The vision goes as follows: Business people who have previously used one of several hundred helicopters to get to the airport in São Paulo without traffic jams on the city motorway will in future get into an electric air taxi and glide quietly from a roof top to the terminal of the Guarulhos Airport. Or in Munich: In the future, First or Business Class passengers, who previously had to make the hop down from Nuremberg on one of the long-discontinued regional flights, will hover in by Lilium Jet and transfer to the Lufthansa plane to Singapore. You can see the construction sites on the A 9 from above.

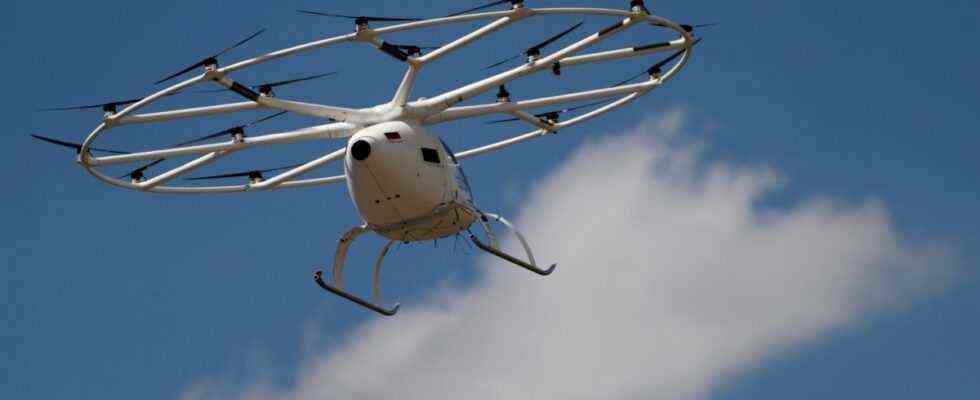

It is a vision of a new kind of mobility. In the future, millions of passengers will get into one of the new aircraft every week for more or less at the price of a taxi and will be able to fly from one of the tens of thousands of vertiports named take-off and landing sites to the next, close to the business meeting or directly at the shopping center. Lilium, Volocopter, Archer, Joby and Vertical Aerospace are the best-known names among well over 100 projects worldwide. Recently there was a gold rush atmosphere in the industry, which until recently nobody knew. Financial investors and venture capitalists pumped around $ 5.5 billion into the emerging sector of air taxis within a few months. Promising concepts are currently landing on the stock exchange in rows via so-called Special Purpose Acquisition Companies (SPAC).

But what is the truth of the hype, how much of it is really realistic, how big the market, what should manufacturers, investors and potential customers expect? Gregor Grandl, Senior Partner at Porsche Consulting, has analyzed the industry in a detailed study and has come to conclusions that will not suit every investor: If it works at all with the new sector, it will take a very long time to get one has reached a significant size and the billions in investments have been amortized. But for the moment: “Technological upheaval is a much more exciting story for investors than new fuel in well-known engines,” says the consultant. The logic of the stock exchanges also plays an important role – and the keywords “digital” and “electric” would attract investors.

The good news first: “Technically, the issues are solvable, and prices could also come down to the level of limousine services such as Uber Black in the medium term,” said Grandl. But: “The question of social acceptance, noise protection and the challenge of building a whole system and integrating it into the existing mobility system speak against the current hype,” believes the analyst.

“The second generation of air taxis could make the breakthrough to the mass market.”

The industry is currently in the early stages of its development. Different manufacturers pursue very different concepts. In Germany, for example, Volocopter is developing an aircraft that is more reminiscent of a helicopter and is therefore more suitable for short distances and rather slow speeds. A second is to connect city centers and suburbs. Lilium from Oberpfaffenhofen near Munich, on the other hand, relies on a seven-seater that is supposed to manage regional flights of up to 250 kilometers and, with its 36 swiveling motors, is extremely technologically sophisticated. Volocopter wants to register its Volocity in the next two to three years, Lilium Jet also wants to achieve certification for the jet in 2024, and Joby Aviation even as early as the end of 2023.

Grandl reckons that the manufacturers will have to raise around ten billion dollars for the first generation of air taxis and that, given the great interest shown by donors, they will manage to do so. But, according to his forecast, investors have to be patient: their investments can be expected to pay off in ten years at the earliest, but maybe not until 2035. Grandl also believes that the machines that are now being developed will not yet bring great success . “The second generation of air taxis could make the breakthrough to the mass market, but the question is whether the investors are really ready to finance the scaling of the technology,” said the consultant.

However, the aircraft themselves are not the only decisive hurdle. According to Porsche Consulting, up to 25 billion dollars would have to flow into the infrastructure in order to build take-off and landing areas or to create the necessary additional capacity for air traffic control. And then the question remains, how much the air taxi services really bring in reality: If the journey to and from the airport is too complicated and changing takes too much time, then many are more likely to stick with the car.

However, should they become a means of mass transport, the question remains of how sustainable the aircraft are in view of the scarcity of climate-neutral energy sources and what that means for competition with other modes of transport.