Mission electromobility

Wrestling over the battery: Europe threatens a “battery bubble”

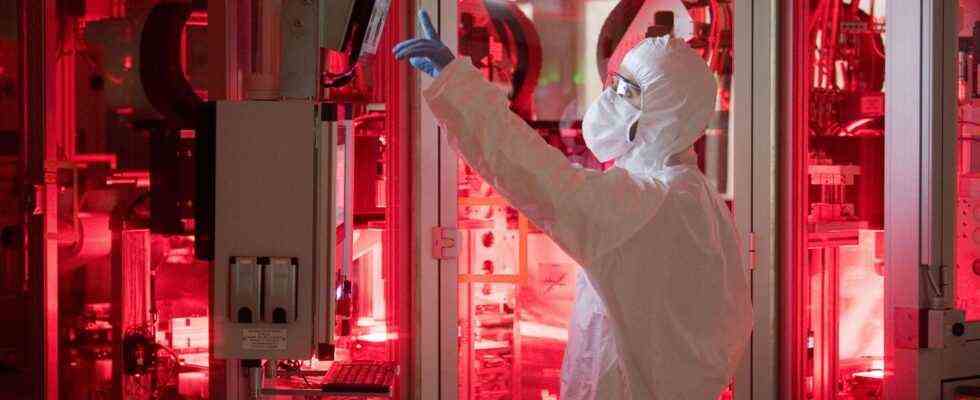

A VW employee stands in a clean room for the production of battery cells. Battery production in Europe could be less successful for automakers than hoped

© Julian Stratenschulte / Picture Alliance

The battery factories are booming: Dozens of car manufacturers as well as development companies are getting into the business and want to build their own batteries in Europe with projects worth billions. This can result in oversupply. A “battery bubble” threatens.

The number of electric cars is steadily increasing. Car manufacturers have set themselves the goal of switching more or even completely to electromobility in the future. This means that the struggle for battery development is also taking on a new dimension. Various battery factories are to be built in Europe in order to be prepared for the strong battery market in Asia, with China as a pioneer. The “Handelsblatt” reports on it.

The Asian manufacturers CATL and LG Chem are already producing in Eastern Europe, Tesla wants to start up its huge “Gigafactory” in Brandenburg. The Korean companies LG Chem and Samsung built cell factories in Poland and Hungary years ago. They supply their batteries primarily to VW and BMW. “The Koreans bring their systems and specialists with them from home, this is a closed shop,” a German car manager told the “Handelsblatt”.

In the meantime, all battery cell factories want to build up in the gigawatt range. There are large orders from the European auto industry as well as EU funding programs worth billions. According to the energy consultancy Avicenne, the battery industry is growing at 25 percent per year.

And that should only be the beginning of the development of e-mobility. According to Avicenne boss Christophe Pillot, the market for lithium-ion batteries (LIBs) will grow the fastest in the coming years. In 2030, 85 percent of global battery demand will come from the construction of electric cars. This makes Europe the largest market for electric cars after China. 40 projects for battery factories in Europe have already been announced for the next ten years. Some of the money comes from state coffers. Because politics wants to break the market power of the Asian manufacturers.

Car manufacturers build their own battery factories

The Chinese supplier CATL, which already built a multi-billion “Gigafactory” in Thuringia in 2019, is delivering to BMW. The Munich-based company does not want to invest any money in building battery factories with lithium-ion technology. The fear of loss is too great. “It is now the wrong time to invest in gigafactories,” says BMW development director Frank Weber. In contrast, Opel parent company Stellantis, Daimler and Total have jointly founded the Automotive Cell Company (ACC). Stellantis and Daimler are planning their own battery cell production at the Opel site in Kaiserslautern and in Douvrin in northern France. The companies are to receive almost 440 million euros in government funding for the construction of the German site.

The start-up Northvolt is now going into operation in Sweden, and a second major project has been agreed as a joint venture with Volkswagen. The companies want to start series production of battery cells with a capacity of up to 40 gigawatts in Salzgitter from 2023. In addition, VW entered into a partnership with the Chinese battery company Gotion in July 2021. Morrow and Freyr in Norway, or Italvolt in Italy also want to get on the bandwagon of battery development. So far, however, they lack the buyers.

Experts fear “battery bubble”

For car expert Wolfgang Bernhart from the management consultancy Roland Berger, the “gigantic subsidy race” would not be necessary. “There has been a change in the strategy of the car companies in the last two years. They want to protect themselves and therefore invest in cell production, try to build them up themselves or work with established manufacturers,” said the car expert.

According to experts, the demand for electric cars will amount to around 900 gigawatt hours in 2030. However, the capacities of the announced cell factories are already 1200 gigawatt hours. This already more than covers the capacities. This is a high risk for companies but also for the sponsoring countries. “It’s a bubble that has been inflated in part with European tax money. The risk of it bursting is definitely there,” says Bernhart. Battery cell factories are only economically successful if they are run to 90 percent capacity, “of course that is not the case with the immense overcapacities”.

In contrast, VW sees a limited risk of oversupply. “The automotive industry will need around 30 large cell factories in Europe by 2030,” said the Wolfsburg-based company. Special machines are necessary, however, and high production costs also make it difficult to plan your own battery factory. Sebastian Wolf, who is responsible for the development of the VW battery factories, believes in “an important role in the development of battery cell production in Europe”.

European battery developers have to hurry

BMW’s partner CATL is considered to be technically reliable and solidly financed. The cooperation between the Chinese developer Farasis and Daimler, however, is even less successful. Industry experts are looking forward to ACC’s plans by Stellantis, Daimler and Total. It is said that a “hot needle” is used here, but it is quite effective. Northvolt could do it too.

However, experts believe that battery developers in Europe have to hurry up. Christoph Theis, co-founder of the management consultancy P3, is certain: “There will be many more Asian battery cell manufacturers to come.” “The Chinese systems are also highly flexible,” emphasizes Wolfgang Büchele, head of Exyte, a specialist in clean room systems for the semiconductor industry, who has now planned cell production for CATL in Erfurt. Theis thinks it is unproblematic if two or three stages are equipped with Asian machines in an eight-stage production process of a battery cell. But he makes it clear: “If the battery projects are to be successful in Europe in the long term, then the supply chain has to be right.”

Another decisive factor in battery production is the limited lithium inventory and the associated rise in the price of lithium carbonate. Battery developers will therefore not only have to think about alternative rechargeable batteries such as solid-state batteries, but also about battery recycling.

Source: Handelsblatt