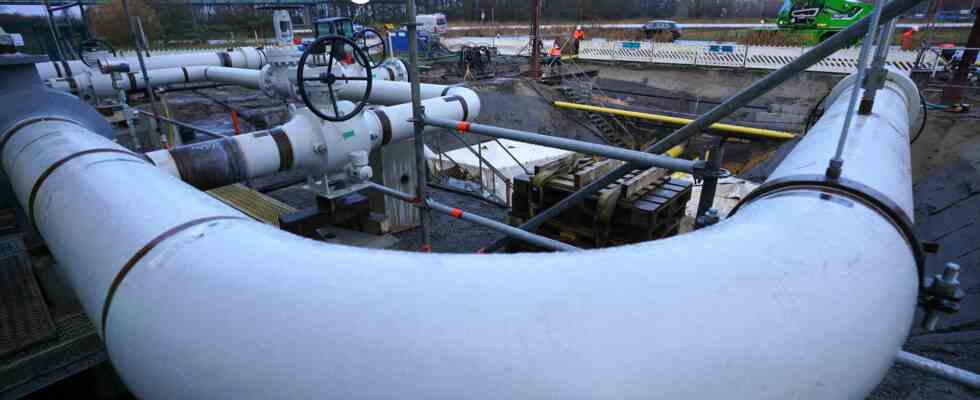

The federal government is actively promoting the construction of import facilities for liquid gas in order to ensure Germany’s security of supply in the future. It has chartered five out of seven terminal ships itself for this purpose, two of which are currently in operation. Today arrives floating terminal for liquefied natural gas (LNG) in Brunsbüttel, where the third floating LNG terminal in Germany is being built.

The terminal ships have already moored in Wilhelmshaven in Lower Saxony and in Lubmin in Mecklenburg-Western Pomerania. The three plants initially have an annual import capacity of around 14 billion cubic meters.

Expansion work and other plants in Lubmin, Wilhelmshaven and Stade should increase this considerably. A total of eleven LNG terminals should be operational by 2026, three of which are planned as stationary terminals.

Network agency boss Müller doubts

Before the start of the attack on Ukraine, Russia provided 55 percent of the local gas requirement. Around 55 billion cubic meters of Russian gas had arrived in Germany via the Nord Stream 1 pipeline.

According to the federal government, the declared goal is to be independent of oil, gas and coal from Russia in the short term. A third of the current gas requirements can then be covered by floating LNG terminals.

The head of the Federal Network Agency, Klaus Müller, now doubts the necessity of all planned import terminals for liquefied natural gas (LNG). It was right to prepare for an extremely cold winter and to “plan for redundancies,” Müller told the digital media company Table.Media: “But I do think that looking back at the first winter without Russian pipeline gas, the statistics would be even more accurate will watch.”

Gas supply currently not at risk

Müller stated that provisions must also be made in the event “that a terminal or another pipeline fails”. The needs of neighboring countries must also be taken into account. Nevertheless, it remains to be seen “whether all the terminals currently under discussion will ultimately be realized or fully utilized”.

Because it is currently proving that even after the complete cessation of all Russian imports, the supply situation with natural gas was never seriously jeopardized this winter. The gas storage facilities are still almost 90 percent full, and thanks to the mild winter, a shortage is becoming increasingly unlikely, writes the Federal Network Agency in its daily assessment of the situation.

With his current statements, Müller takes up the assessments of other experts who were also critical of the magnitude of the terminal construction. Environmentalists also warn of possible consequences for the environment and climate.

Bad investment of tax money?

The New Climate Institute, a Cologne-based think tank on the subject of energy transition, came to a clear conclusion in a recent study: “The currently planned German LNG import terminals are not absolutely necessary to cover Germany’s gas requirements after Russian imports have ceased is permissible while complying with the German climate protection goals”, is the conclusion of their investigation.

“Eleven LNG terminals with a total capacity of around 73 billion cubic meters per year could enable the import of around 50 percent more gas than was obtained from Russia before the war, writes the institute. “If all the planned terminals are in operation, Germany could over Land and sea import nearly two-thirds more natural gas than is currently consumed.”

This means that significantly more capacity is built up than is necessary. If all LNG plans are implemented, bad investments are foreseeable, which would be supported by taxpayers.

Oversupply very likely

An analysis of A few weeks ago, Climate Action Tracker (CAT) also came to the conclusion that countries around the world are building significantly more LNG infrastructure than is actually necessary. According to the data, the foreseeable oversupply of LNG could reach around 500 megatons as early as 2030. This corresponds to almost five times the amount of Russian gas imported by the EU in 2021.

And the “Handelsblatt” had recently had the market research company Icis calculate the cases in which LNG terminals could become a loss-making business and even tried to quantify the possible losses. ICIS expert Andreas Schröder has calculated that an LNG terminal with a five percent margin would make a loss of around 200 million euros over ten years.

However, his sample calculation is subject to large uncertainties. Depending on the margin, profits are also possible. If a worse scenario occurs, but also significantly larger losses.